Within the framework of a Latin America conference in London last November, the members of national central banks, the professional investors of various investment houses, and local representatives from Latin America shared their insight as well as an outlook for the coming year with the conference attendants. The core topics of this exchange of opinion were based on countries like Argentina, Brazil, Chile, Columbia, Mexico, and Peru. The overarching theme was quite positive for investors, with both upside and downside risks.

Mild recovery of growth

Latin America has experienced a decade of particularly low GDP growth. One of the most important reasons for this has been the structural weakening of economic growth in China and the resulting, significant decline of commodity prices. For the past year, the IMF estimates real economic growth of only 0.2% y/y. This is complemented by social unrest and political conflict.

Both upside and downside risks are still in place. Higher commodity prices, subsiding political risks, and the partially resolved trade conflict between the USA and China could contribute positively to the economic situation in Latin America.

Will the interest cut cycle come to an end in 2020?

We also expect further support on the monetary front (rate cuts). That being said, in contrast to last year, the extent of monetary loosening will be rather subdued. In 2019, the rate cuts of the US Fed and the generally receding inflation rates (Q4 2019: about 3.2% y/y; source: Erste AM) allowed important central banks in Latin America to cut their respective key-lending rate.

The aggregate key-lending rate for Latin America is currently about 5%. The completion of the interest cuts in the USA and the slightly increasing inflation suggest an end to the rate cut cycle in Latin America for the first half of 2020 as well. Mexico is the notable exception, where the key-lending rate may be cut further in the second half of 2020.

Fiscally, the focus will remain on the consolidation of state finances. According to IMF estimates, the budget deficit, adjusted for interest payments, as a percentage of GDP will fall from -1% last year to only -0.5% in 2020. Even though there was talk of a “controlled, expansive fiscal policy” at the conference, this decline has a dampening effect on growth. On the upside, government debt has consolidated at just below 70% of GDP.

Even less heterogeneity to come

The central risk factor for the years ahead of us is the lack of rising economic growth in Latin America in an environment of low commodity prices and low global growth. Social unrest and political tensions will also keep a prominent profile and will be monitored closely in the coming years. They lead to rising heterogenous risks in the region, which will be playing an important role this year as well.

The gap between the countries deemed as “good” or “bad” is growing.

The following countries seem particularly problematic

- Argentina: due to its default, the country will be forced to restructure its debt, which will result in investors having to forego some of their investments. Capital controls have been in effect since 2019.

- Chile: the current protests and social unrest constitute the biggest political and economic challenge for Chilean institutions since the return to democracy. Chile is also facing a historic shift in 2020 while re-writing its constitution. Optimists believe that the principles that have made the Chilean economy successful – an open economy, the respect for private property, an independent central bank, and solid macroeconomic policies – will be kept. Pessimists, on the other hand, are, well, pessimistic about it and feel there is a risk of any measures aimed at social equality possibly overshooting. The uncertainty created by this ambiguity could turn into a stumbling block for private investment activity.

while these are the favourite children of Latin America

- Columbia: the dynamic domestic demand supports economic growth in Columbia. However, the labour market displayed signs of weakness last year. The central risk factor of 2020 is the current account deficit (IMF: about 4% of GDP). That being said, investors are generally well disposed towards Columbia.

- Peru: the Peruvian economy showed solid indicators in 2019, and it enjoys a great deal of confidence from investors. The increased demand for government bonds and the positive sentiment about the Peruvian economy caused yields to fall last year.

- Brazil: investors have rediscovered their goodwill towards Brazil in the wake of its recovery from the worst recession in history (2014 to 2016) and as a result of the increased trust based on the reforms implemented by the new government.

- Mexico: after a year without economic growth, Mexico may see a trend reversal in 2020 and achieve a slight increase in economic growth on the basis of the repeatedly strong fundamental macro data and the USMCA trade agreement with the USA and Canada.

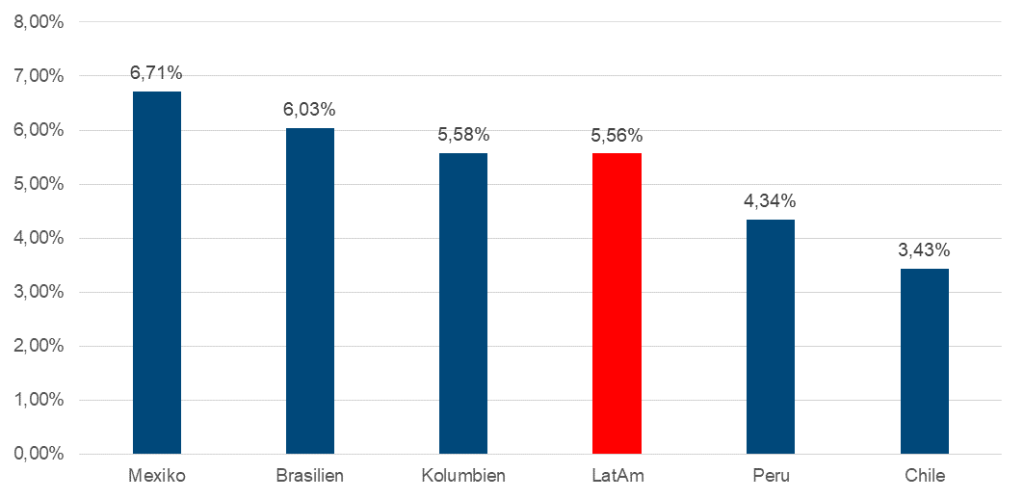

Search for yield

In the current global environment of low interest rates, investors are looking for attractive yields. One answer to this search is Latin America. However, it will be important to go about any decisions selectively due to the heterogenous risk on the continent when it comes to evaluating the opportunities there in 2020. The differentials in the current yields reflect the variety of risks priced in. Therefore, active management will remain crucial.

