The first quarter had a few surprises in store for the markets. The US tariff announcements shook the markets to the core and caused a volatile stock market environment. The environmental technology sector was not spared either. What is the outlook for the sector? We asked fund managers Clemens Klein and Alexander Weiß in a double interview.

All articles on the topic “Sustainability”

Sustainable income with “double dividends”

Comfortably making return on the money market via interest? A thing of the past. Investors wanting to outsmart inflation should think about dividends and dividend shares. The combination of dividend shares with a selection process that takes into account ESG criteria constitutes an interesting investment alternative. So there is a kind of “two dividends”.

Impact investing: a new strategy for overcoming environmental challenges

Impact investments are currently hot property in the financial sector. Impact funds are investments that are meant to generate positive, measurable social and environmental effects in addition to financial return.

Saving the world with an impact fund?

Can sustainable investment change the world? What is impact investing, and what does Erste AM offer in this respect? Do only sustainable investors make an impact, or do all investments have an impact on the future? Impact funds – the cherry on the cake of sustainable investing? For a long time, it would be up […]

Sustainable finance – an (overdue) act of re-orientation?

In general terms, impact investments are investments that bring societal benefits on top of financial yield. This topic therefore offers a great opportunity to talk to experts about the effects of investments on society. This is why Erste Asset Management also has an internal forum, where ESG topics, sustainability aspects, and climate risks are periodically […]

Focus on ESG risk – the EU approach

From the coldest winter in Beijing’s recorded history to the storm in Texas that surprised the world – extreme weather phenomena remind us again and again of the invasion of climate change into our daily routine. Climate risk can no longer be ignored and has to be taken into account in asset management as well. […]

Changes to the investment universe, March 2021 – June 2021

Actual / nominal 2.100 Admitted Aker Horizons AS (sector: renewable electricity (renewable energy)), ESGenius score 53 (03/2021); invests in, and develops, companies in the field of renewable energy and other technologies that contribute crucially to the reduction of CO2 emissions. Majority investments in the listed companies Aker Carbon Capture AS and Aker Offshore Wind AS […]

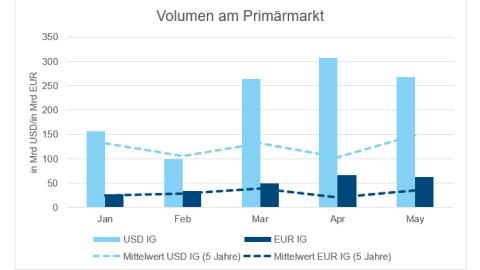

Impact bonds are here to stay

It started with the first climate awareness bonds of the European Investment Bank. Even back then, the issue proceeds were earmarked for explicitly sustainable projects of the supranational bank. In recent years, the volume of such bonds has increased rapidly. The issue volume rose from USD 300bn in 2019 to USD 500bn in 2020. The […]

US and Europe restarting joint efforts in fight against climate change

The USA and the EU are back on the same page as new President Joe Biden takes office. The new US climate envoy John Kerry, on his first visit to Brussels in this role, underlined the importance of the renewed climate alliance with Europe. “We are committed to renewing our strong alliance in the fight against the climate crisis,” the former US Secretary of State said in a joint statement with EU representatives last Wednesday.

The EU Sustainable Finance Disclosure Regulation and its impact

Today the EU Disclosure Regulation comes into force. This is intended to create transparency with regard to the inclusion of sustainability risks in financial investment products. What does the regulation include and what do we do as a fund company?

“Environmentally friendly technologies will be growing for years”

Technologies – and, in particular, environmentally friendly ones – were THE big narrative on the stock exchanges last year. The upward trend of these companies continues in view of the clear political cues. Interview with Clemens Klein, Senior Professional Fund Manager.

What are the characteristics of a good sustainability fund?

The strong market growth in recent years of sustainable investment products has produced a variety of investment strategies that makes it hard to recognise such investments at first glance. Is there any relief in times where every player on the financial market is talking about sustainability? Guest commentary by Roland Kölsch, Qualitätssicherungsgesellschaft Nachhaltiger Geldanlagen.

“Our funds lead companies to engage more actively with sustainability”

Can investment companies contribute to making the world a better place? Walter Hatak, Head of Sustainable Investments with Erste Asset Management (Erste AM), responds with a resounding “Yes – but only with the help of our clients!” More and more client assets go towards climate-friendly companies, while at the same time Erste Asset Management uses its votes from the shares it has invested the clients’ funds in to elicit more sustainability from companies across the board.

