Author: Bernhard Ruttenstorfer

Author: Bernhard Ruttenstorfer

Senior Fundmanager Equities

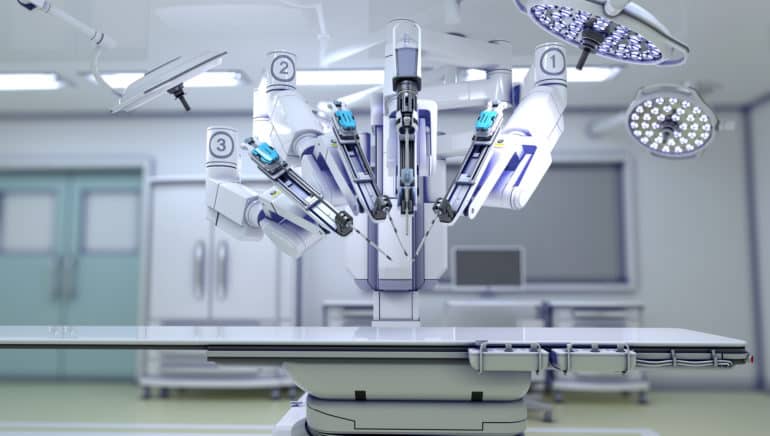

At this year’s IT trade fair CEBIT, the focus was on robots that support humans in their daily routine; on drones that can be used for difficult jobs in the field such as oil rigs; driverless electro busses that are steered by sensors and accelerate and stop autonomously; and various other technological innovations that are no fiction but have in fact already entered our daily lives. Of what relevance are they for the economy, for companies, for consumers – and for investors?

Technologies that support mankind

The information technology (IT) sector has transformed dramatically over the past 20 years. While back in the days “IT” primarily meant personal computers and the first internet applications, the meaning of these technologies has changed comprehensively since then. IT-specific products and solutions are employed across many sectors: communications, traffic, healthcare, manufacturing, retail, safety, consumer goods etc. How do the aforementioned megatrends manifest themselves? Critics will quickly point out that this is all about replacing man with machinery. But haven’t we been hearing this sort of scepticism for years? Should we not approach this situation from the other end? Is this not all about machinery and technologies that support mankind?

Data: the big business

In most cases the benefits of technological progress are of relevance when two or more developments meet and cross-fertilise each other. Cloud computing and social networks are a good example: cloud computing allows the user to access their applications from various interfaces (smartphone, tablet, PC) and to process data there. Facebook, with more than 1.8bn users, offers exactly those options: the users can upload photos, videos, or other information to their account at all times. Data and not stored on the device, but on a server operated by facebook (private cloud). There they can be accessed 24/7. With other kinds of clouds, the data are not processed on servers of the software provider, but via the infrastructure/server of external server providers (public cloud). The US online video library Netflix uses this technology. Netflix film material is also stored on servers of the (also) listed US online mail order company Amazon. Users access it via streaming. The advantage is that companies and users can employ their resources more efficiently: Netflix rents the capacity that its users actually require on a continuous basis. The users can watch films whenever and especially wherever they want: on the TV set at home, on the laptop, or on the mobile phone.

Big step from automatic parking to autonomous driving?

The topic of robotics has also become more prominent. Industrie 4.0, “Internet of Things”, Autonomous Driving – all these applications rely on data processing via cloud services. The ongoing improvement of sensor capacity has fostered their increasing popularity. In combination with specific software, new fields of application emerge. Autonomous driving is currently a media buzzword. The investments by leading companies are promising. Google, NVidia, or Tesla, to name but a few, are constantly making progress. While the step to the commercial use of autonomous driving may still be a sizeable one, the functions supporting the driver are already in use today. Lane departure warning system, automatic parking, and automatic braking are no uncharted territory for drivers anymore.

Significant earnings increase of listed technology companies

The developments of the past years are also reflected in the financial results of the listed technology companies despite the slight decrease in growth in 2016 due to intermittently reduced IT investments. The consensus estimates of analysts forecast earnings growth of more than 10% p.a. for 2017 to 2019. Share prices have also risen impressively in the IT sector. The robust earnings increase keeps valuations stable and below the long-term average.

Source: Bloomberg, EAM, 16.03.2017

Since the burst of the technology bubble at the beginning of 2000 and the frictions during the financial crisis in 2008/09, technology shares have experienced years of rising prices. But in contrast to (the period leading up to) 2000, valuations have remained low and shares are not overvalued.

Conclusion

It is the combination of megatrends and economically successful companies from the IT sector that confirms our positive attitude towards the technology sector. The megatrends in this sector ensure continuous growth in the coming years. The applications are integrated into the process of companies and the economy on an ongoing basis. The possibilities for consumers to use these technologies are being expanded.

Investing in technology stocks

The ESPA STOCK TECHNO* offers the chance to invest in the high-growth technology sector. This equity fund of ERSTE-SPARINVEST contains the most important technology companies worldwide. ESPA STOCK TECHNO works also as additional fund in an already existing equity portfolio mix and is suitable for investors with adequate willingness to assume risk and with a long-term horizon.

The author:

Bernhard Ruttenstorfer is Senior Fund Manager in the equity fund management team of ERSTE-SPARINVEST and has been responsible for ESPA STOCK TECHNO since July 2010. He holds a Master in Business Administration from the Vienna University of Economics and Business Administration and the degree of Certified Portfolio Manager (CPM).

ESPA STOCK TECHNO may exhibit increased volatility due to the composition of its portfolio: i.e. the unit value can be subject to significant fluctuations both upwards and downwards within short periods of time.