Author's Contributions

London Calling – New momentum for the UK stock market?

The UK is starting 2026 with optimism: falling inflation, improved sentiment indicators, and hopes of imminent interest rate cuts are driving momentum in the economy – and on the stock market. In today’s blog post, we take a look at the UK economy and stock market.

After a strong IPO year, there could be even more this year

Following a comeback last year, the IPO market is experiencing a further upswing. According to experts, several factors point to a large number of IPOs this year. In today’s blog post, we take a look at which sectors and companies could take the plunge onto the trading floor in 2026.

Economy, geopolitics and AI – that was the World Economic Forum in Davos

From geopolitics to AI, the range of topics at this year’s World Economic Forum in Davos was diverse. The conflict over the USA’s Greenland claims was the main focus of the summit. In today’s blog post, we look at what else was on the agenda at the meeting of leading politicians and economic experts.

Gold and silver prices continue record rally

While all eyes were on the conflict surrounding US President Donald Trump’s Greenland plans this week, the prices of gold and silver continued their record run unabated. The reasons for the rally are manifold and are unlikely to disappear any time soon. It doesn’t always have to be physical gold to participate in this trend. More on this in today’s blog post.

Stock markets end turbulent year close to record highs

Trade conflicts, interest rate decisions, geopolitical tensions and the ongoing AI boom – 2025 had a lot in store for investors. Despite a turbulent year on the stock markets, the most important share indices close close to all-time highs. In today’s blog post, you can find out which sectors particularly shone in 2025 and which topics shaped the year as it drew to a close.

Netflix vs. Paramount: Who will win the bidding?

The takeover battle for Warner Bros. Discovery is making headlines: Following Netflix’s planned acquisition of the media group, Paramount has responded with a surprise counteroffer. Who will prevail in the battle between the streaming and film companies, and what does the bidding war mean for investors? Find out more in today’s blog post.

COP30: What remains of the World Climate Conference?

The COP30 climate conference in Brazil did produce a new package of measures—but there was no major breakthrough. Read today’s blog post to find out why the phase-out of fossil fuels is still a long way off, what new initiatives have been launched, and how the results are being assessed.

AI boom and cloud growth: Tech giants set new standards

Artificial intelligence, cloud boom, and new records: Major US tech companies are turning heads with strong figures and ambitious plans. What is behind the current boom at Microsoft, Alphabet, and others? Read more about the latest developments at the tech giants in today’s blog post.

Is the automotive industry facing a new chip crisis?

After delivery problems at a major supplier became known last week, fears of a new chip crisis are spreading in the automotive industry. How do industry associations and leading car manufacturers assess the risk?

Precious metal prices soaring: Silver at all-time high

Not only has the price of gold risen sharply so far this year, but other precious metals and commodities are also continuing to increase in price. One reason for this is high demand from industry, especially for the production of electronic components.

Cybersecurity: A protective shield in the digital age

Phishing, deepfakes, and targeted attacks on the internet are on the rise—and with them, the cybersecurity industry is growing rapidly. How well equipped are companies to deal with these increasing threats, and where do the opportunities and risks lie for investors? Find out in today’s blog post.

Automotive market: Europe’s industry giants are feeling more optimistic again

Chinese car manufacturers are pushing into Europe – and putting pressure on the domestic industry. Nevertheless, the latter was once again optimistic about the future at this year’s IAA Mobility motor show in Munich. Read more about this in today’s blog post.

Chinese stocks: The sleeping giant awakens

China’s stock markets are making a strong comeback after years of weakness – driven by growing confidence among domestic investors and targeted measures by the government in Beijing. Will the rally continue?

Semiconductor Industry Optimistic for the Future Despite Tariff Uncertainties Thanks to AI Boom

The semiconductor industry is expected to continue growing strongly in 2025, despite uncertainties surrounding US President Donald Trump’s trade policy, thanks to the AI boom. The World Semiconductor Trade Statistics organisation (WSTS) recently raised its growth forecasts for this year slightly.

