To us, the positive opportunities still outnumber the negative ones on the capital markets – that was the conclusion of our Investment Committee on 17 May. At 79% of the total bandwidth, the willingness of our EIC to take risks is still optimistic and also moderately higher than in April.

In view of the good performance of equities (in EUR terms) the cautious stance of the Committee is actually somewhat surprising; hardly anyone has changed their view in the wake of recent data and news.

Source: EAM

In summary, this is our view on the economic environment:

o The economy continues to grow at a robust pace, but we can clearly see that the wave of positive surprises and rising growth rates has been broken. In such a situation, there is the risk of the wave indeed breaking too fast, triggering worries about the economy. This is currently not the case. At the moment, the cycle is following the textbook. The robust investment activity has turned into a positive risk for the economy. After years of cautious investments from the corporate sector, this spending category has now started to grow by a significant rate. This is important for two reasons. On the one hand, investments enter GDP directly and thus increase it. On the other hand, investments today also create the conditions for growth in the future.

o Since our last EIC, inflation rates have not increased – with the notable exception of the USA. In the USA, inflation is currently at or above the Fed target, depending on the inflation indicator. In addition, wages are rising – not sharply, but they are rising all the same. In view of the good situation on the labour market, this does not come as a surprise. Overall, we are still of the opinion that inflation will not explode and is in fact contained, given the situation. We also believe that this scenario, in particular interest rate expectations, are already largely priced in. The term “symmetrical” best summarises the central bank news of the past month. In a statement following its recent meeting, the central bank said that its goal was symmetrical. – Nothing we had not already known. But given that the Fed only amends its statement when it wants to communicate something, there is a message hidden in there.

And it is largely interpreted to mean that a temporary overshooting of inflation beyond the Fed’s target will not automatically lead to further/massive interest rate hikes. The interest rate expectations have changed accordingly little. On the day prior to the FOMC meeting on 2 May the futures market had a Fed funds target rate of 2.18% priced in for December; today, that value is at 2.22% (22 May 2018). We have not changed our opinion and still expect three additional US interest rate hikes of a total of 0.75% for 2018. With regard to the ECB, we do not expect to see the immediate end of the bond purchases in September, but instead we envisage a short transitional phase. The main effect of such a step would be the set-back of rate hike expectations since we expect the ECB to stick to its announcement of only raising rates after the end of the QE programme. We think the big issue in the coming months in Europe will not be the actions of the ECB in terms of bond purchases and interest rates, but who will succeed Mario Draghi as president. Please find our opinion about this topic further down, among the risks.

Despite the generally positive stance, we have also seen some negative news enter the market since our previous meeting – yet again, Donald Trump and his politics were the source.

o The Sword of Damocles of a trade war is still hanging over the markets. Although not much has happened yet, both political decisionmakers and financial market participants globally both spend a lot of energy on analysing the situation and the best response. If the intentions, which are currently still confined to the realm of political symbolism, were to turn into actions and thus into large-scale trade barriers, this would negatively affect financial markets.

o Also, the decision by Donald Trump to pull out of the Iran deal pushed the oil price up. Higher oil prices eat into disposable income in oil-importing countries and thus into consumption, which is detrimental to economic growth: given that such a decline is usually not balanced by increased spending from oil exporters (because parts of the proceeds are funnelled into sovereign wealth funds), global economic growth tends to slow down as well. At the moment, the oil price does not yet present any risk for the global economy or the financial markets. However, further increases could trigger short-term turbulences and are among one of the biggest risks at the moment. While a long-term increase in the oil price also tends to have a dampening effect on the global economy, this effect comes with a time lag.

o The inferior US budget forecast due to Trump’s tax reform is gradually starting to cast a shadow as well. Our Fixed Income Team reports that the market in the USA has started to demand a clear premium at Treasury bond auctions so as to be able to absorb the additional supply. This situation is being reflected in the US yield level. At 3.07% (21 May 2018), the USA currently pays higher yields in the 10Y segment than many other governments do in hard currency, including those of emerging economies.

