All articles on the topic “Bonds”

EU and US Looking to Latin America as new Strategic Business Partner

The EU and the USA want to focus more on Latin America as an important economic partner. Most recently, the chances of concluding the EU’s long-planned trade agreement with the Latin American Mercosur free trade zone have also increased.

Attractive yields: Why corporate bonds are worth a look

Corporate bond yields are now back at attractive levels. In his article, senior fund manager Hannes Kusstatscher explains what this means and how the situation on the bond market could develop.

How to invest in corporate bond funds

Yields on corporate bonds in both the investment grade and high-yield segments have risen significantly in recent months. This means that there are currently interesting entry levels again.

Our expert Johann Griener explains in his blogpost how to take advantage of this opportunity with a corporate bond fund.

How a bond fund “works”

Interest rates are back, which means that investing in bonds and bond funds again offers opportunities for attractive returns. Our expert Johann Griener explains how a bond fund works and what you should bear in mind when investing.

Market commentary: What will the new year 2023 bring?

In the past year, numerous trouble spots preoccupied the markets. In his market commentary, Gerald Stadlbauer, Head of Discretionary Portfolio Management, gives an outlook on what 2023 might bring.

Interest rates are back

After many years of low interest rates, the tide has turned in recent months. This is also creating some opportunities on the bond market again, as our expert Johann Griener explains in his article.

The forthcoming steepening of the term structure of interest rates: An investment case

How the yield curve of a bond looks depends on several factors. In his article, fund manager Tolgahan Memişoğlu explains what this means and why yield curves could become steeper again in the future.

Hawkish holidays from the Bank of Japan

Last week, the Japanese central bank made the last major monetary policy decision of 2022, bringing an eventful year to an end – also from a central bank perspective.

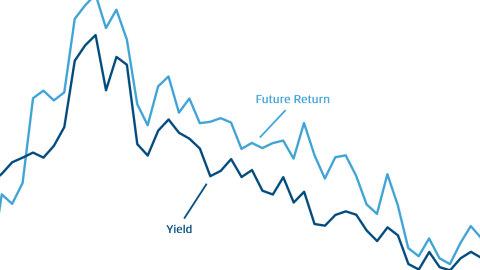

Yield and Return on Bonds

How are interest rates and future bond returns related? Why can the yield be higher than current interest rates? Our blog looks at the correlations in fixed-income investments.

Outlook: Development of the neutral real interest rate

This year brought a turning point in the monetary policy of the major central banks. The crucial question is whether this turning point is cyclical or structural. It is therefore worth taking a look at the neutral interest rate, as this captures structural macroeconomic changes.