Sustainable performance via engagement and dialogue

The topic of sustainability offers a great opportunity to discuss the question of engagement. By engagement, we understand the dialogue between investors and shareholders and the respective companies in order to suggest changes and to bring them about in a targeted fashion.

ADDED VALUE FOR (WO)MAN AND NATURE: Sustainable investments for a better tomorrow

The coronavirus pandemic is currently a challenge to the entire world, but the climate crisis has not lost any of its urgency either.

Sustainability – a critique of a success story

The term “sustainability” can be found in the 2019 annual reports of all 20 ATX companies – and usually more often than terms like “profit” or “efficiency”. What the reference to sustainability means specifically is not always clear.

How do rating agencies assess sustainability?

To many companies, ESG is still a relatively new field, which is why it is important to understand how rating agencies evaluate sustainability and how the approach has changed over the years.

Erste Asset Management becomes a climate-neutral fund company

Numerous companies increasingly see themselves as responsible for doing something to protect the climate, and for good reasons. Erste Asset Management compensates for company-specific CO2 emissions and supports international climate protection projects.

EU GREEN DEAL: OUT OF THE CRISIS, BUT THE RIGHT WAY

The “European Green Deal” is a new vision for a sustainable and fair economic system in Europe. Green investments can also be profitable investors in the long term.

The European Green Deal: Do no significant harm

A European Green Deal is the ambitious goal of the EU to implement a new growth strategy to stop net greenhouse gas emissions by 2050 and make economic growth independent of resource use.

Active ownership in times of Covid-19

Corporate dialogues were not particularly hindered by Covid-19. After a short collection phase, both in the companies and in our company, corporate dialogues were resumed or already ongoing dialogues were continued.

An entire bus fleet of sustainability

The EU wants to be climate-neutral by 2050. Mobility – one of the biggest producers of greenhouse gases – is of particular relevance to this strategy. Traffic is currently responsible for more than 25% of total CO2 emissions in the EU. Road traffic accounts for 72% thereof, and traffic by air and by water for […]

Everybody will know someone who is affected by climate change

Will Europe become the first climate-neutral continent in the world? What has become of the climate movement? In recent months, Corona has completely ousted the issue of climate change from the media. Walter Hatak, Head of Sustainable Investments at Erste AM.

Interview with WALTER HATAK, Head of Investment Erste AM

According to the latest report from Forum for Sustainable Investments, the investments in sustainable funds/mandates (i.e. institutional clients) increased by 39% in 2019. What do you think is the reason for the drastic increase of this asset class? What has become clear during this crisis is that people are ready for big changes within short […]

Erste Asset Management excludes oil companies

Austrian sustainability pioneer withdraws early from the oil sector in all sustainable funds with eco-labels. What are the reasons?

Electricity & Energy – facts & figures

*ESG stands for Environmental, Social and Governance“ – These are the three broad categories according to which companies are examined in sustainable investment. Disclaimer: Forecasts are not a reliable indicator for future developments.

Ørsted AS: Best Practice and Environmental Leader

According to our evaluation, the Danish Ørsted AS is among the leading companies in the environmental sector, which results from a radical transformation of the business model that the company has gone through in the recent decade. Whereas ten years ago the company produced 85% of its energy from fossil fuels and only 15% from […]

Time is running out

Many of the companies in the utilities sector have so far failed to implement a comprehensive decarbonisation strategy. Utilities sector: assessment & engagement According to the analysis by our partner MSCI, less than half of the companies in this sector[1] have set themselves goals such as the ones required for the containment of climate warming […]

Energy and phasing-out of coal-based electricity

The topic of energy and electricity provides an excellent background to have a closer look at the issue of energy transition. The prevalent energy mix, which is still very much geared towards fossil fuels, is in the process of transition, as also pointed out by Erste AM’s research partners. The comeback of coal? The current […]

Green bonds for clean energy

Green bonds are bonds whose issue proceeds are exclusively used to finance existing or new projects with environmental benefits. Long tradition In 2007, the European Investment Bank (EIB) issued the first green bond and called it “Climate Awareness Bond”. While during the first years this young market segment was largely driven by supranational issuers and […]

Divesting oil – personal preface included

When I think back to my first school outing to the refinery in Schwechat (Lower Austria), the first thing that comes to mind are the excellent wiener sausages at the canteen. The highly complex processes involved in the refinement of crude oil, on the other hand, are hard to digest even for an adult. Divesting […]

Erste Asset Management integrates sustainability in funds and on corporate level

Erste Asset Management expands on its pioneering role in the area of ethics and environmental issues. The company is taking the next step by making sustainable criteria an integral part of a large number of its investment decisions.

Frankincense, myrrh, or gold? Have you found the right Christmas present yet?

