This week we held our monthly Investment Committee meeting. Although only little has changed with regard to the overall economic picture, we were having a few interesting discussions that we would now like to share with you.

Optimism on the rise

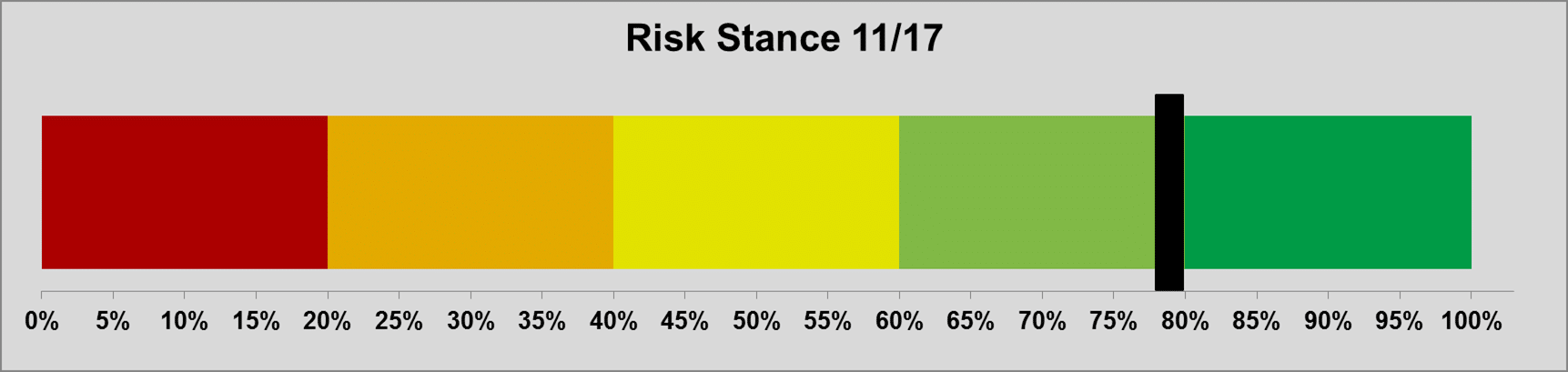

Our Risk Stance, i.e. the current risk appetite of our Committee, is very positive and also more positive than last month. Thus, we have seen an improved assessment of the environment for risky assets for the third consecutive time. However, the improvement was moderate. Two of the 13 members of the Committee were a notch riskier in their assessment. This is due to the fact that the economic environment remains very positive, which suggests investments in risky assets, while the political problems (North Korea, Catalonia) have declined over the past months.

High growth, low inflation: thank you, global economy!

The presentation on economic drivers has shown us yet again how strong and broadly based the growth of the global economy currently is. There is hardly a region or a country that is not growing at the moment. Given the decline in growth potential of the global economy after the crisis, the global economy seems to be driving at maximum velocity.

In view of this environment, the low inflation is all the more surprising. The unemployment rate in the OECD countries is now on pre-financial crisis levels despite the significant differences among the various countries, the unused capacities of the economy have been on a noticeable decline, and the prices of many important commodities (energy, industrial metals) have increased by an average of more than 20% in the past six months.

In spite of this situation, prices are hardly rising, or doing so below expectations. Against this backdrop, inflation is currently the most important economic parameter for us. If inflation were to pick up – as has been customary at this point in the economic cycle in the past – it could severely dampen the upbeat sentiment on the markets.

“Balance Sheet Normalisation“ – a topic for 2019

The effects of the balance sheet normalisation, i.e. the reduction of the bond holdings in the balance sheets of the central banks, accounted for the biggest part of our discussions. After a presentation on economic drivers by the Chief Investment Officer (CIO), we highlighted a few issues in our discussion:

- In our opinion, the bond purchase programme had a strong effect on the markets. The yields of government bonds and the spreads of risky bonds were down, as was the uncertainty on the markets, measures for example by volatilities, and share prices were up. Many studies show these effects and provide an, albeit very scattered, quantitative assessment of this effect.

- The reduction of bond holdings that has now set in in the USA should come with a milder effect than the purchase of the bonds had done. Why? In simple terms, the purchase programmes occurred during a phase of high tensions on the markets. In this environment, they contributed significantly to calming those tensions. Now that the markets are functioning again, they should be able to absorb a reversal of measures much better.

- Even after the announcement by the US central bank not to reinvest parts of the expiring bonds and by the ECB to reduce its bond purchase programme, the large central banks will be buying more government bonds in 2018 and 2019 than the respective governments are issuing on aggregate.

- The central banks are well aware of the fact that both they and the financial markets are far less experienced with the tools of unconventional monetary policy than with ordinary tools. They are accordingly cautious when it comes to reducing or reversing unconventional monetary measures.

- Many studies suggest that the essential part of the effect of the bond purchase programmes occurred at the announcement of these programmes. Since the so-called tapering tantrum in the first half of 2013 it has been clear that the US central bank has put the monetary policy in reverse. Since then, the Fed has consistently and cautiously prepared the market for its next move. So far that has worked out well and has reduced the risk of sudden, strong spikes, for example in US Treasury yields, which could build snowball momentum.

Overall, we expect the programme aimed at reducing the bond holdings of the US Fed to amount to about USD 230bn in 2018; this should exert moderate upward pressure on yields. Estimates by the US central bank, by research providers, and by our own experts suggest an effect of about 15bps. We expect other drivers of government yields such as the increase of key-lending rates, inflation, or economic growth to have the potential of dominating these effects.

More interestingly, from our point of view, will be to see what happens when not only the Fed, but also other central banks start reducing their bond holdings, or when higher yields of government bonds cause investors to begin investing in government bonds at large scale again. Here we might see non-linear, self-amplifying portfolio rebalancing effects. From our point of view, this is an issue for 2019.

Surprises?

As always, we also discussed possible surprises. Donald Trump topped the list of the usual suspects. A successful tax reform in the USA would strongly support risky assets for a short while. We also discussed the likelihood of impeachment, but it was unclear to us, whether the markets would react positively or negatively. That being said, we do no regard the impeachment of the US president as imminently probable scenario, despite the recent brouhaha around the arrest of Trump’s campaign manager.

The elections in Catalonia and in Italy (spring) are another topic we discussed. Basically, we regard the election in Catalonia as topic of little market currency. However, we do consider the Italian elections as fairly significant. We will analyse both elections in the coming meetings of the Investment Committee.

The topic “political uncertainty in Saudi Arabia” is a new entry on our watch list. While we cannot yet assess what effects the wave of arrests of the weekend will have on the political stability of the most important oil producer in the world, the increase in the oil price indicates the relevance of this question.

Bitcoin – room for further research

Bitcoin was another exciting topic of our discussion. More and more products such as ETFs and derivatives are entering the market that make bitcoin “investable”. However, we still are unclear about how might invest in bitcoin, and how. The basic sentiment of the discussion was that we take an open yet critical stance vis-à-vis cryptocurrencies. On the one hand, there is no reason not to invest in cryptocurrencies, on the other hand the price development of bitcoin reminds us of many a bubble on the financial markets. From our point of view, the technology behind bitcoin, blockchain, has the potential to change many areas of our daily life sustainably.

Another issue we managed to outline in our discussion: a currency lives on the trust that people have in it. Especially bitcoin supporters like to point out that bitcoins are the better currency due to their limited number and the way they are created (mining). That being said, none of us would want to receive their salary in bitcoin. Either way, an exciting topic that we have filed under “room for further research”.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.