China has been increasingly opening up to the global market. Last year the Renminbi was taken into the currency basket of the International Monetary Fund in October 2016. Now, another step towards liberalisation has followed. China has cleared A-shares for international trade via trading platforms.

What are A-shares?

A-shares are securities issued by Chinese companies that are listed in Chinese currency, the Renminbi, at the stock exchanges in Shanghai or Shenzhen. Previously only Chinese citizens were allowed to trade these shares. This was due to the restrictive economic policy pursued by China, which was supposed to protect the domestic economy from foreign investors and their influence. From 2002 onwards, the first foreign investors were permitted to invest within the framework of the “Qualified Foreign Institutional Investors” (QFII) System. The programme entailed a substantial amount of terms that could only be complied with by very large international investors. Many of the most successful Chinese companies are listed at the Hong Kong Stock exchange or in the USA and have been accessible to international investors for years.

In spite of the opening of China, its equity market regulations still contain sizeable barriers to entry. Different categories of shares are available on the stock exchange, depending on the respective group of investors (domestic vs. foreign). In contrast to A-shares, B-shares are listed in foreign currency (Hong Kong dollar and US dollar) and can also be traded by foreign investors. The implementation of the trading platforms Shanghai-Hong Kong Connect (2015) and Shenzhen-Hong Kong Connect (2016) were important steps towards a liberalised market access. A-shares are currently only available on these two platforms.

What is new?

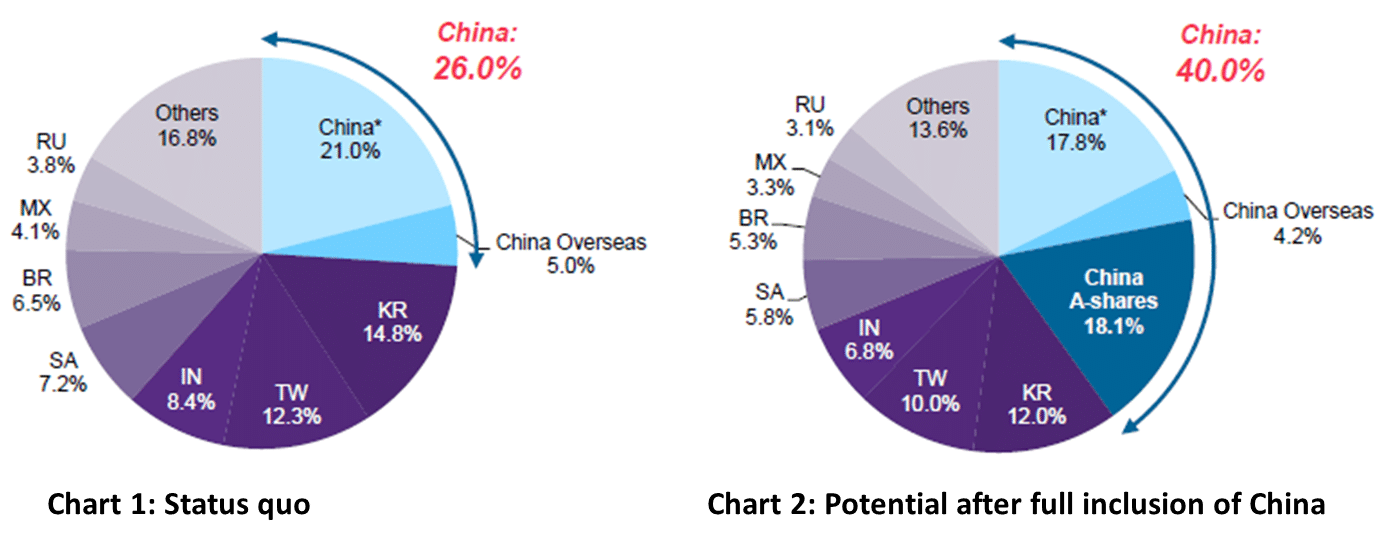

The Chinese equity market now ranks as second-largest financial centre in the world. As far as liquidity is concerned, it has long surpassed the US stock exchanges. Every year since 2013, the admission of Chinese companies into the MSCI indices[1] has been discussed, given that the quickly growing capital market in China continues to become more and more relevant. This year, MSCI has decided to take 222 A-shares into the Emerging Markets index in two steps in May 2018 and August 2018. At the moment, China accounts for a weighting of 28.55% in the MSCI Emerging Market index (please refer to chart no.1) on the basis of its companies listed in Hong Kong and the USA. Thus, China is already the most heavily weighted country in the MSCI Emerging Market index. At first, the additional weighting of A-shares will only account for 0.73% for 2018. This equals only 5% of all shares in the Chinese overall market.

A symbolic step

Accepting the A-shares is imbued with significant symbolic meaning. In the long run though, the economic effects are enormous as well, because the full implementation of these A-shares would translate into a weighting of 18% in the MSCI Emerging Markets index (based on current data). As a result, the weighting of China would increase to more than 40% (please refer to chart no.2). So far, MSCI has not indicated any schedule for full inclusion beyond the aforementioned time line. For Korea and Taiwan, the path to full inclusion of all shares took between six and nine years.

Country weighting of the MSCI Emerging Markets index

Source: MSCI, data as of 30th June 2016

Conclusion

The full inclusion of China will depend on how fast China is opening itself to the international capital market and is creating lower barriers to entry for all investors. In spite of the liberalisation of A-shares, the Chinese government has capped the purchase of A-shares by foreign investors at a total of 10%. This way, the Chinese government continues to limit the influence of foreign shareholders. That being said, the liberalisation of A-shares is very positive and could be a step towards a liberalisation of the entire country. China continues to harbour great growth potential. As a result of gradual liberalisation of the market and the inclusion of the Renminbi in the currency basket of the IMF, the relevance of China for the global economy has increased again.

[1] MSCI Indices are equity indices that represent the development of equities in 23 developed and 23 emerging economies.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.