The gifts of the three Magi to the new-born Christ Child are well known. Even back then, gold was of high value due to its scarceness and was regarded as a special kind of paying one’s respects to someone. Frankincense and myrrh have since then lost some of their appeal as gifts, but it is […]

Gold: the most sustainable commodity in the world?

Guest commentary by expert Ronald-Peter Stöferle The public is still being fed the narrative of gold being a dirty metal. Gold is considered environmentally reproachable because open-pit mining requires enormous volumes of rock to be moved; and in rare cases, mercury is used in the process. Gold is also regarded as soiled in terms of […]

All that glitters is not gold

To extract gold, copper, nickel, tungsten and other metallic raw materials, entire ecosystems are destroyed. Guest author Georg Scattolin from the WWF, on environmental threats in the extraction of raw materials.

Tiffany as exemplary company in the field of sustainability

The takeover by LVMH raised the media profile of Tiffany last week substantially. Not only financial aspects, but also the sustainability strategy make the company attractive. Tiffany has gone through an impressive development in terms of sustainability. The company has co-financed or implemented numerous projects to facilitate a better and more environmentally friendly production of […]

Gold with traces of rust

Hardly anyone can escape the fascination of gold. But, what is the economic function of gold, and how does it perform socially and environmentally?

Changes in mobility

Whereas in previous decades the development in the car industry had almost come to a halt, we have seen momentum picking up in recent years in the development of alternative forms of propulsion in this sector. E-car technology should prevail in the long run – our research partners agree on that. For other technologies such […]

Changes to the investment universe, September 2019 – November 2019

Admitted PowerCell Sweden AB (sector: Electrical Components & Equipment), EAM ESG rating 09/2019 of C; admitted into the investment universe of ERSTE WWF STOCK ENVIRONMENT in September 2019. The company was created as a spin-out from Volvo Group in 2008. PowerCell Sweden AB develops and produces modular and scalable fuel cell stacks and systems. Development […]

Do you feel guilty about driving a car?

Do you feel guilty about driving a car? – What’s this question all about? Whereas the term flygskam (flight shame) has become popular outside of Sweden in recent years, there are far fewer people who feel they need to justify driving a car. It has become routine for booking websites to offer compensation options for […]

Automotive Sector: Engagement and Voting

VW is no longer part of the responsible funds. Reasons for this are the use of cheating software and animal testing.

Automotive sector Facts & Figures

Read more articles from this issue of our ESG letter here. *ESG stands for Environmental, Social and Governance“ – These are the three broad categories according to which companies are examined in sustainable investment. Legal note: Prognoses are no reliable indicator for future performance.

Mobility of the future: moving the traffic of goods onto the rail track

Currently only a third of transport is by rail. However, in domestic transport (i.e. Austria), 60% is possible, and even 85% in cross-border traffic – a clear signal that should be heeded by rail infrastructure strategies. In addition to a socio-ecological tax reform, a comprehensive turn-around in mobility is a crucial factor in the fight […]

TESLA: no investment in environmental funds

Tesla Inc. is not part of the sustainable investment universe of our environmental fund, ERSTE WWF STOCK ENVIRONMENT, which is also the oldest one of the sustainable range of Erste AM and is subject to strict criteria. The underlying rationale of the fund is to invest in products or technologies with particularly high environmental utility […]

“In 2040, 60% of all new cars will be electric” – Interview with equity fund manager

Equity fund manager Clemens Klein is interviewed about promising new environmental technologies and explains what investing in renewable forms of energy can do to help the environment.

Meat production: Perspective of a sustainable investor

Sustainable investors and informed customers are essential in order to decrease the negative impact of meat production on the environment.

Mobile hen houses and high-tech: the AUGA Group

High water consumption, pollution of soils and destruction: These are just some of the criticisms of conventional agriculture. The AUGA Group shows that it can be done differently!

Revolution on a plate

For many Austrians meat is simply one of them. But the enjoyable change spares both the wallet and the environment. WWF guest author Helene Glatter-Götz gives tips for a sustainable and balanced diet.

Searching for the hair in the (chicken)soup

ESG analysts look beyond traditional key ratios like cash flow and growth rates. They take a closer look and take into account the social and environmental aspects of a company.

Meat as a driver of climate change

Cattle-breeding on a global scale is very harmful to the environment. The usage of water in draught areas is one of the biggest problems. But are substitute products the answer to limiting emissions from meat production?

Pesticides, Animal Feed and Meat Consumption – The Food Revolution

The last article in our dossier on “Meat”: What role do animal feed and pesticides play for the environment and the climate?