Based on the lunar calendar, the Chinese zodiac is a repeating cycle of 12 years, with each year being represented by an animal. 2021 is the year of the ox, which is associated with strength, harvests and fertility. After the turbulent year 2020, there are good reasons to look forward to returning to normalcy and development in the year of the ox. This is particularly true for China.

Pandemic in China largely under control

Thanks to the effective response including lockdowns and massive tests, China has brought the epidemic largely under control. China follows a “zero corona” policy, which helped bring cases through local transmission down to zero by summer 2020. Authorities have also acted quickly to curb a few local outbreaks during the winter. As a result, life in China has broadly returned to normalcy, with people coming back to work and students returning to schools. Vaccinations against COVID – 19 are underway across the nation, as China aims to vaccinate 50 million of its population by the Lunar New Year in February. Masks and Contact-Tracing Apps are standards in the new normal life in China, and are important tools helping the country to stay ahead of the COVID – 19 curve.

Economy recovers thanks to exports and consumption

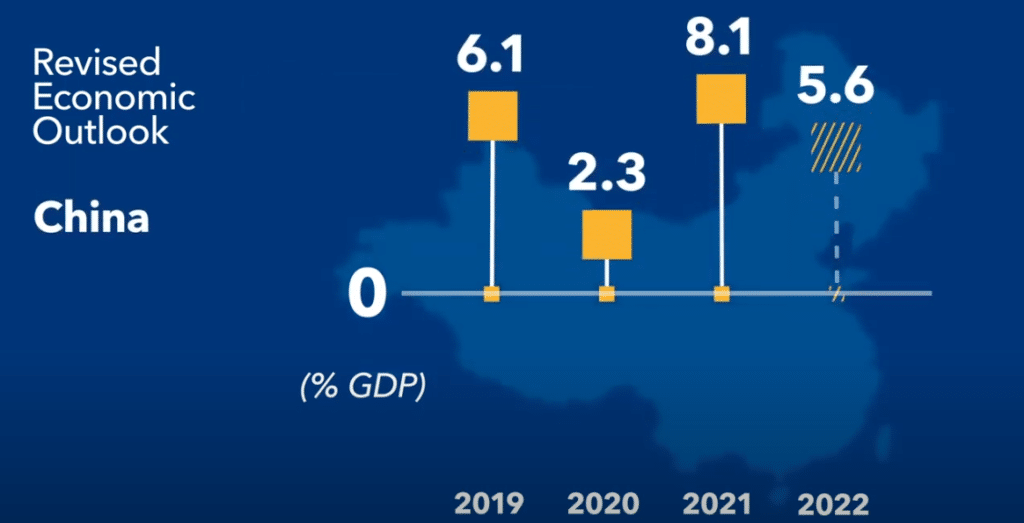

The successful containment of COVID-19 and targeted policy supports enabled the V-shaped recovery of China’s economy. China’s GDP expanded by 2,3% in 2020 and marked China as the only nation with positive 2020 growth among major world economies. The growth recovery was broad-based, led by investment and exports activities initially, and extended to consumption space a few months later. As the coronavirus spread across the globe, manufacturing capacity outside China started to fall apart. This strengthened China’s role as the manufacturing hub of the world. Chinese companies are making up a greater share of the world’s exports, manufacturing personal protection equipment, consumer electronics and other goods in high demand during the pandemic.

Chinas Economy to double by 2035

China’s economic strength is expected to continue into 2021, led by global recovery and domestic consumption. The International Monetary Fund (IMF) projects China’s 2021 growth at 8,1% and 5,6% in 2022. 2021 is the start year of China’s 14th Five-Year Plan, the year to move into the next stage to develop a high-income society, with the new objective of doubling GDP by 2035. Economic rebalancing towards consumption, services and greener growth is on the top of the government agenda. Consumption is expected to revive with both employment and income growth to recover further, especially after vaccines are available. Beside economic rebalancing, China also sets a long-term ambitious goal of “carbon neutrality” by 2060. Various policies related to energy consumption and carbon emission can be expected.

Uncertainty factors credit quality and human rights

Uncertainties remain in the path to China’s growth. On the domestic front, fiscal consolidation and credit slowdown could lead to a deterioration in credit quality. Defaults and nonperforming loans (NPLs), especially among small and medium-sized enterprises (SMEs), local state-owned enterprises (SOEs) and some local government financing vehicles (LGFVs) could potentially rise.

On the external front, the super-power competition between the US and China will continue to dominant the headlines. As the Biden administration will likely work with its allies to deal with China, the competition for cooperation with the rest of the world could intensify. The confrontation in ideology-related areas such as democracy and human rights could further escalate. US technology restrictions and decoupling pressures may also lower China’s potential growth.

Conclusio:

There are some obstacles ahead for China, however, the bottom line is that China is poised to continue to grow in 2021 while the rest of the world still struggles to bring the coronavirus under control. After all, the year of the ox shall be a better year- for China and for the world.

IMF World Economic Outlook Update, January 2021:

Investment funds for investing in China/Asia

ERSTE STOCK EM GLOBAL

In the last 10 years, the stock markets of the established markets have performed significantly better than those of the emerging markets. This could reverse in the current decade. There are good reasons to expect strong growth in the emerging markets: Besides the economic recovery after the end of the pandemic, which is already strong in China, it is the significantly lower valuation of companies and the low key interest rates in many markets such as Thailand and South Korea.

ERSTE STOCK EM GLOBAL offers the opportunity to invest broadly in equities from the world’s most promising growth regions. Equities from China and Asia (e.g. Taiwan, South Korea) currently account for more than 80% of the portfolio. The most important sector is information technology, but companies from the mining industry and consumer stocks, which profit when the global economy picks up again, are also well represented.

ERSTE BOND CHINA

There is hardly any money to be made with euro government bonds for the moment. Yields have fallen so much that even long-dated papers cannot come close to compensating for inflation. Many investors are asking themselves where there are still bonds with good credit ratings and attractive yield opportunities in this difficult environment?

ERSTE BOND CHINA offers an interesting investment opportunity with a focus on Chinese government bonds. The fund invests primarily in a diversified portfolio of government bonds with different maturities denominated in the currency yuan (renminbi). Ten-year papers from the People’s Republic yield a good 3.1% (source: Bloomberg, 29.1.2021), i.e. considerably more than government bonds from Europe, which are considered safe. And China is also a good borrower. The rating agencies Standard & Poors and Fitch give the country a credit rating of “A+”. Moody’s currently gives it an “A1”.

Legal note:

Prognoses are no reliable indicator for future performance.