This shows that the USA is a special case. High growth, rising inflation, a tight labour market, high and growing budget deficits, and a significant current account deficit have led to a situation where investors want and have to be compensated. The aforementioned list of well-known issues suggest that a lot has already been priced into US Treasury bonds. Therefore, we expect the 10Y yields of Treasury bonds to rise only moderately anymore in the coming months to a bandwidth of 3.1% to 3.5%.

The sentiment on the equity markets remains positive. The recently published quarterly results were surprisingly positive, especially in the USA. While it is part of the game for companies to “surprise” by exceeding their guidance, the surprises have been above the level that can normally be “expected”. We saw second-degree surprises. Sales were outstanding in addition to profits. This is important because companies cannot boost their margins forever – at some point, there has to be sales growth to fuel profit growth. In view of this development, one might have even expected the reaction of share prices to be more significantly positive.

We believe that this is testament to the amount of positive news flow that was already priced into the markets. After all the big expectations surrounding the US tax reform it was time for said reform to feed through to the bottom line. This assessment also confirms that those companies that did not surprise positively were penalised excessively.

All in all, still a good environment for risky assets then. We stick to our recommendation of avoiding unnecessary back and forth and holding risky assets in the portfolio at prominent weights.

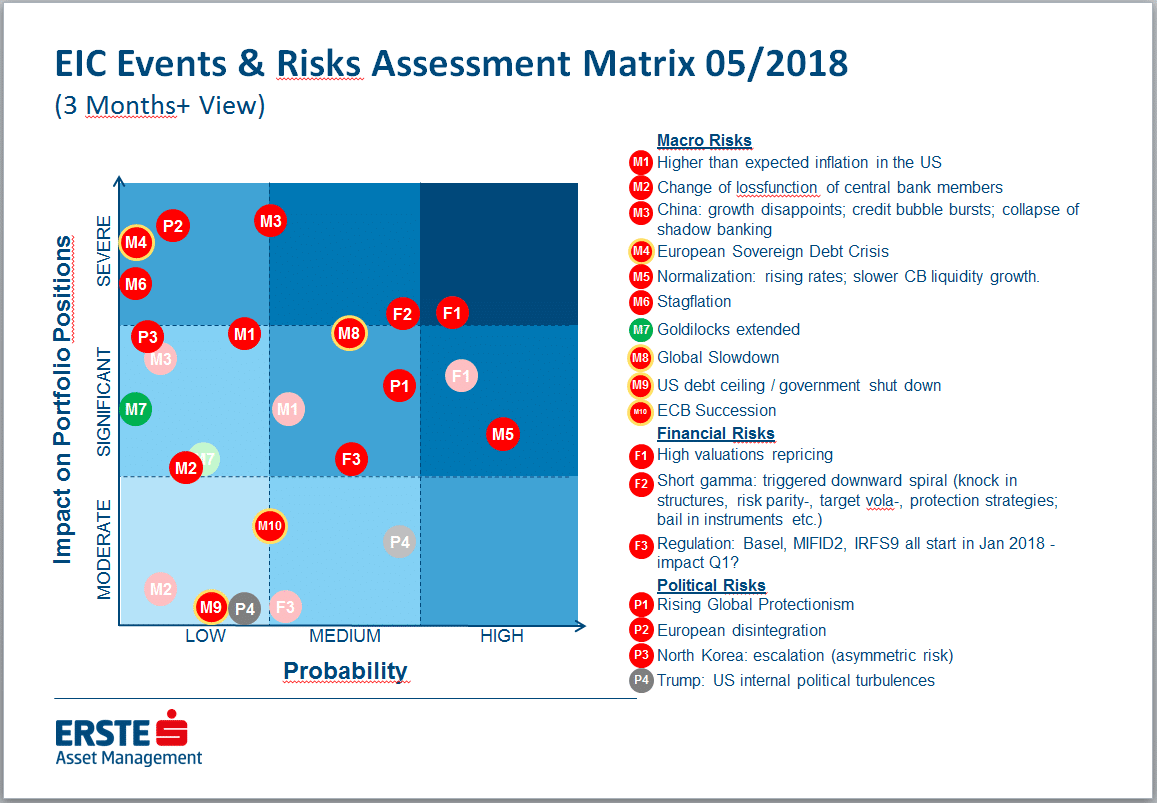

What are the risks affecting our evaluation? As always, we started the systematic discussion of the risks that we can see with our risk matrix.