Japan: US trade deal in politically difficult times

With the conclusion of a trade deal, Japan has resolved the tariff conflict with the USA, its most important trading partner, for the time being. The stock market – especially the automotive sector, which is so important for Japan – reacted with relief. However, the domestic political situation in Japan remains tense following the recent upper house election.

Automotive Industry facing challenging climate focuses on EVs and Autonomous Driving

The US import tariffs have made the environment more difficult for the global automotive industry. Local competition in the important Chinese market is also causing concern for many manufacturers. In the future, many automotive companies want to focus more strongly on autonomous driving in addition to e-mobility. There is still some catching up to do in this area, especially in Europe.

Oil prices under pressure: Why producing countries are changing their strategy

The oil price recently fell to a new four-year low. Not only global uncertainties but also unresolved tariff disputes are weighing on growth prospects and thus also on the oil price. After all, oil is considered an important indicator of global economic development. Nevertheless, some oil-producing countries want to expand their production. What consequences would this have for the oil price, and what are the reasons for this unusual step?

Eastern Europe’s economy showing good growth – trade conflict remains a risk factor

Despite geopolitical tensions and trade risks, Eastern Europe remains on track for growth. Read today’s blog post to find out why Poland is performing particularly well, what role the investment program in Germany and the war in Ukraine are playing, and which markets could be promising.

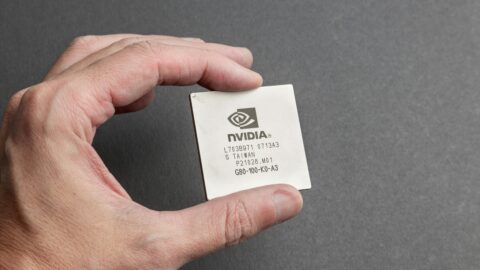

Semiconductor Industry: Between AI Boom and US Tariffs

The semiconductor industry is considered one of the biggest beneficiaries of the AI boom. Investors therefore kept a close eye on the sector’s figures for the first three months of 2025. One thing became clear: the expansion of AI infrastructure continues to deliver good results for most chip companies – but the sword of Damocles in the form of impending US tariffs is still hanging over industry giants such as Nvidia & Co. Read more in today’s blog post.

Stock markets react volatile to tariff pause: what happens next?

The US government’s extensive tariff plans have been causing volatility on the stock markets since last week. Yesterday’s announcement of a 90-day pause for the new tariffs was met with relief by the markets – even though a further escalation between the US and China is on the horizon. We take a look at the current situation on the financial markets and analyse the possible consequences of an escalation in the trade conflict.

Turkish financial markets temporarily under pressure following political turbulence

The Turkish stock market has been turbulent recently: the arrest of Istanbul mayor Ekrem Imamoglu caused massive uncertainty. What does the political unrest mean for the Turkish economy and the Istanbul stock exchange?

China Prepares Itself for Trade War and Makes Plans to Get Economy Back on Track

China’s government wants to get the country’s stagnating economy back on track and is preparing for a trade dispute with the US. Under the motto “Made in China 2025,” the goal is to achieve growth of 5 percent. The focus is on key industries: Did you know that China has become the global market leader in renewable energies and produces by far the most electric cars worldwide?

Read more about this and investment opportunities with funds in our blog.

Luxury goods sector could resume expansion

For years, the growing demand for luxury lifestyle products kept the tills of the luxury goods industry ringing. In 2024, that has changed: after years of booming sales, the industry experienced a decline for the first time since the coronavirus outbreak of 2020.

This year, the market could return to growth. Hopes are pinned on a comeback of the important sales market China and a growing appetite for luxury goods among Americans. How are the listed industry heavyweights LVMH & Co. faring in this environment and why are European stocks particularly worth a look in the world of glamor and luxury?

Election in Germany: New government must lead the country out of the economic crisis

Following the premature end of the traffic light coalition, Germany will elect a new Bundestag in around a week’s time. The challenges for the future government are manifold. First and foremost, the weakening economy needs to be revitalised. We take a look at the real state of the EU’s former economic engine and what the parties have in store for the crisis.

