The sharp rise in interest rates is weighing more heavily on environmental and renewable energy equities than on assets from other sectors. Clemens Klein, fund manager of ERSTE WWF STOCK ENVIRONMENT, explains in an interview why this is the case, why environmental shares remain very attractive, and why this could even be a good time to enter the market.

Please note that investments in securities entail risks in addition to the opportunities presented.

After the strong gains in the past years, the prices of environmental and renewable energy shares have been weak in the year to date. Why is that so?

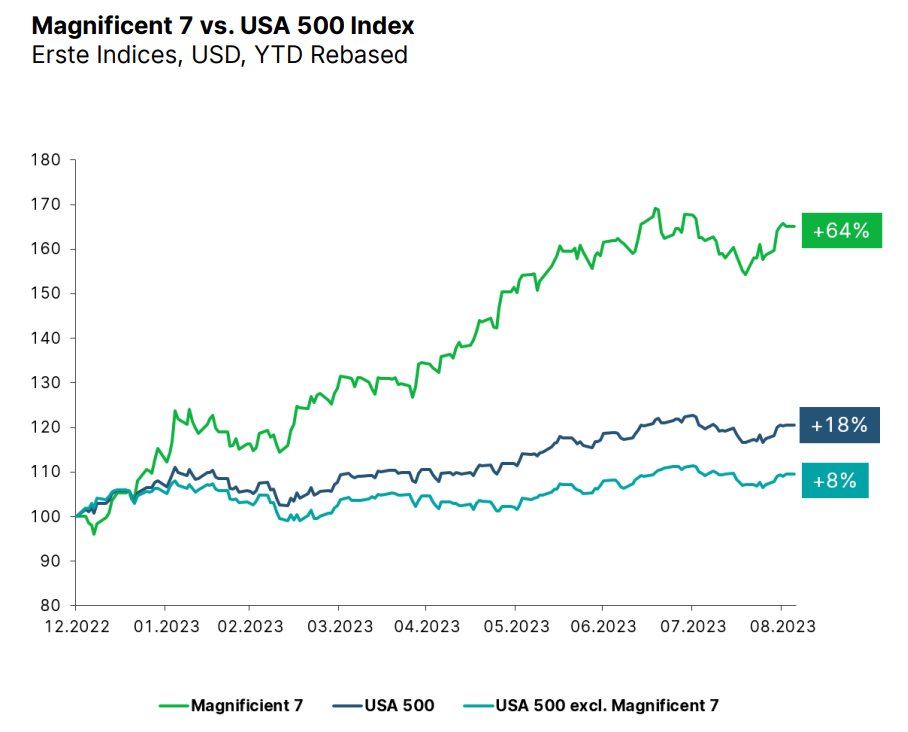

The positive performance in the broad equity market was mainly driven by the large US tech companies around Apple, Microsoft, Meta, Nvidia, etc. (note: please see the chart below). At the same time, assets from the renewable energy sector or the environmental sector were generally on the underperforming side. These companies are mostly still relatively young and small but have very strong growth rates and need capital to generate said growth. The main reason for the negative development is the changed interest rate policy of the central banks. This is having a much stronger impact on smaller companies than on large, established ones.

Without the Magnificent 7 (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, Meta), the broad US equity market would have seen a significantly less impressive performance in the year to date. Please note: past performance is no reliable indicator of future value developments. The benchmark index has no influence on the discretion of the Management Company in selecting the assets of ERSTE WWF STOCK ENVIRONMENT. Representation of an index, no direct investment possible. The companies listed here have been selected by way of example and do not constitute an investment recommendation. Source: Erste Research.

