After the price rally at the end of last year, the markets started 2024 with price losses. The ongoing positive correlation between bonds and equities is striking. Both asset classes have fallen equally recently, making diversification in a portfolio more difficult.

But the year has only just begun. This article will therefore look at 10 key topics for 2024 that could be helpful when putting together a portfolio:

Note: Prognoses are not a reliable indicator of future performance.

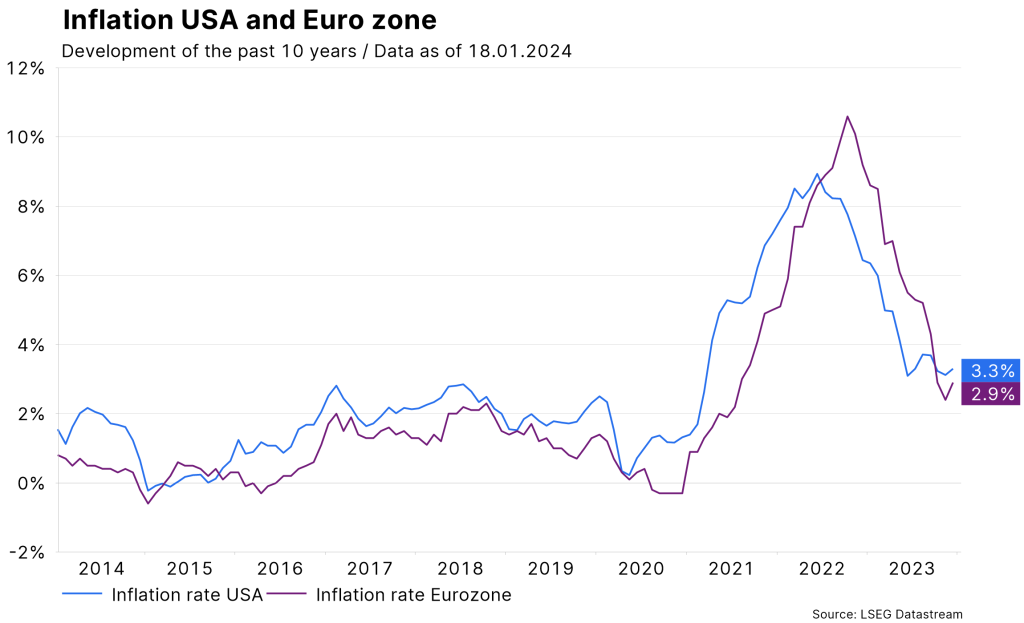

#1 How stubborn will inflation remain?

Inflation rates fell more sharply than expected in the second half of 2023. At the same time, economic growth exceeded expectations. This development has strengthened optimism for a further “painless” decline in inflation towards the central bank target of 2%. However, falling inflation was largely driven by falling goods prices, while inflation in the services sector fell only hesitantly and remains at too high a level.

Note: Past performance is not a reliable indicator of future developments.

Indicators such as the purchasing managers’ indices for the manufacturing sector are now pointing to an end to the downward trend in goods prices. Meanwhile, the firm labor market continues to ensure a certain persistence of the inflation trend in the services sector. In the baseline scenario, inflation is expected to continue to fall, but less rapidly than hoped.

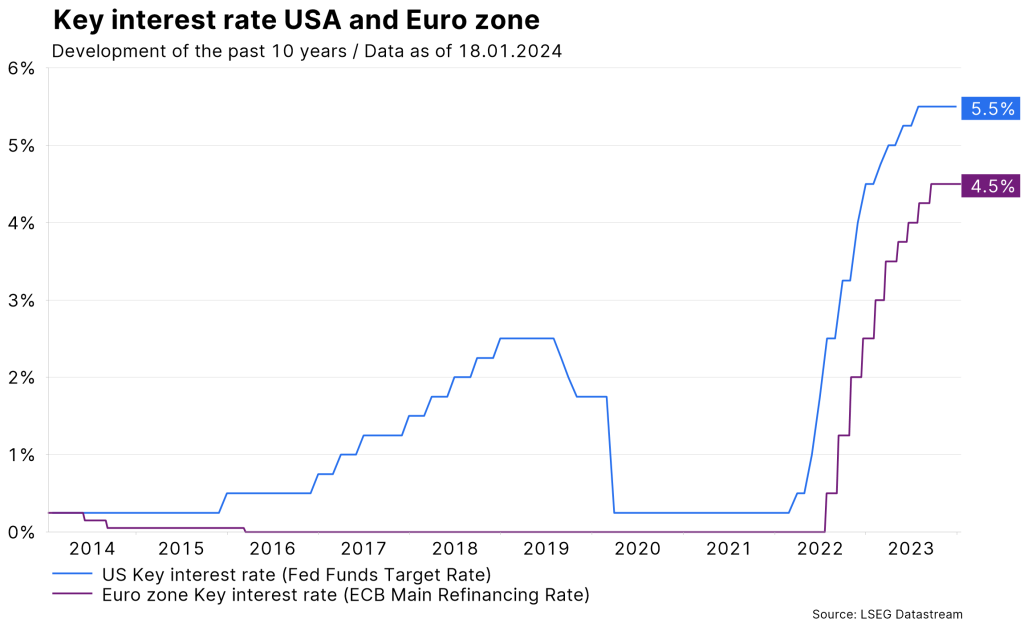

#2 Too early for rapid interest rate cuts

The most important central banks are currently pursuing a restrictive monetary policy. High key interest rates are intended to dampen economic activity so that inflation falls. However, the relationship between key interest rates, growth and inflation is highly uncertain. Monetary policy should neither be too restrictive so that the inflation target is not achieved in the medium term, nor should it be too restrictive and thus trigger a recession.

