Our 2019 stock market review: for investors around the world, 2019 was by and large a continuation of the previous year: the trade dispute between the US and China and the back and forth over Brexit remained the dominant topics.

Our 2019 stock market review: for investors around the world, 2019 was by and large a continuation of the previous year: the trade dispute between the US and China and the back and forth over Brexit remained the dominant topics.

Only a few weeks left and then 2019 is history. Thanks to booming stock exchanges and yet another increase in bond prices. Investors can look back on a pleasing balance sheet.

Against the background of the initial public offering of Saudi Aramco, the international energy agency predicts a robust demand for oil by 2025. Thereafter demand-dynamics will decline sharply due to increase in energy-efficient vehicles.

The FT Nordic Investor Outlook 2019 was dedicated to the topic „Agile Investment in Uncertain Markets“. High caliber speakers were discussing China, ESG and Brexit.

The Turkish invasion in northern Syria and the conflict surrounding it with the USA put the lira under renewed pressure, raising concerns about the Turkish economy’s recovery.

Although the current phase of the czech economy is not utterly perfect, it can be called a golden age. What is behind all of this ?

In the previous week crude oil prices have been the highest since 1991. How is the struggle for stable prices on the oil market going? First AM resource expert Alexander Weiss explains the current situation.

New smartphones will dominate the international radio exhibition in Berlin until the middle of this week. What does the current market look like & what does that mean for technology stocks?

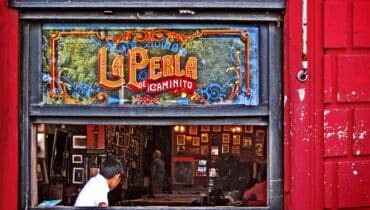

The developments surrounding the election in Argentina & presidential challenger Alberto Fernandez are currently frightening investors. Are we looking at a “default”? Our fund manager Felix Dornaus analyzes the situation.

The recent confrontation between the USA and China in the areas of trade and currency management triggered temporary losses for risky asset classes such as equities. Are the negative implications of an ongoing USA-China conflict strong enough to set off a decline or even a recession?