In line with the surprisingly strong economic indicators in the US, government bond yields have risen significantly in recent months. This is putting pressure on the prices of many classes of securities and intensifying discussions about how restrictive interest rate policy really is. Could the higher level of yields make the central bank’s job easier in the form of further interest rate hikes?

Article on tag "yields"

Best of Charts: News from the inflation

Even though inflation has weakened recently, it remains an important topic for private individuals as well as for companies and the markets. What might happen next in terms of inflation and how long will the restrictive monetary policy stay with us? A look at some important financial charts will shed some light on this.

Attractive yields: Why corporate bonds are worth a look

Corporate bond yields are now back at attractive levels. In his article, senior fund manager Hannes Kusstatscher explains what this means and how the situation on the bond market could develop.

Transition Phase

So far this year, high inflation rates have been the driving factor on the financial markets. This could now change, as Chief Economist Gerhard Winzer writes. Disappointingly weak indicators of economic activity could now increasingly come into focus.

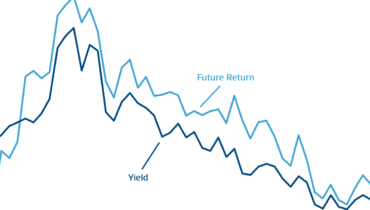

Yield and Return on Bonds

How are interest rates and future bond returns related? Why can the yield be higher than current interest rates? Our blog looks at the correlations in fixed-income investments.

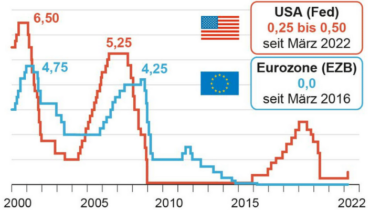

How far will the interest rates be rising, Mr. Zemanek?

With the first interest rate hike in five years, the US Federal Reserve has ushered in a new era. Is the period of cheap money now over? When will the European Central Bank follow suit?

Hungary: fiscal and monetary policy news

The European media has been paying attention to unorthodox economic policies in Hungary for years, supporting or opposing them depending where they stand on the political spectrum. At the same time Hungarian decision makers always stress they represent normality. Nowadays the question is: should we finally expect both monetary and fiscal policy normalization in the following years?

Attractive yields for emerging markets bonds in local currencies

On 17 October 2018, ERSTE BOND LOCAL EMERGING celebrated its 10th anniversary – a perfect time to have a closer look at the asset class “Emerging markets bonds in local currency ”. More in our Blog.

YIELD RADAR: September 2018

Annualised real global GDP growth amounts to slightly above 3%. The composition of growth is not homogenuous. While the US economy grows strongly, the weakening loan growths puts weight on the economic activity in China. Find out more in the current yield radar.

Equity returns and dividends: it depends on the market phase

To most people, the notion of the performance of shares relates to changes in the share price. This does not take into account the second component of return, i.e. the dividend. Simply looking at the share price development seems too one-sided to me. After all, dividends may account for up to a third of total return, as is the case for example for the shares listed on the Vienna stock exchange. However, shares with strong dividends do not generate the highest total return in every phase of the market.