Until recently, the signals from central banks were hawkish, i.e. primarily aimed at combating inflation. The signal was for more rather than fewer interest rate hikes and for key interest rates to remain at a high level for longer rather than shorter. The central banks are now signaling a (temporary) end to the cycle of interest rate hikes.

Note: Past performance is not a reliable indicator of future developments.

In December, the most important central bank, the Fed in the US, even hinted at interest rate cuts for this year. The market has reacted to this and is already expecting the first interest rate cuts in March. In the baseline scenario, however, inflation will not continue to fall rapidly towards the central bank’s target. In addition, inflation risks remain on the upside. The central banks will therefore not cut key interest rates as early as the market has priced in. The first cautious cuts could take place around the middle of the year. If growth indicators weaken, significant interest rate cuts are also conceivable by the end of 2024.

However, if the central banks actually cut key interest rates early and sharply while economic growth remains resilient, inflation risks would increase in the medium term. A second wave of inflation could even be triggered next year.

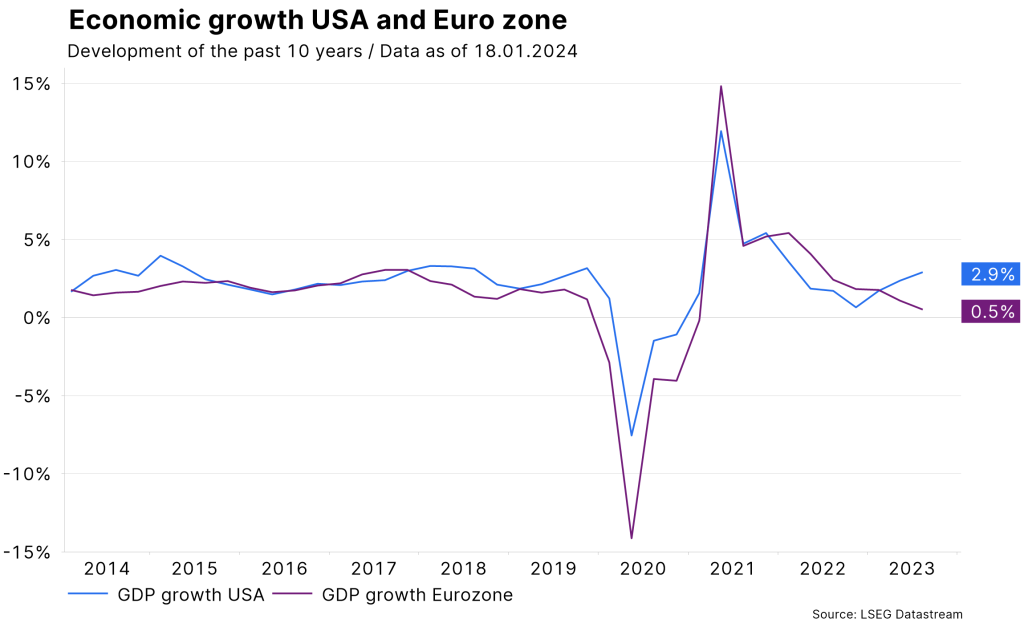

#3 From resilience to low growth

Economic growth surprised on the upside last year, even if the country composition was mixed. In the US, GDP growth was well above potential, while growth in the eurozone and the UK was only just above zero. One of the reasons for the higher growth in the USA is the increase in productivity. In contrast, productivity continues to stagnate in other countries, particularly in Europe.

Note: Past performance is not a reliable indicator of future developments.

The growth pessimism at the beginning of the previous year has not materialized. While many forecasts at the start of 2023 still pointed to a recession in most countries, the markets are now pricing in a soft landing for the US economy. This would mean a fall in inflation towards the central bank target of 2%, while the unemployment rate remains low. Rapidly falling inflation would increase the scope for the Fed to cut key interest rates early. While this scenario is possible, it is not safe to assume that last year’s trend will continue.

Assuming that inflation remains too high in the first half of the year, the Fed will not cut rates so early. A restrictive interest rate policy that has been priced in for longer than expected would put increasing pressure on economic growth. Growth rates that are below the long-term trend are realistic. In the base scenario, growth in the USA will therefore converge more towards the lower levels in Europe than vice versa.

#4 Geopolitical tensions create cost pressure

Geopolitical risks have increased. The focus is on the war in Ukraine, the conflict in the Middle East and tensions between the USA and China. Even if there is no escalation, this has an impact: the trend is towards risk reduction.