Space industry hopes for new boom under Donald Trump

With Donald Trump in the White House, the private space industry is hoping for a new lease of life. Right at his inaugural address, Trump announced a manned mission to Mars. Many experts see the SpaceX group, led by Trump confidant Elon Musk, as naturally being in pole position for new government contracts. But other companies, such as Blue Origin, owned by Amazon founder Jeff Bezos, also want to get involved. Experts also see potential for the European space industry.

Trump’s tariff plans: a game with no winners?

On 20 January, the world will once again look to Washington with anticipation as Donald Trump is sworn in as US President for the second time in front of the Capitol. In any case, his statements and plans are already the focus of attention on the financial markets.

Trump is planning high import tariffs for goods, for example from Mexico and China. The possible consequences range from the threat of a trade war to a comeback of inflation. In the end, will no one benefit from the planned tariff measures?

China prepares economic stimulus package in response to recession and looming trade war

The former growth engine China is having trouble getting back on track. Geopolitical tensions, the crisis in the domestic real estate sector and weak domestic consumption are hampering the country’s economy.

The government in Beijing is using billions in support measures not only to counter the economic downturn, but also to brace itself against the tariffs announced by US President-elect Donald Trump. But can these measures also help the faltering Chinese stock market?

Traffic light coalition stop – fast lane or reform logjam in Germany?

First, Donald Trump’s victory in the US presidential election, and then the end of the coalition government: What does the German economy have to look forward to? Experts see major challenges ahead for the world’s fourth-largest economy. However, the upcoming elections also offer the potential for a fresh start. In today’s blog post, we discuss what this could look like.

Deficit spiraling out of control: French government plans drastic austerity program

The high deficit in the French national budget is forcing the new government to implement drastic austerity measures. Investors are keeping a close eye on the announced plans, as the tense financial situation has been noticeable on the stock market for some time.

Tense situation in the Middle East: Will oil prices rise again?

Oil prices have fallen significantly in the year to date, which also had a noticeable dampening effect on inflation. However, this could change with the further escalation in the Middle East. Following the Iranian missile attack on Israel, Prime Minister Netanyahu announced retaliation.

Is the AI Rally Nearing its End?

Following this week’s interest rate cut by the US Federal Reserve, shares related to artificial intelligence (AI) applications are once again in the spotlight. Investors are hoping that AI will have a positive impact on the business figures of the key players. With the ERSTE STOCK TECHNO fund, you can invest in the most important companies in future technologies.

Japan: Back to Normality

The Japanese stock market quickly recovered from the slide at the beginning of the month. However, attention remains focused on the Japanese central bank after it announced that it would hold off on further interest rate hikes for the time being. However, the Bank of Japan’s direction of travel seems clear: away from the ultra-loose monetary policy of recent years.

After Biden’s withdrawal: What plans does Kamala Harris have for the economy?

The withdrawal of incumbent US President Joe Biden from the presidential race is bringing new momentum to the election campaign. Kamala Harris, currently Vice President under Biden, is now seen as the likely Democratic candidate. What policies could Harris stand for and what plans could she have for the US economy?

France and UK face economic policy decisions after elections

The recent elections in France and the UK have brought about a realignment of the political balance of power in both countries and thus also a new start for economic policy in the two major economies. What lies ahead for the two countries?

Market update: Economists see Germany economy regaining momentum

In football, things have been going well for the European Championship host country Germany recently with its place in the round of 16, but the economy has been in the doldrums in recent quarters. According to leading economists, this could now change. Positive signals from industry and private consumption indicate that the German economy is regaining momentum.

Europe’s Economy Faces Major Challenges After Parliament Elections

The European People’s Party (EPP) remained the strongest group in the EU Parliament in last Sunday’s EU elections. Right-wing populist parties made significant gains in many of the 27 EU member states. What impact will the election result have?