Local currency bond yields

Data as of per 3 February 2020; sources: Bloomberg, JP Morgan (GBI-EM Div Index) Note: Past performance is not indicative of future development.

Currencies weaker

The political and social unrest did not only rattle the economy last year, they also exerted pressure on the currencies. The Argentinean and the Chilean peso as well as the Brazilian real hit new lows relative to the US dollar. In Argentina and Chile, the national central banks even had to carry out foreign exchange interventions in order to stabilise the local currencies. The Mexican peso was an exception, moving sideways throughout the year.

Most regional currencies have picked up vis-à-vis the US dollar in recent weeks. This is mainly due to the optimism with regard to the “phase 1 trade agreement” between the USA and China. In contrast to the opinion represented at the conference, we do see upside potential for the most important currencies in Latin America. Of course, the foreign exchange rate remains a significant risk factor for local currency bonds.

Local currency bonds becoming attractive

The environment for local currency bonds in Latin America has become slightly more favourable. The risk of rate hikes is lower than the likelihood of rate cuts. Also, the general weakening of currencies across the board may come to an end. However, the current case of the coronavirus shows that not all events can be predicted, which may upset forecasts.

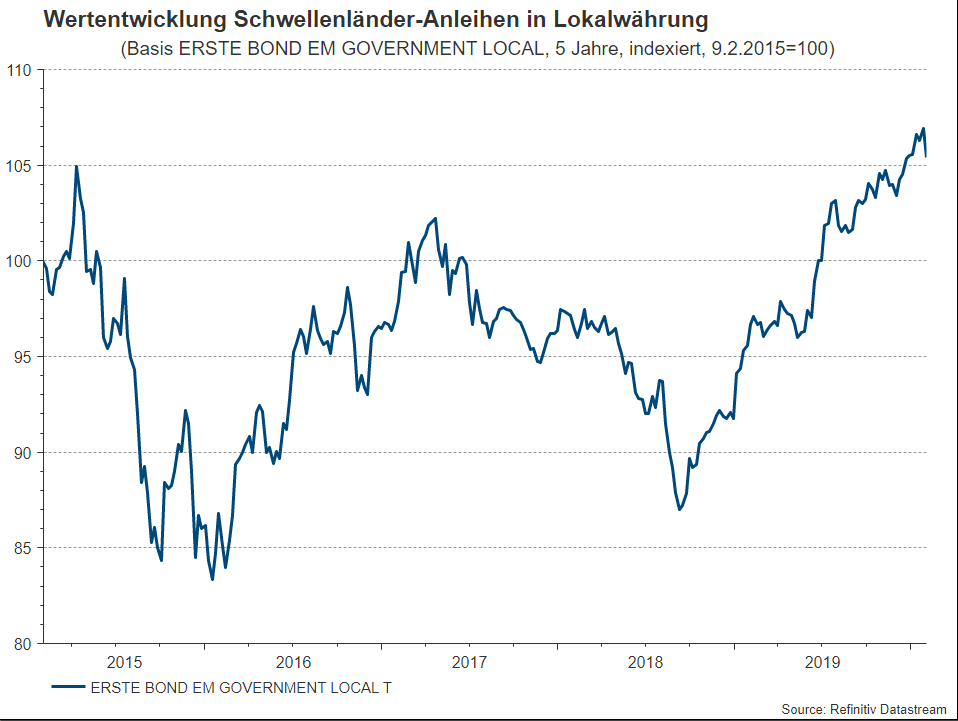

Investment in local currency bonds

ERSTE BOND EM GOVERNMENT LOCAL offers a chance to invest comfortably in a broadly diversified portfolio of local currency bonds of emerging markets. Our experts select mainly countries from CEE, Asia, Latin America, the Middle East, and Africa, and they may add corporate bonds from issuers based in the respective countries as well. Latin America accounts for about a third of the portfolio. The trade-off here are the high long-term return opportunities versus the risk of high volatility and the foreign exchange risk (please refer to the link for details).

![]()

Note: Past performance is not indicative of future development.

Advantages for the investor

-

Broad diversification of risks through the selection of bonds from a variety of emerging markets.

-

High, long-term return opportunity.

-

Opportunity to earn high annual payouts.

-

Investment funds are separate assets.

Risks to be considered

-

Emerging markets are traditionally subject to considerable volatility; as a result, a medium to high level of price fluctuations is possible.

-

Higher risk due to the addition of issuers with average to lower credit ratings.

-

Due to investments denominated in foreign currencies, the net asset value of the fund can be negatively impacted by currency fluctuations.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.