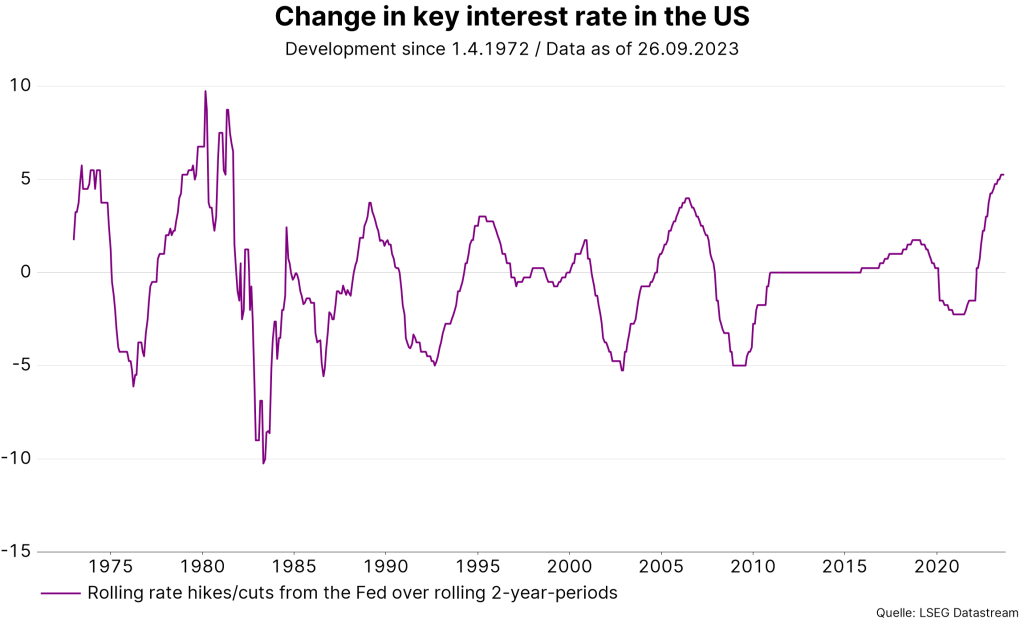

Why do higher interest rates hit SMEs harder?

For the most part, companies of this size do not finance themselves via the capital market, i.e. via fixed-interest bonds, but via variable-interest bank loans. If interest rates rise to an extent and at a speed as in the past two years, this has an impact on companies in the form of higher financing and interest costs.

Note: Past performance is not a reliable indicator for future performance. Source: LSEG Datastream

At the same time, large caps like Apple or Microsoft can even benefit from higher interest rates. Some of them are sitting on very high cash reserves, for which they are now receiving significantly higher interest income.

How did ERSTE WWF STOCK ENVIRONMENT do in this difficult environment?

The weak YTD performance of environmental equities so far has also had a negative impact on the performance of ERSTE WWF STOCK ENVIRONMENT. The fund pursues the strategy of achieving a measurable, positive impact for the environment and invests in numerous so-called “pure plays” from the environmental and renewable energy sector. Most of these are small or mid-cap companies, i.e. companies that are far smaller in terms of market capitalisation than the large tech corporations. The prices of these so-called SMEs have therefore suffered particularly badly from the turnaround in interest rates.

