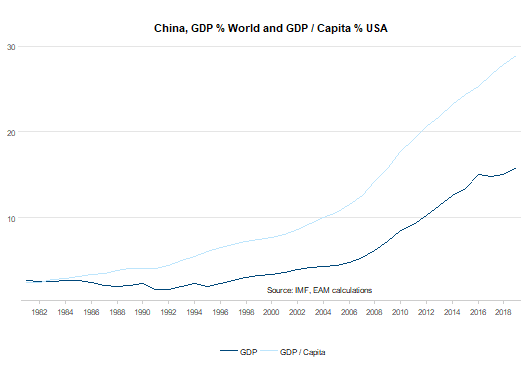

The rise of China is a story of success. The average annual growth rate of GDP in the past 38 years has been an impressive 10%. At his point, China is the second-largest economy in the world, accounting for almost 16% of global GDP. The economic rise has been accompanied by an enormous increase in relevance in the areas of technology, geopolitics, and military. Can this success story last?

Transformation process

GDP per capita, adjusted for differences in purchase power, is an important benchmark of the state of development of an economy. Here, China has reached the important threshold of USD 18,000 per capita last year. This is roughly 29% of the developmental status quo of the USA (GDP per capita of USD 62,000). At this level, economies run the risk of falling into a stagnation phase (i.e. the so-called middle-income trap).

The model of high growth through capital accumulation has become unsustainable. The infrastructure (cities, rail tracks, ports, internet) is fully set up. Ultimately, the probably most important measure illustrating the development potential of an economy is its productivity. According to estimates, average productivity growth (total factor productivity) is around 3%.

In order to ensure the maintenance of this comparatively high value, the Chinese economic policy has in the meantime set off another, highly ambitious transformation process. Broadly speaking, it focuses on the strategic transformation from quantity (high growth through capita accumulation) to quality (higher value-added through innovation and technological change).

- The growth focus has been shifted from the production to the service sector, from investments to consumption, and from the external to the domestic industry.

- The strategy “Made in China 2025” (or MIC2025) is a blueprint for the improvement of value-added in the important sectors of the industry, geared towards the achievement of technological leadership in about 30 technology sectors. Also, a bigger share of high technology is to be produced domestically (e.g. semi-conductors). China also intends to become the technology leader in the key industry of Artificial Intelligence by 2030.

- The New Silk Road (“Belt and Road Initiative”) is a collection of different investment projects outside of China with the goal of the integration of Eurasia with Africa and China.

- At the same time, the currency is being internationalised with a long-term perspective. As a result, more and more transactions – goods, services, and finance – are being settled in renminbi instead of US dollar. The Chinese currency, renminbi, is now also official reserve currency, i.e. it has joined the basket of special drawing rights of the International Monetary Fund (IMF). And Chinese securities are indeed increasingly finding their way into international equity and bond indices.

Chart: Key Indicator Productivity Note: Past performance is not a reliable indicator of future performance.

Multipolar world

The rise of China to a global power has of course created a sense of rivalry with the incumbent, i.e. the USA. Said rivalry is driven by a rise in nationalist and protectionist attitude. At the moment, the possible failure to reach an agreement in the trade talks between the USA and China is dominating the markets. The controversial subjects are:

- the balance of trade deficit of the USA with China

- the allegedly forced technology transfer from US to Chinese companies

- the bad level of protection of intellectual property rights

- the protection and support of Chinese companies (protectionism)

- the future development of the Chinese currency

- the Chinese industrial policy (MIC2025)

A further escalation of the trade conflict between the USA and China would come with negative repercussions for the global economy. In that case, China would probably take stimulus measures (higher public spending, lower taxes, higher credit growth, weakening currency). However, even if a compromise were to be reached, it would not do away with the strategic rivalry. Future conflicts are inherent to the new, multipolar, more nationalistic world order. This does not change the fact that China’s success story will continue as long as good productivity growth can be sustained.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.