Articles about “corporate bonds”

Netflix – the movie script of a success story

Everyone knows Netflix these days. The company has developed from a DVD rental service into a globally renowned streaming service. The company’s history is also an example of the important role the high-yield market can play in corporate bonds for young and innovative companies.

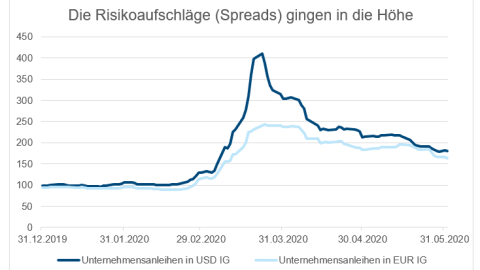

Is this time different?

The risk premiums on corporate bonds are close to their lows. What are the reasons? Is a correction imminent or is everything perhaps completely different on the bond market this time?

ERSTE BOND EM CORPORATE becomes sustainable: Interview with fund manager Péter Varga

ERSTE BOND EM CORPORATE becomes part of our sustainable Integration fund family. Péter Varga discusses what this sustainable change means for him as a fund manager and what it changes in his investment process.

Attractive yields: Why corporate bonds are worth a look

Corporate bond yields are now back at attractive levels. In his article, senior fund manager Hannes Kusstatscher explains what this means and how the situation on the bond market could develop.

How to invest in corporate bond funds

Yields on corporate bonds in both the investment grade and high-yield segments have risen significantly in recent months. This means that there are currently interesting entry levels again.

Our expert Johann Griener explains in his blogpost how to take advantage of this opportunity with a corporate bond fund.

How a bond fund “works”

Interest rates are back, which means that investing in bonds and bond funds again offers opportunities for attractive returns. Our expert Johann Griener explains how a bond fund works and what you should bear in mind when investing.

Interest rates are back

After many years of low interest rates, the tide has turned in recent months. This is also creating some opportunities on the bond market again, as our expert Johann Griener explains in his article.

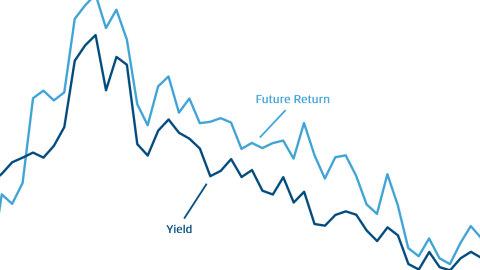

Yield and Return on Bonds

How are interest rates and future bond returns related? Why can the yield be higher than current interest rates? Our blog looks at the correlations in fixed-income investments.

Emerging Markets Credit Conference – a sentiment snapshot among investors

The mood among investors in the bond sector in emerging markets is mixed, as this year’s Emerging Markets Credit Conference held by US investment bank J.P. Morgan showed. Thomas Oposich, Senior Fund Manager, reports on the conference and his impressions.

The return of the yield was short and painful

Due to the rapid rise in yields, almost all types of bonds have suffered significant price losses since the beginning of the year. But now you have the chance to take advantage of the higher yield level. Find out the best way to do this in today’s blog.

India: Narendra Modi – the prime minister as crisis winner?

A year ago India was one of the fastest growing economies in the world. Today the world looks completely different because of COVID-19. But no matter how bad the conditions in India are, Prime Minister Modi’s popularity is on the rise. Could he really emerge from the crisis as a profiteer?

Spotlight on: corporate bonds

ESPA RESERVE CORPORATE: 3 questions for Bernd Stampfl, fund manager.

Emerging Markets: Opportunities with Corporate Bonds

In an interview with Péter Varga, Senior Fund Manager Erste Asset Management, I am discussing the chances and risks with investments in emerging markets corporate bonds. Many Investors feel unsettled by the weak performance of the emerging markets. Why is this the case?

Two canaries in the coalmine

The US dollar has appreciated significantly vis-à-vis the euro in the past months. For this trend to continue, at least two developments would have to be in place. Firstly, the US Fed would have to abandon its zero interest rate policy; and secondly, the ECB would have to remain on its path of negative interest […]