…and go away, but remember to come back in September.

– this is an old stock market adage that most investors probably know. There are loads of those, and this is among the most popular ones. It refers to a capital market anomaly that claims that from May to August, the rate of return that can be achieved on the equity market is below average, whereas from September to April, above-average rates can be earned.

Does this “May effect” hold up to empirical scrutiny? We have had a look at the recent past from the perspective of a euro investor in order to assess the truth content of this adage.

May effect – comparative performances

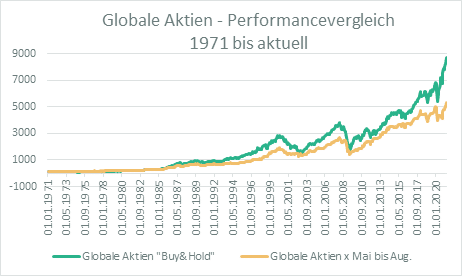

We base our analysis of the May effect on two euro investors (or prior to 1999, deutschemark investors) who invested EUR 100 in global equities in January 1971. Whereas investor 1 (INV1) pursues a buy-and-hold strategy, investor 2 (INV2) would have always sold his equity portfolio in May and bought it back in September. If the stock market adage of “sell in May” holds true, we can expect INV2 to have come out on top

. However, as it turns out, the opposite is the case. Our fictitious INV1 had grown his portfolio to a respectable EUR 8,675 by the end of April 2021, while INV2 was only holding equities worth EUR 5,285. In terms of yields, the difference looks less dramatic at first glance, but given the compounding effect the first glance is not what counts. INV1 achieved an annual return of 9.3%, while INV2 generated an annual 8.2% return on investment (or on a monthly basis, 0.83% for INV1 and 0.73% for INV2, on average). This simple model suggests that the validity of the aforementioned stock market adage has to be rejected.

Sources: Bloomberg, own calculations

May effect from a risk perspective

Of course, one could argue that INV2 may have taken less risk in his investments by avoiding the possibly volatile months of May to August. At first glance, this suggestion can actually be substantiated. While INV1’s annual volatility was 14.8%, INV2’s portfolio was only subject to 12.7%. But what about relative risk? Which of the two investors reaped a higher reward per unit of risk he assumed over time? This question can be answered by looking at the Sharpe ratio, which allows for the comparison of historical performance of investments while taking into account risk. And we see that with a Sharpe ratio of 0.37x, INV1 is has beaten INV2 (0.34x) to it again. We can therefore say that the risk assumed by the two investors reaped a higher reward for the buy-and-hold strategy than for the strategy that would try to avoid the May effect.

The May effect over time

Having found out that there has been no aggregate May effect over the past 50 years, we now want to look more closely at the sub-periods. After all, it may well be that there has been a May effect in the past but that it has dissipated in the meantime. Also, the May effect might exist, but it may have been diluted in the long-term analysis by some positive outliers.

In order to get to the bottom of this question, we segmented the observation period into periods of ten years each. As the following table suggests, the stock market adage was indeed valid in the 1970 and 2000s. In those decades, INV2’s portfolio outperformed INV1’s portfolio. Those were difficult times for equity investments overall; the 70s were dominated by oil shocks and economic crises, while in the first decade of the new millennium, the bursting of the tech bubble was followed by the financial crisis. In such an environment, investors were able to achieve higher annual returns (1970s: 0.73%; 2000s: 0.69%) by avoiding the months of May to August. In the other three decades of the observation period (please refer to the table below), the holding strategy would have been preferable.

| Perf. p.a. buy & hold | Perf. p.a. without May-August | Difference p.a. | |

| 1970s | 6.17% | 6.90% | -0.73% |

| 1980s | 17.51% | 13.45% | 4.06% |

| 1990s | 11.30% | 9.91% | 1.39% |

| 2000s | 1.70% | 2.39% | -0.69% |

| 2010s | 9.51% | 7.83% | 1.68% |

Sources: Bloomberg; own calculations

A detailed look at the individual months

Next, let us have a detailed look at the individual months of the year. As the following chart illustrates, the average performance over the years of August is indeed negative, but only marginally so. While May and June tend to underperform, at least they are positive. July, on the other hand, exceeds the average across all months. This explains why INV2 came in second: since he does not invest from May to August, he misses out on three months of positive performance on average. Only avoiding August has had a slightly positive effect on his performance in the past 50 years.

Sources: Bloomberg; own calculations

May effect – a subjective experience

There is, however, an above-average prevalence of negative months during late spring and summer; this is particularly true for June, which has been negative half of the times in the past 50 observations. May, July, and August also account for above-average shares of negative monthly returns relative to most other months of the year. While on average 37.6% of months have resulted in negative rates of return for the investor historically, that percentage increases to above 40% for the months affected by the May effect. This means the stock market adage may be the result of a subjective experience. In terms of absolute numbers, these months yield a negative performance an above-average amount of times, but the positive years more than make up for them.

Sources: Bloomberg; own calculations

Negative trends would cluster around the period of May to August. Overall, we have noticed 19 periods of more than four months of falling share prices in the past 50 years on a rolling basis. Four thereof (i.e. 21%) occurred during the aforementioned period. In further six corrections (32%), at least three of the respective months were involved (1x April to July, 5x June to August). This means that on aggregate, some 53% of these negative trend phases occurred (largely) during the summer months – another reason why this stock market adage may have established itself. But we should not forget that such profound periods of weakness occur only very rarely and make up only about 3% of all rolling four-month observations in the past 50 years. This means it seems to be yet again due to subjective experience that this adage according to which investors should be particularly cautious about the months of May to August on the equity markets keeps making its rounds.

Sources: Bloomberg; own calculations

Weak September

The aggregate of data available does not actually suggest returning to the market in September – quite in contrast to the adage. In fact, if you wanted to steer clear of a month, September would be the one. Alongside August, September is the only negative month on average, and significantly so (-0.53%) over the past 50 years. At 42%, the number of negative return observations in September is also above average. In addition, the month of September was involved in 37% of all negative trend phases (i.e. four negative months in a row).

Therefore, we now add a third investor (INV3) to our model, who is invested in global equities over the entire observation period but always sells his equity portfolio on 31 August and re-invests on 30 September. As it turns out, INV3, achieving 9.97% p.a., would actually beat the buy-and-hold strategy of INV1 (9.27%) – and at a lower volatility to boot (14% vs. 14.8%). This also leads to a better Sharpe ratio relative to the buy-and-hold strategy of 0.43x vs 0.36x.

These are of course all theoretical musings, because in real life, the improved performance achieved by avoiding September is often not enough to offset transaction costs and thus create added value.

Conclusion

We have to reject the hypothesis (i.e. old stock market adage) according to which it pays off to abstain from the market fully or partially from May to the end of August on empirical grounds. While some of these months are associated with below-average performance rates and above-average numbers of negative returns in a multi-year analysis, the performance over the summer months in the recent 50 years has been positive, which means it also contributed positively to the overall performance.

Legal note:

Prognoses are no reliable indicator for future performance.