The semiconductor industry is considered one of the biggest beneficiaries of the AI boom. Investors therefore kept a close eye on the sector’s figures for the first three months of 2025. One thing became clear: the expansion of AI infrastructure continues to deliver good results for most chip companies – but the sword of Damocles in the form of impending US tariffs is still hanging over industry giants such as Nvidia & Co. Read more in today’s blog post.

All articles on the topic “Markets and opinions”

London Calling – New momentum for the UK stock market?

The UK is starting 2026 with optimism: falling inflation, improved sentiment indicators, and hopes of imminent interest rate cuts are driving momentum in the economy – and on the stock market. In today’s blog post, we take a look at the UK economy and stock market.

Trump’s tariff hammer

The US Supreme Court has put a stop to the majority of tariffs. The Trump government’s response: new tariffs – even if they already have an expiration date. Is uncertainty now increasing again?

Weekly Winzer: Is the situation between the USA and Iran escalating?

Tensions between the US and Iran have intensified again in the past week. Is there a threat of escalation and what impact will the conflict have on the financial markets?

After a strong IPO year, there could be even more this year

Following a comeback last year, the IPO market is experiencing a further upswing. According to experts, several factors point to a large number of IPOs this year. In today’s blog post, we take a look at which sectors and companies could take the plunge onto the trading floor in 2026.

Weekly Winzer: Sector rotation

The stock markets are rising, which is not surprising given the fundamentally positive environment. However, the sector rotation away from growth stocks and toward value stocks is becoming increasingly noticeable. Chief Economist Gerhard Winzer explains the reasons for this in his weekly market commentary.

Market update: “Business as usual”

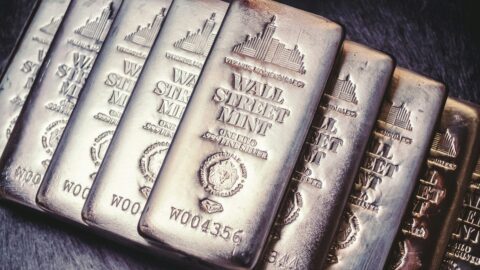

The new year has so far continued in the same vein: there has been a flood of news on the markets, while the stock markets remain robust, undeterred by the perceived high level of uncertainty. In recent weeks, events have been dominated by the appointment of the future US Federal Reserve chairman and price turbulence in gold and silver.

Economy, geopolitics and AI – that was the World Economic Forum in Davos

From geopolitics to AI, the range of topics at this year’s World Economic Forum in Davos was diverse. The conflict over the USA’s Greenland claims was the main focus of the summit. In today’s blog post, we look at what else was on the agenda at the meeting of leading politicians and economic experts.

Energy hunger and energy transition: what environmental technologies have to do with AI

With the rapidly growing power requirements of modern AI applications, renewable energies, high-performance grids, and flexible storage solutions are coming into focus. Read why the energy question is becoming a decisive factor in the digital future in our new blog post.

Gold and silver prices continue record rally

While all eyes were on the conflict surrounding US President Donald Trump’s Greenland plans this week, the prices of gold and silver continued their record run unabated. The reasons for the rally are manifold and are unlikely to disappear any time soon. It doesn’t always have to be physical gold to participate in this trend. More on this in today’s blog post.

USA demands control over Greenland: What are the possible consequences?

After US President Donald Trump continued to demand that the US gain control over Greenland, he has now announced further tariffs against certain EU countries. How might the Greenland issue develop, and what are the possible consequences?

A new “D” in the D world

With the “Donroe Doctrine”, a new term is shaping the first few weeks of the year. Despite the geopolitical events, the markets are proving robust, which is probably also due to positive economic data. Read more about this in the latest commentary by Chief Economist Gerhard Winzer.

Stock markets end turbulent year close to record highs

Trade conflicts, interest rate decisions, geopolitical tensions and the ongoing AI boom – 2025 had a lot in store for investors. Despite a turbulent year on the stock markets, the most important share indices close close to all-time highs. In today’s blog post, you can find out which sectors particularly shone in 2025 and which topics shaped the year as it drew to a close.

Reality check for the market outlook

Just before Christmas, the markets were once again on fire: numerous interest rate meetings and fresh economic data caused a stir. While expectations for the coming year seem largely set, the new signals from the central banks provide material for a reality check – especially with a view to 2026. Which scenario will win the race and where are the risks lurking?

Fed rate cut – A Christmas present

As expected, the US Federal Reserve has lowered its key interest rate once again. This is a positive step for the markets. But how will the Fed continue with its interest rate policy in the new year?

Netflix vs. Paramount: Who will win the bidding?