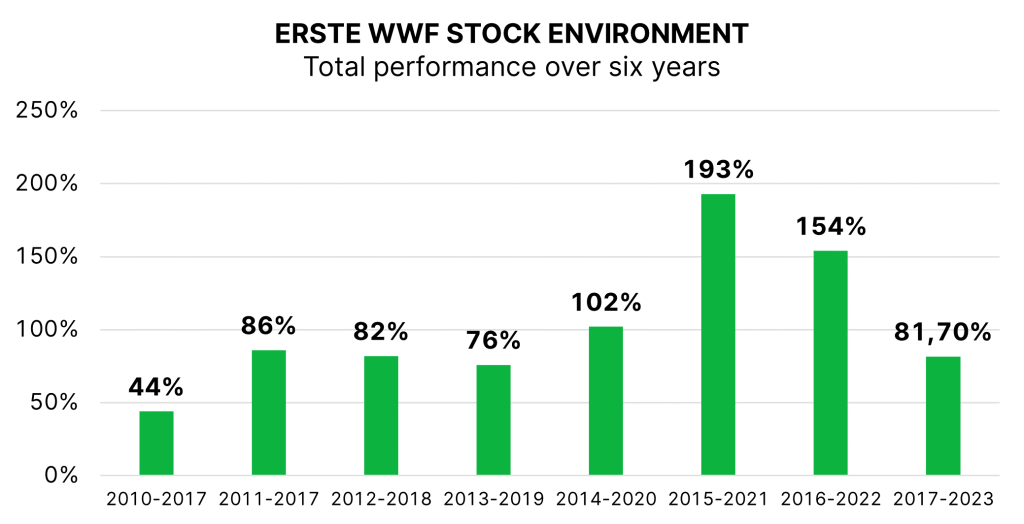

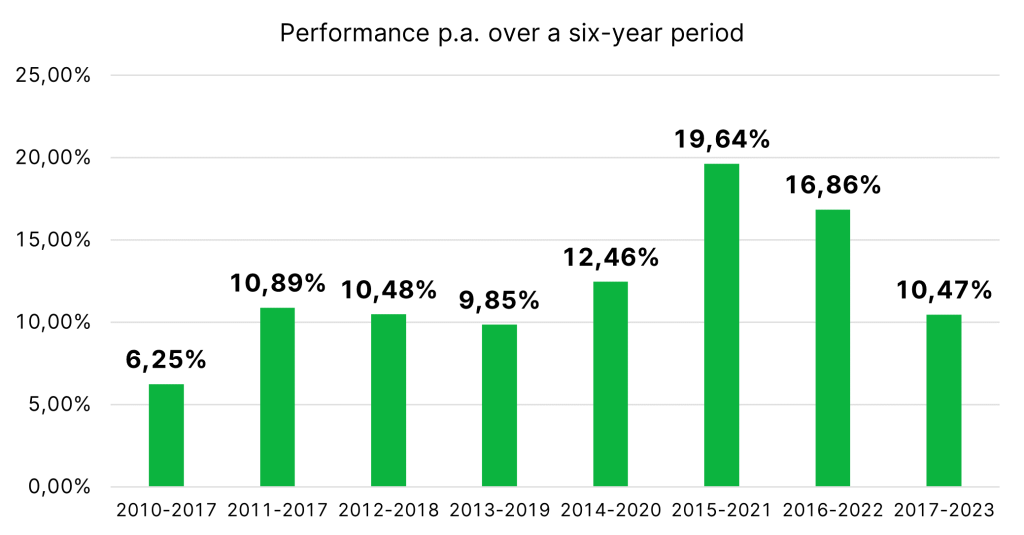

Despite the negative of ERSTE WWF STOCK ENVIRONMENT in the year to date, the view of the long-term price chart remains very positive. Over the recommended minimum holding period of 6 years, the fund has regularly performed well in recent years, always generating a return of at least 6.25% p.a.

Note: Past performance is not a reliable indicator for future performance. Source: LSEG Datastream

What is it that makes you optimistic about the further development of environmental shares all the same?

On the one hand, the themes and trends we invest in with ERSTE WWF STOCK ENVIRONMENT remain relevant. In view of the increasingly frequent dry and drought periods, solutions for water treatment and supply will be needed, to name just one example. But topics such as recycling and the circular economy are also becoming increasingly important, not least because of the race for limited resources. Above all, however, the megatrends of renewable energies and electromobility will persist regardless of the market situation and will even accelerate in the coming years despite already currently high growth rates.

On the one hand, because there is no way around these technologies if we want to counteract climate change and get away from fossil fuels. On the other hand, because renewable energies are now the cheapest form of electricity generation in most parts of the world, and electric cars are increasingly overtaking combustion engines in terms of total costs (purchase and use).

One can also continue to count on tailwinds from the political support packages (N.B. Inflation Reduction Act in the USA and RePowerEU in the European Union). The implementation of these packages has only just begun, but we can already see that renewable energies and all related topics will benefit from them in the long term.

What is the rest of the year going to look like?

The significantly lower prices for solar modules are currently lending support to the sector. Compared to the previous year, they have almost halved and reached new lows. Prices have declined by more than 80% in the past ten years. For companies that manufacture these modules, this is of course a negative development, which is why we also try to avoid these companies in the fund.

However, for other parts of the value chain and companies that are active in them, this situation is extremely attractive. Freight costs have also returned to pre-Covid levels. These costs are a significant factor given that 80 to 90% of solar modules are still sourced from China. The combination of halved prices and normalised transport costs means that companies that install modules or build solar power plants are benefiting greatly.

What about the valuation level in the sector? Can we see any attractive entry levels at the moment?

The aforementioned positive factors are not yet reflected in the share prices, but very much in the valuations. At this point, the S&P Global Clean Energy index, a broad equity index that covers renewable energies, commands much lower valuations than the MSCI World index, i.e. the broad equity market. The price-earnings ratio (P/E ratio) of the former is currently 16.9x, while the MSCI World has a P/E ratio of 20x.

The PEG ratio (N.B. price-earnings-growth ratio), which also includes earnings growth in the assessment of an investment, is 0.64x compared to 1.8x for the MSCI World. (N.B. according to a rule of thumb, everything below 1x is cheap, everything above 1x is expensive). On the basis of this indicator, renewable-energy shares are valued at around one third of the overall market, which is extremely attractive.

Conclusion

Given the global interest rate turnaround, shares from the environmental sector have incurred significant losses. ERSTE WWF STOCK ENVIRONMENT was not spared from this development. At the same time, we can see signs that suggest that topics such as renewable energies continue to offer attractive long-term investment opportunities. Positive factors such as the lower prices for solar modules are not yet reflected in the share prices, but in the valuations. Compared to the broad equity market, environmental equities now command a much more attractive valuation. This means that there could be attractive entry opportunities for investors.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Please note that investments in securities entail risks in addition to the opportunities presented.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.