👉 Find out in this article

Anyone watching the markets on Monday was probably reminded of The Bangles’ song “Manic Monday”. Japan’s leading index, the Nikkei-225, slipped by 12.4% in the night from Sunday to Monday as global markets were unsettled by heightened expectations of a recession in the USA. The markets in Taiwan and South Korea, for example, also suffered, with losses of around 8% and 9% respectively.

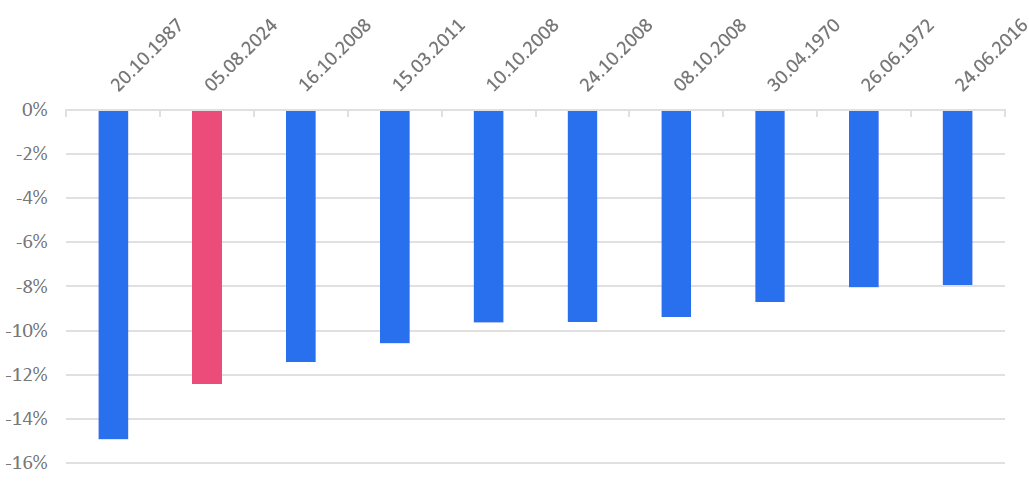

In Japan and Korea, trading was temporarily suspended as planned by so-called circuit breakers due to the high losses. As the following chart shows, yesterday’s drop in the Nikkei-225 was the biggest daily loss since “Black Monday” in 1987.

The 10 biggest days of losses on the Nikkei-225

Quelle: Refinitiv Datastream

Weak labor market, strong yen and geopolitical risks

In our opinion, the reasons for the selling pressure, which began on Friday, were as follows:

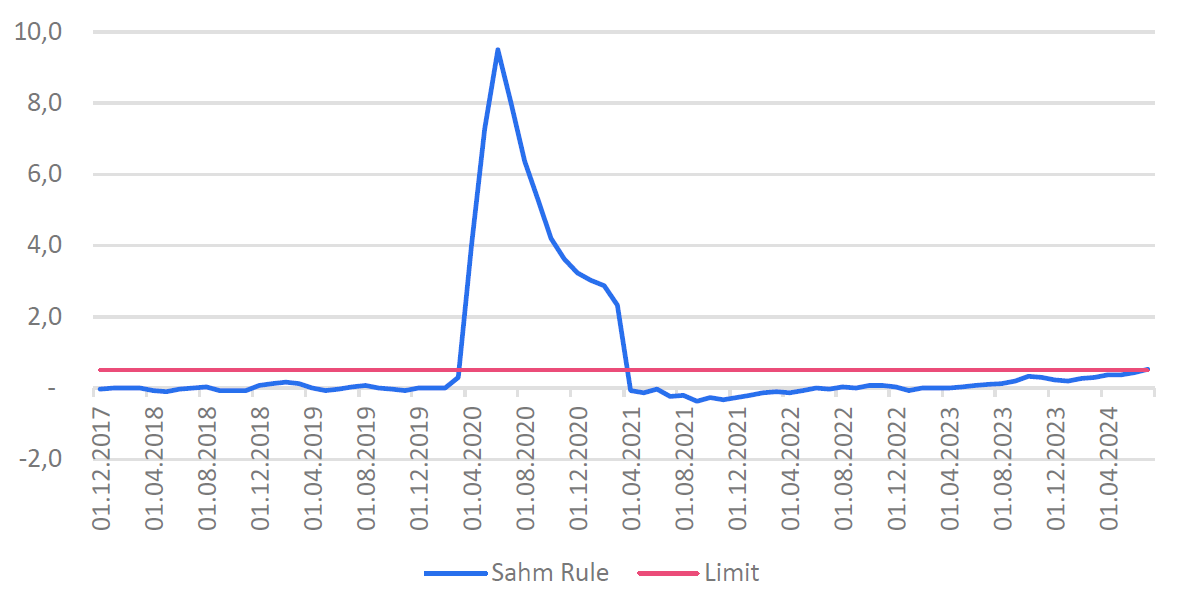

1. Weak labor market data in the US: non-farm payroll employment rose by 114,000, the weakest reading since the end of the pandemic. In addition, the unemployment rate rose for the fourth month in a row to 4.3%.