China hopes to extend its export boom with continued investments

Thanks to booming exports, the Chinese economy started the year with surprisingly strong growth. As growth has now lost some of its momentum, the aim is to keep the export boom going with new investments. However, this could have a negative impact on the trade dispute with the US and the EU.

20th Anniversary of the 2004 EU Enlargement: The Success Story Continues

The EU is celebrating a political and economic success story with the 20th anniversary of the EU’s eastward enlargement on 1 May. The countries that joined at that time and those that followed have caught up massively in economic terms. The signs continue to point to solid growth in the region.

EVs: Industry plans to drive sales with price reductions, compact models, and new batteries

Even though the car industry continues to focus on e-cars, demand has recently stalled somewhat. In addition to the major car manufacturers, more and more tech companies are entering the market. Meanwhile, a new hope for the future is emerging in the field of battery technology.

India: The new counterweight to China?

The Indian economy is booming as more and more companies see the country as a potential alternative to China. In the coming years, India wants to become the third largest economy in the world. What is behind these ambitious plans? Is India really the market of the future?

Pharma industry continues to profit from booming weight loss drugs

The boom in weight loss products has long since spread to the stock markets. While the shares of pharmaceutical companies Novo Nordisk and Eli Lilly are benefiting from the high demand, other industry giants are also looking to follow. However, experts are also warning of possible side effects of the drugs, which were originally developed to treat diabetes.

AI Boom Yields Strong Quarterly Gains for US Tech Giants

The topic of artificial intelligence continues to flourish on the stock market. The US chip company Nvidia recently attracted attention with another strong set of quarterly figures. How did the rest of the “Magnificent Seven” fare in the reporting season and what are the plans of the tech giants in the AI sector?

Global Economy: IMF with more positive outlook

According to the IMF, the global economy could grow more strongly than expected this year. In the US and China, the economy is likely to remain robust, although growth in the People’s Republic is likely to weaken. The experts are less optimistic about the German economy.

Davos 2024: Climate Crisis, AI, geopolitics and interest rates were key topics

Last week, many high-ranking representatives from politics and business once again gathered in Davos, Switzerland, for the annual World Economic Forum. The most pressing topics were the use of AI, the climate crisis and geopolitical tensions. Meanwhile, central bankers made interesting statements on future interest rate policy.

Money tip: Invest in Japanese stocks

Following the recent gains in the Japanese benchmark index, the stock market of the world’s third-largest economy could be worth a look. What is the state of the economy and monetary policy in the “Land of the Rising Sun” and how can investors invest in Japanese stocks?

Stock markets review: Hopes for interest rate cuts fuelled significant gains in 2023

The international stock markets closed out 2023 with significant gains. Hopes of abating inflationary pressure and declining interest rates were the main market drivers in Q4, resulting in a strong year for stock exchanges.

Members of OPEC+ plan to further cut oil production

The OPEC+ oil association was unable to agree on official production cuts at its meeting last Thursday. However, individual member states announced plans for cuts. In a joint statement after the meeting, the more than twenty OPEC+ states also announced that Brazil would join the production alliance at the beginning of next year.

More Optimistic Outlook for German Economy among Experts

Stock market professionals are less pessimistic about the prospects for the German economy in the next six months. This is shown by the current economic barometer of the Center for European Economic Research (ZEW). The government also wants to get the economy moving again with additional relief measures.

Holiday sales: Hopes for record season in the US

The robust labor market and many special offers give hope for another record Christmas season in the USA. The latest market research data also shows that, despite inflation and high interest rates, Americans are once again planning to spend more over the holidays this year.

Middle East Conflict continues: worries about expansion to other countries

Roughly two weeks after the surprising terrorist attacks by the radical Islamic Hamas ruling the Gaza Strip, on targets in Israel, the military conflict in the country continues unabated. The war in the region also continues to dominate the financial and commodity markets, with global concerns that the conflict could possibly spread to other countries in the Middle East being the main driver of uncertainty.