Articles about “Donald Trump”

The United States – a country in transition?

About a year after Donald Trump was elected US president, it is clear that his second term in office will bring many changes to the US – from numerous regulations to an aggressive tariff policy. The effects of these measures are being felt in many areas. Where are the United States heading?

Section 899: How Trump’s tax plans could affect international investors

With the ‘One Big Beautiful Bill Act’, US President Donald Trump wants to push through extensive tax cuts. Section 899, among others, is viewed critically. The passage could primarily affect foreign investors in the US and thus also weaken the US capital market.

The Triple B Plan

Donald Trump’s “Big Beautiful Tax Bill” package is intended to bring comprehensive tax cuts in the US. The already high budget deficit would increase further. This would also have an impact on US government bond yields, which have been rising for months anyway. There is a threat of a downward spiral with unforeseeable consequences.

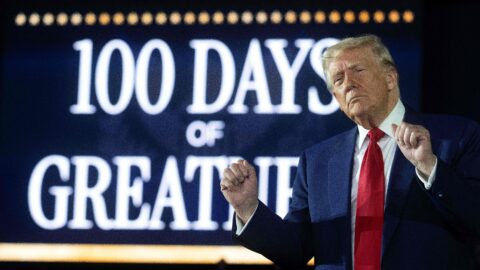

Trump 2.0 – The first 100 days lie behind us

Following the tariffs shock and the accompanying market turmoil, the deferral of said tariffs has led to a surprisingly rapid upturn on the equity markets. That being said, uncertainty remains high, even though the US reporting season has been positive so far. Read more in the market commentary by Gerald Stadlbauer, Head of Discretionary Portfolio Management.

The first 100 days

The first 100 days of Donald Trump’s second presidency are behind us. What has happened since then? Will the structural changes continue at this pace?

Central banks at odds: How are Fed and ECB reacting to the trade conflict?

Trump’s customs policy and the trade conflict also pose new challenges for central banks. However, while the ECB has room to cut interest rates in order to support the economy, the Fed must exercise caution in the USA. Higher tariffs also threaten to push up inflation again.

However, US President Donald Trump does not like the Fed’s course at all. His attacks on Fed Chairman Jerome Powell are fuelling concerns about the central bank’s independence. Even though Trump has recently backed down slightly, his comments are once again unsettling the markets.

Stock markets react volatile to tariff pause: what happens next?

The US government’s extensive tariff plans have been causing volatility on the stock markets since last week. Yesterday’s announcement of a 90-day pause for the new tariffs was met with relief by the markets – even though a further escalation between the US and China is on the horizon. We take a look at the current situation on the financial markets and analyse the possible consequences of an escalation in the trade conflict.

US tariffs trigger a price slide – what to do now

The latest US tariffs have caused considerable turbulence on the financial markets worldwide. What is the background to the tariffs and how can investors react in the current environment?

G7 countries agree climate targets, vaccination programmes and China policy

With renewed vigour, the heads of state of the G7 group of leading industrialised nations recently agreed climate targets, vaccination programmes for poor countries and a common front against China at their eponymous summit, held in the British resort of Carbis Bay.

USA: Clear sailing for Joe Biden’s economic programme after winning Senate majority

After the Democrats’ success in the Senate run-off elections in the US State of Georgia, the party now has the de-facto majority in both chambers of Congress, and therefore US President-elect Joe Biden should soon have much more leeway for implementing his economic policy programmes.

US election campaign entering hot phase: decision in the midst of the crisis

In the midst of the corona crisis, following the first TV debate and US president Donald Trump’s infection with the corona virus, the race for the US presidential office enters its critical phase. In nationwide opinion polls, Democratic candidate Joe Biden is currently ahead of Republican incumbent Trump.

Tensions are rising in the run-up to the US elections

The US elections in November are not only important from a geopolitical perspective. The race between Joe Biden and Donald Trump for the presidency also influences events on the financial markets.

Trump declares war on Chinese companies behind TikTok and WeChat

US President Donald Trump has escalated his fight against the Chinese-owned social media services TikTok and WeChat, and in the process also caused new tensions in the trade dispute with China.

World Economic Forum Davos 2019: about economic downturn and trade war

In view of a trade war, the Brexit and the threat of an economic downturn, the World Economic Forum meeting this year was dominated by calls for increased international cooperation. Read here what Lagarde and Merkel had to say.

New year gains for stock markets as hopes for end of trade dispute increase

As hopes for an end to the trade war between the US and China increase, the stock markets reflected the sentiment with gains at the outset of the new year. Find out more in the new blog entry.

Financial Markets Monitor May: positive opportunities outnumber negative ones

Positive opportunities still outnumber the negative ones on the capital markets – that was the conclusion of our Investment Committee. Our willingness to take risks is still optimistic and also moderately higher than in April.

Market Monitor: Optimism on the rise

This week we held our monthly Investment Committee meeting. Although only little has changed with regard to the overall economic picture, we were having a few interesting discussions that we would now like to share with you.