What are the risks affecting our evaluation? As always, we started the systematic discussion of the risks that we can see with our risk matrix.

Two risks that were subject to intense discussion where the following ones:

- The oil price (WTI) has increased by about 70% since the end of June 2017. As discussed above, the decision by Donald Trump to terminate the Iran agreement has pushed up the oil price significantly over recent weeks. However, that somewhat glosses over the fact that the oil price had been rising for a while, and quite substantially so. The good news (from the perspective of the fund manager or analyst) is that we can point out a few specific reasons for this: the good global economic environment, the supply limits agreed on by OPEC 2.0 (Saudi Arabia and Russia), political difficulties in some large production economies (Venezuela, Libya, Iran), declining inventories in the USA, robust speculative demand for oil (Commitment of Traders Report), the effect of production cuts due to the reduction of investments after the decline in the oil price in 2014/2015 now coming to full bear, and finally the intention of Saudi Arabia to float what according to many analysts may well turn into the biggest company of the world by market capitalisation after the transaction, the oil company Aramco, via IPO. All of this suggests higher oil prices now and lower ones in the future. At an oil price of USD 75 per barrel, there is hardly a shale producer that cannot produce at a profit. Accordingly, higher prices lead to an increase in production and thus to a decline in prices. If the increase in the price of oil were only politically motivated, the risk associated with investments would be a significant one. But given that the price is also the result of supply and demand at work, the investment risk is contained. From our perspective, the main risk for the financial markets is that of the oil price overshooting in the short run prior to the long-term effects of increased production making themselves noticed on the market.

- A risk that is not new but has been rediscovered in the past weeks is Italy. With the likelihood of a populist and Eurosceptic government taking over power soon increasing daily, the markets have started focusing more on the possible effects. From our point of view, this situation does harbour a certain degree of risk, since in the past years despite claims to the contrary no new way of overcoming a crisis (see Draghi’s “Whatever it takes!”) has been developed. With Mario Draghi soon to leave office, the question of who will be his successor emerges. This discussion has only just started. Jens Weidmann has been the odds-on favourite for a while. If he were to succeed Draghi, Europe’s only “crisis fire brigade” would be run by someone who had declared himself against the use of fire engines in the event of a fire, to stick with the metaphor. From our point of view, this would come with a substantial degree of risk if a crisis were to materialise. At this point though, we do not think that Jens Weidmann is still the frontrunner for the job as EZB President.

Interestingly, almost all bigger risks in the recent past have been noticeable in terms of impact and probability. One example is “gamma pricing”, of which we saw a version in February. The risks emanating from China are an exception in this context. From our angle, this reflects the fact that China is of a different magnitude as far as risk is concerned. The fear here is not that of a “normal” recession, but that of the failure of a growth model. But that is a topic for another day.

How are we positioned in the context of this discussion?

o We remain duration-short with respect to interest products. We have reduced the interest rate risk in the USA. We expect the yields of 10Y Treasury bonds to increase towards 3.25% (currently 3.07%) and the yield curve to flatten from the short end. In Europe, we expect the 10Y yield of German government bonds to increase to 0.75% (currently 0.56%). Our positioning in Italy is currently neutral. Due to the high excess yield we have decided against underweighting this market (yet). We are overweighted in Spain.

o Equities continue to command a prominent weighting in our asset allocation, whereas Eurozone government bonds are at best lowly weighted. We have recently reduced the weighting of bonds with USD exposure such as for example emerging markets corporate bonds, which in terms of their behaviour tend to also follow the development of the US yield curve.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.