The mood among investors in the bond sector in emerging markets is mixed, as this year’s Emerging Markets Credit Conference held by US investment bank J.P. Morgan showed. Thomas Oposich, Senior Fund Manager, reports on the conference and his impressions.

ARTICLES IN THE TOPIC “Bonds”

An extraordinary half year

The first half of the year on the financial markets was characterized by price declines in equities and bonds, rising inflation, and the war in Ukraine. What developments does Erste Asset Management expect for the second half of the year?

Central Banks Attempt to Prevent Inflationary Spiral

Since the beginning of the year, the bond markets have been in a bear market. What are the implications for the economy? Erste Asset Management Chief Economist Gerhard Winzer analyzes three models in relation to the development of inflation and their implications.

Austria goes green

The first green bond of the Republic of Austria was issued on 24 May 2022 and is meeting with high demand. The majority of the proceeds will go towards clean and sustainable transport, e.g. the expansion of the railway network. In which other areas will the Green Bond invest?

The return of the yield was short and painful

Due to the rapid rise in yields, almost all types of bonds have suffered significant price losses since the beginning of the year. But now you have the chance to take advantage of the higher yield level. Find out the best way to do this in today’s blog.

Alternative investments defy market losses

The losses of equities, bonds and gold since the beginning of April have put the limelight on the asset class of alternative investments. What are the characteristics of such an asset? Can this slow the downturn? And how can you invest?

ECB and price stability – an oxymoron?

Is the ECB reacting too late to the rising inflation? Is the massive money supply a ticking time bomb? All eyes are on the European interest rate policy.

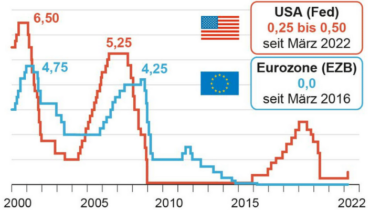

The End of Loose Monetary Policy

The US Federal Reserve is turning the interest rate screw hard and accelerating the exit from its ultra-expansive monetary policy. Will it get a grip on high inflation? And how will the economy cope with higher interest rates?

How far will the interest rates be rising, Mr. Zemanek?

With the first interest rate hike in five years, the US Federal Reserve has ushered in a new era. Is the period of cheap money now over? When will the European Central Bank follow suit?

Do Eastern European bonds offer opportunities?

The war in Ukraine led to losses for Russian bonds. In an interview for OUR VIEW, fund manager Anton Hauser explains why government bonds from Eastern Europe offer an alternative.