This triggered a recession indicator observed by many market participants, the so-called Sahm Rule. This barometer compares the three-month moving average of the unemployment rate with its lowest point over the past twelve months. In the past, the barometer has been regarded as a very meaningful recession indicator and rose above the decisive value of 0.5 percentage points for the first time since the coronavirus crisis with the US labor market report.

Sahm Rule points to recession in the USA

Quelle: Refinitiv Datastream

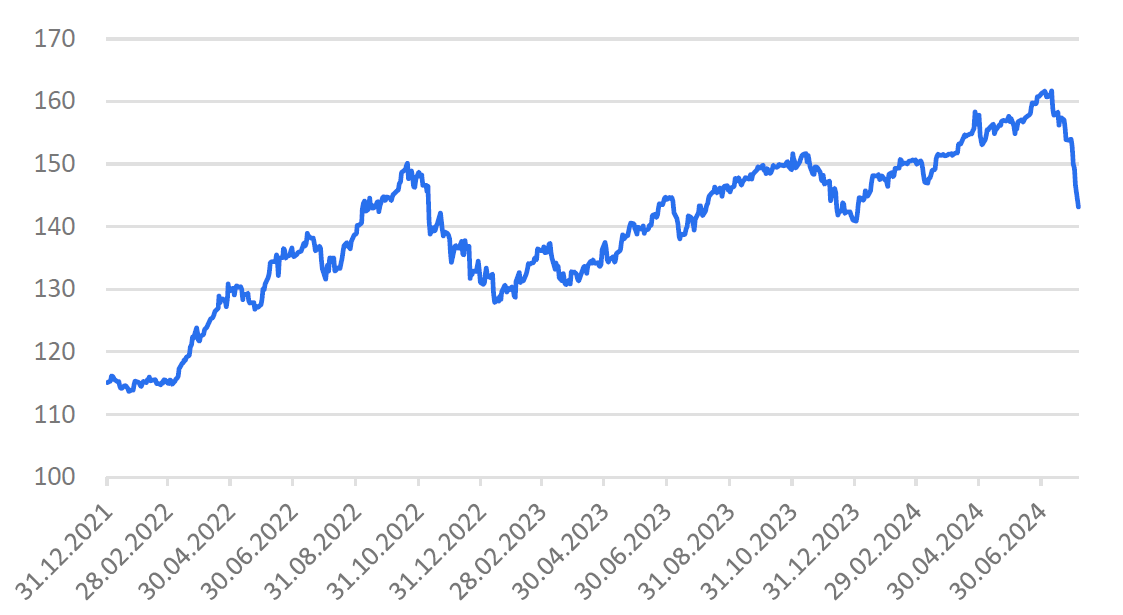

2. Partial unwinding of carry trades in the Japanese Yen: This involves investors borrowing funds in the Japanese currency at relatively low interest rates in order to use them to make investments in other currencies that promise higher returns. The latest interest rate hike by the Japanese central bank and the appreciation of the Japanese currency in recent weeks have put this investment strategy under pressure. This in turn led to positions in more promising investments having to be liquidated.

Japanese yen significantly stronger recently (Exchange rate USD/JPY)

Quelle: Refinitiv Datastream

3. Geopolitical risks: In particular, the heightened tensions in the Middle East between Israel and Iran are causing concerns about an escalation in the region to rise again. Some media recently reported, citing several representatives from the USA and Israel, that a retaliatory strike against Israel announced by Iran and the allied terrorist organization Hezbollah could be imminent.

Losses across the board

Subsequently, the selling pressure was not limited to the Japanese market: In Europe, the Euro-Stoxx-50 lost 1.8% yesterday (Monday), the DAX in Frankfurt closed around 1.5% lower and the CAC-40 in Paris fell by 1.4%.

In the afternoon, the US stock markets also joined the general downward trend. The technology index Nasdaq 100 and the broader S&P 500 both ended the day down around 3%.

Yields on credit-safe government bonds have fallen significantly in recent trading days, reflecting both the flight to a safe haven and the expectation of many investors that the Fed could cut key interest rates more significantly due to the weak economic data. Yields on 10-year US government bonds are currently trading at around 3.75%, having been as high as 4.2% at the beginning of last week.

Tuesday, the markets have seen countermovement to the losses. In Asia, the Nikkei-225 was able to put the deep red start to the week behind it and gained around 10%. The Japanese benchmark index thus recovered at least some of Monday’s losses.

What does the sell-off mean for the markets?

We also believe that the risks of recession have increased in recent weeks. This is underlined above all by the weaker economic data in the US. At the same time, the US economy has so far proved surprisingly resilient. In addition, statistically based recession indicators such as the steepness of the US yield curve and the Conference Board’s leading indicator have failed in recent years. The Sahm Rule is an important recession indicator, but it is also only based on statistical relationships.

In our opinion, the market movements of the last few trading days are partly due to technical factors. These include the aforementioned carry trade in the Japanese yen, but also the fact that institutional and retail investors were heavily involved in promising investments. In addition, liquidity on the markets is lower in the summer. In such an environment, weaker-than-expected economic and corporate data is enough to trigger large price jumps.

A countermovement to yesterday’s losses was seen in Asia on Tuesday. The Nikkei-225 in Japan gained around 10%, making up some of the significant losses of the previous day.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.