Erste Asset Management fund manager Anton Hauser, specialist for emerging markets bonds, analyses the status quo of the Turkish financial markets after the surprising dismissal of the Turkish central bank governor by President Erdogan.

Turbulences at the stock exchange and on the interest and currency markets: what is the reason for the dismissal of the central bank chief, who had been in office for only a short while?

The Turkish President Erdogan dismissed the governor of the Turkish central bank, Agbal, on Saturday night. This move was triggered by the further increase of the key-lending rates from 17% to 19%, which Erdogan did not approve of at all. According to the state news agency, the designated governor is Sahap Kavicioglu, a former MP from Erdogan’s governing party AKP. The market did not acknowledge this step. The trust that had been slowly built up for months was destroyed in one blow.

How did the markets react to the dismissal of the central bank governor?

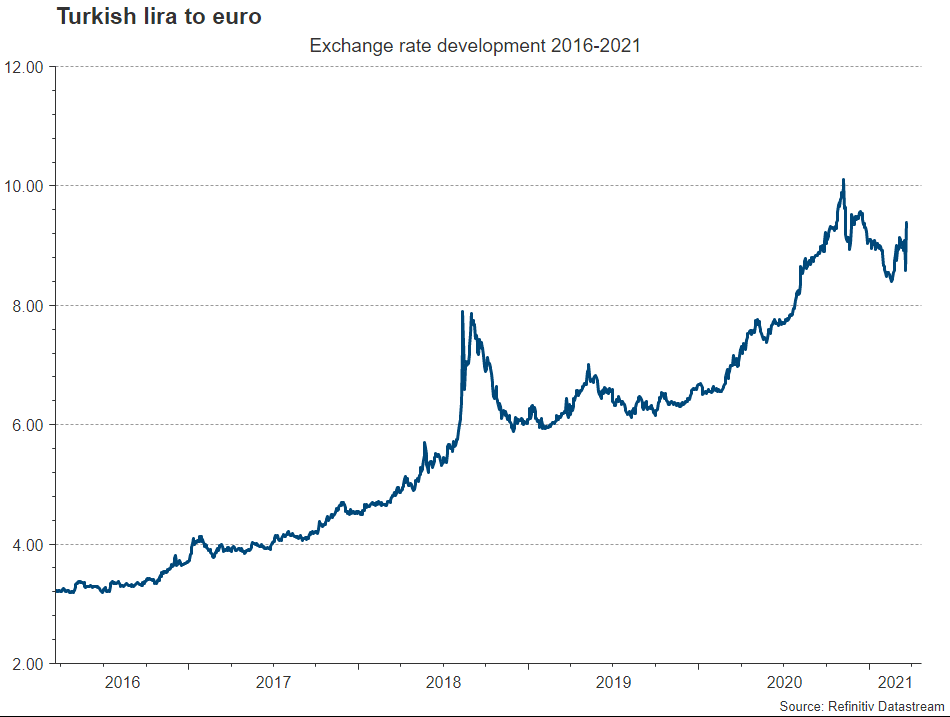

The response of the markets was instantaneous and hard. The Turkish lira depreciated dramatically against the US dollar at the beginning of the week, having lost almost 9% since Friday to TRY 9.40 for EUR 1 (source: Bloomberg). The yield of 10Y Turkish local currency government bonds jumped by more than four percentage points. The stock exchanges also recorded a dramatic slump, which comes with negative implications for the currency as well.

Please note: historical performance data are not indicative of the future development

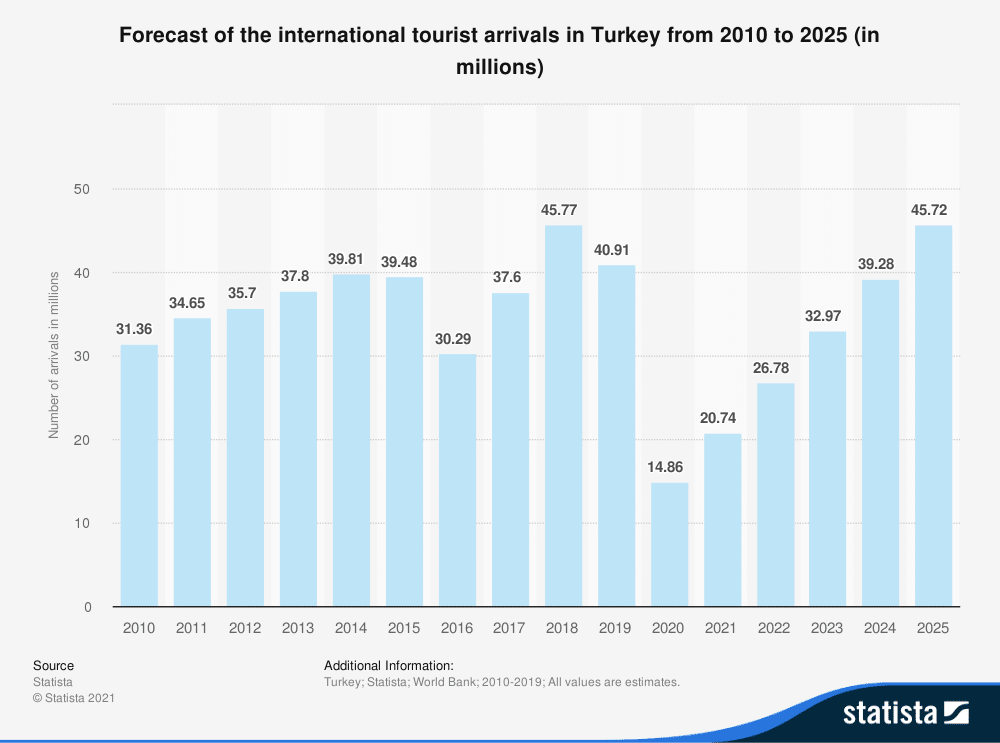

What does the Turkish economy look like? Will it be growing this year, even though tourism, one of the main sources of income, is down?

The Turkish economy grew by 1.8% in 2020 and was thus one of the few economies worldwide that managed to avoid shrinking despite the covid crisis. This growth was strongly driven by lending from state banks, but it came with a cost: the cheap lending accelerated the depreciation of the lira, ate into the foreign exchange reserves of the country, and caused inflation to rise by 15% relative to the previous year.

Why is Turkey having such a hard time stabilising its currency?

Turkey has been living above its means almost permanently. Excessively low interest rates lead to strong domestic demand, which of course affects the current account and subsequently the currency (N.B. negatively). President Erdogan is against any attempts to establish an equilibrium by raising interest rates, and he has nipped such attempts in the bud repeatedly.

What impact does the falling value of the lira have on the emerging markets portfolios of Erste Asset Management? Do we expect the currency fall further? Are the interest rate hikes likely to be taken back again in due course? What would that do to government bond yields?

Turkish bonds command a weighting of up to 5% of assets under management in the Erste Asset Management bond funds. The price movements we have seen at the beginning of the week will affect the fund prices negatively. However, the impact on other emerging markets is limited. Overall, the situation has limited negative effects on the performance of the funds. The central bank policy will be the main performance driver in the coming weeks. At this point, only a limited number of details are known, which of course contributes to the uncertainty on the markets.

Legal note:

Prognoses are no reliable indicator for future performance.