The takeover battle for Warner Bros. Discovery is making headlines: Following Netflix’s planned acquisition of the media group, Paramount has responded with a surprise counteroffer. Who will prevail in the battle between the streaming and film companies, and what does the bidding war mean for investors? Find out more in today’s blog post.

The Tulip Mania

History often serves as a cautionary tale for investors, reminding us that speculative bubbles are usually recognised only after they burst. Just as the Tulip Mania of the 17th century.

The United States – a country in transition?

About a year after Donald Trump was elected US president, it is clear that his second term in office will bring many changes to the US – from numerous regulations to an aggressive tariff policy. The effects of these measures are being felt in many areas. Where are the United States heading?

Tech stock fund manager Ruttenstorfer: “AI is more than just a hype”

Investors around the world are wondering whether the current developments surrounding artificial intelligence (AI) are only a hype on the stock markets or actually heralding a new era of value creation. What is really behind the boom? Bernhard Ruttenstorfer, fund manager of ERSTE STOCK TECHNO, assesses the situation.

Argentina: What does Milei’s election victory mean for investors?

Following the surprisingly clear election victory of President Javier Milei’s party in the Argentine midterm elections, he is likely to further accelerate his reform efforts. Fund manager Anton Hauser analyzes the potential implications for Argentina’s economy and investors in an interview.

From High Yield to High Risk: What happens when companies stumble?

High-yield bonds carry a higher risk, but usually offer higher returns. But what happens in the event of a default, i.e., if the company fails to make its payments? Bond fund manager Hannes Kusstatscher explores this question in his blog post.

AI boom and cloud growth: Tech giants set new standards

Artificial intelligence, cloud boom, and new records: Major US tech companies are turning heads with strong figures and ambitious plans. What is behind the current boom at Microsoft, Alphabet, and others? Read more about the latest developments at the tech giants in today’s blog post.

The markets in a gold rush – overheated rally or brilliant opportunity?

Gold on the rise: Will the rally continue and what opportunities are still available for investors? Read today’s blog post to find out what is behind the development of the gold price and why shares in the gold sector might also be worth a look.

Private equity: Central Europe comes into focus

Erste AM is launching a new private equity fund of funds, Erste Diversified Private Equity II. Thomas Bobek, Head of Private Markets, talks about the investment approach and the private markets segment in an interview.

Speed to power: Why Cleantech equities keep catching up

Clean tech stocks continued to catch up in the third quarter. Above all, the energy demand generated by AI remains a key driver for renewable energies and environmental technologies.

Emerging markets surprise: positive development despite tariff headwinds

Despite tougher US tariff policy and political uncertainty, the emerging markets are proving surprisingly robust this year. What factors are behind this and what opportunities are there for investors? Find out more in today’s blog post!

Is the automotive industry facing a new chip crisis?

After delivery problems at a major supplier became known last week, fears of a new chip crisis are spreading in the automotive industry. How do industry associations and leading car manufacturers assess the risk?

The search for stability continues, despite rising stock markets

Despite rising stock markets, investors are increasingly seeking stability and are finding it more and more often in new ‘safe havens’. Portfolio Manager Clemens Brugner explains why this is the case and which asset classes are meant by this.

Between the gold rush and AI hype: what can we expect on the home stretch of 2025?

The investment year is gradually approaching the home straight. And 2025 will be remembered in many ways: From the upheavals surrounding Liberation Day to the ongoing AI rally and the sharp rise in the price of gold. Gerald Stadlbauer, Head of Discretionary Portfolio Management, analyzes what the final quarter of 2025 could bring.

Weekly Winzer: Autumn fog

The ongoing government shutdown in the US is also preventing the publication of important economic data. This makes it more difficult to assess the economic environment in the US. Chief Economist Gerhard Winzer explains possible scenarios in his weekly market commentary.

Precious metal prices soaring: Silver at all-time high

Not only has the price of gold risen sharply so far this year, but other precious metals and commodities are also continuing to increase in price. One reason for this is high demand from industry, especially for the production of electronic components.

Weekly Winzer: Interest rate cuts, government shutdown, and the gold rally

While the price of gold exceeded the $4,000 mark for the first time, the government shutdown in the US also dominated the headlines recently. In today’s interview, Gerhard Winzer answers questions about the impact this is having on the stock markets and what else is happening on the markets.

Cybersecurity: A protective shield in the digital age

Phishing, deepfakes, and targeted attacks on the internet are on the rise—and with them, the cybersecurity industry is growing rapidly. How well equipped are companies to deal with these increasing threats, and where do the opportunities and risks lie for investors? Find out in today’s blog post.

Automotive market: Europe’s industry giants are feeling more optimistic again

Chinese car manufacturers are pushing into Europe – and putting pressure on the domestic industry. Nevertheless, the latter was once again optimistic about the future at this year’s IAA Mobility motor show in Munich. Read more about this in today’s blog post.

Weekly Winzer: Growth rates above expectations

The impact of higher US tariffs on economic growth has so far been less significant as expected. Globally, growth continues to exceed expectations. However, potential downside risks remain.

Federal Reserve cuts US key interest rate

As expected, the US Federal Reserve lowered the key interest rate by 0.25 percentage points yesterday. Chief economist Gerhard Winzer analyzes the interest rate decision and statements by Federal Reserve Chairman Jerome Powell.

Élysée Palace under pressure: who is the real victim of the political stalemate in France?

Yields on French government bonds have risen sharply amid the recent government crisis. How should the current situation in France be assessed?

Chinese stocks: The sleeping giant awakens

China’s stock markets are making a strong comeback after years of weakness – driven by growing confidence among domestic investors and targeted measures by the government in Beijing. Will the rally continue?

Weekly Winzer: Powell opens door to interest rate cut

US Federal Reserve Chairman Jerome Powell signalled a possible interest rate cut in September in Jackson Hole. The markets reacted immediately with price gains – but there is more to his words than pure monetary policy. The Fed is caught between inflation risks, a weaker labour market and growing political pressure.

Biotechnology remains an exciting stock market topic

Innovative medicines and geopolitical risks – the biotech sector remains in flux. Topics such as rare diseases, cancer and eye diseases are particularly in focus. In this interview, fund manager Harald Kober provides insights into current trends and challenges.

Weekly Winzer: Fed Signals Rate Cut – What Jerome Powell’s Words Mean for Markets

The U.S. Federal Reserve is signaling a possible rate cut in September. What’s behind Powell’s message—and what does it mean for markets and investors?

Semiconductor Industry Optimistic for the Future Despite Tariff Uncertainties Thanks to AI Boom

The semiconductor industry is expected to continue growing strongly in 2025, despite uncertainties surrounding US President Donald Trump’s trade policy, thanks to the AI boom. The World Semiconductor Trade Statistics organisation (WSTS) recently raised its growth forecasts for this year slightly.

Innovation and automation: A visit to Seoul

Fund manager Thomas Oposich reports on his trip to South Korea. There he was able to gain some insights into the innovative strength of the South Korean economy.

Between AI euphoria and recession worries: which scenario will prevail?

The markets are rising thanks to AI hopes, strong corporate profits and non-restrictive monetary policy. But geopolitical risks, weakening labor markets and inflationary pressures are casting shadows. Which scenario will prevail – recession, AI exceptionalism or a period of slowdown?

Advice in turbulent times – Interview with account manager Andreas Stary

In turbulent times on the stock market, investors often seek advice from market experts. What are the most pressing questions for investors and how can they hold their own in the current environment? We spoke to Andreas Stary, customer advisor at Erste Bank Austria, to find out more.

ATX surprises in 2025: why Austria’s equity market is ahead of the rest this year

While economic growth in Austria remains weak, the domestic stock market index ATX has recently climbed significantly. What is behind this strong performance?

Japan: US trade deal in politically difficult times

With the conclusion of a trade deal, Japan has resolved the tariff conflict with the USA, its most important trading partner, for the time being. The stock market – especially the automotive sector, which is so important for Japan – reacted with relief. However, the domestic political situation in Japan remains tense following the recent upper house election.

Weekly Winzer: Optimistic profit expectations despite risks

Despite the risks posed by the threat of US tariffs, the stock markets have performed positively since April. There are several reasons for this. Nevertheless, the current environment favors a more neutral stance in the portfolio.

New momentum for environmental stocks?

The stock market year to date has been volatile. Tariffs, geopolitical uncertainties and the new US tax law have dominated the headlines. The latter turned out better than expected for the environmental technology sector. Many companies have recently taken a more positive view of the future and the sector could also be worth a look from a valuation perspective.

Between uncertainty and stability – a half-year full of contrasts

The stock market has been dominated by geopolitical tensions and trade disputes so far this year. Despite this, the markets have proven surprisingly resilient. However, the environment remains challenging, which is why a balanced and broadly diversified portfolio is crucial right now. Read more in the latest market commentary by Gerald Stadlbauer, Head of Discretionary Portfolio Management.

Back to the Basics: Understanding High Yield Bonds

What distinguishes high-yield bonds and how do they differ from other bonds? We explain this in today’s blog post. You will also learn which funds investors can use to invest specifically in companies in the high-yield segment.