For example, the use of longer, safer sea routes (Cape of Good Hope instead of the Red Sea) is extending delivery times. Expenditure on national defense is also being increased. The result is greater economic resilience at the expense of efficiency. In general, this trend promotes the fragmentation of the global economy. This means higher costs, which exert pressure on consumer prices.

#5 The “super election year”

This year, around 4.2 billion people will be called to the polls in a total of 70 elections (source: The Economist). These elections will show that democracy and elections are not the same thing. Not all elections are fair and free.

In addition, the global trend towards populism is likely to continue. The latter implies fewer fact-based decisions. This means, among other things, an aversion to the issues of austerity (meaning higher budget deficits and inflation), climate change, biodiversity, immigration and the international community. Above all, Donald Trump’s election victory as President of the USA would have geostrategic implications. NATO could be weakened and Russia strengthened. In addition, the trend towards a nationally oriented industrial policy would probably increase.

#6 Higher volatility and risk premiums

Two developments have supported the markets over the past year: First, the prospect of a soft landing for the economy; second, the hope for a successful application of artificial intelligence. Generally speaking, the market is currently pricing in low risk premiums. Market prices are therefore already reflecting a favorable scenario.

However, the economic and geopolitical environment has become more uncertain and volatile since the outbreak of the pandemic. This affects both economic growth and inflation. As a result, monetary, fiscal and economic policy, commodity prices and the countercyclical US dollar currency could also be subject to greater (and difficult to predict) fluctuations.

Note: Past performance is not a reliable indicator of future developments.

The news is full of negative political and geopolitical headlines. However, the impact on the markets has been minimal. Only in the event of escalation, such as the outbreak of war in Ukraine, have energy prices risen and supply chains been disrupted. Structurally, however, no increase in geopolitical risk premiums can be identified to date. However, if the market environment does indeed remain uncertain and volatile, an increase in risk premiums would ultimately put pressure on prices.

#7 Negative correlation in a recession

Historically, share prices tend to rise because corporate profits increase during a period of growth. In a recession, share prices fall because, among other things, corporate profits also fall. The favorable characteristic of government bonds is that interest rates fall in a recession. This means disproportionately high price gains for outstanding government bonds. In the best-case scenario, the correlation between share and bond prices is therefore negative.

However, with the sharp rise in inflation, interest rate movements are a dominant influencing factor for equities and bonds alike. Interest rate rises weigh on these security classes, while interest rate falls boost prices.

This was also the case in the last two months of 2023, when hopes of early interest rate cuts led to sharp price rises. Generally speaking, if those factors that influence the risk of interest rate rises dominate, the correlation between share and bond prices should remain positive (inflation, term premium). However, if the risks to economic growth increase over the course of the year and a recession becomes likely, the correlation would probably turn negative again. The assumption for this year is that bonds will not always be able to cushion some of the price losses in risky security classes, especially in the event of a recession.

#8 Wait and see for bonds

The pricing out of early interest rate cuts could weigh on bond prices in the short term. Over the year as a whole, however, falling inflation, the onset of interest rate cuts and the slowdown in growth will have a supportive effect on bond prices. In the event of a recession in particular, not only would key interest rates fall sharply, but government bond prices would also rise significantly. The underlying assumption is that the potentially negative structural factors (government debt) will not be relevant this year.

#9 Optimism for equities, but also risks

As long as a recession is avoided, share prices will continue to rise. In addition, there is the prospect of a shift from a restrictive to a neutral monetary policy. Fiscal policy will also be more expansionary than restrictive in the super election year 2024. However, just like bonds, share prices at the start of 2024 will be weighed down by falling expectations of early interest rate cuts and generally by a technical correction following the price rises at the end of 2023. Looking at the year as a whole, however, the outlook for equities remains favorable as long as fears of recession remain low.

However, there are two main factors that speak against strong price rises: In the base scenario, real economic growth in the developed economies is expected to remain low. Inflation is also falling. Both of these factors point to lower sales volumes and falling sales growth. In other words, profit margins could come under pressure.

The cautiously optimistic view for equities has an important secondary condition: The numerous geopolitical risks are not spreading. In any case, the forces acting in different directions could lead to increased price fluctuations.

#10 Cautiously optimistic for emerging markets excluding China

On the positive side, there is the prospect of a soft landing for the emerging markets.

However, the positive view could be disappointed: The structural problems in China (real estate, debt) and increasing tensions between China and the West have led, among other things, to stagnation in Chinese import demand since the beginning of 2023. Global manufacturing has also shown no growth since the beginning of 2022.

Emerging markets are structurally extremely heterogeneous. However, one single distinguishing feature in particular could remain decisive: China. While Chinese equities have been falling since March 2021, emerging market equities excluding China have been on an upward trend since September 2022, similar to global share prices.

In the base case scenario, the outlook for emerging market equities excluding China is cautiously optimistic. However, the risk list is somewhat longer than that for global equities. In addition to margin pressure (weak real growth, falling inflation), continued weakness in China in particular could put pressure on growth in the other emerging markets.

Conclusion

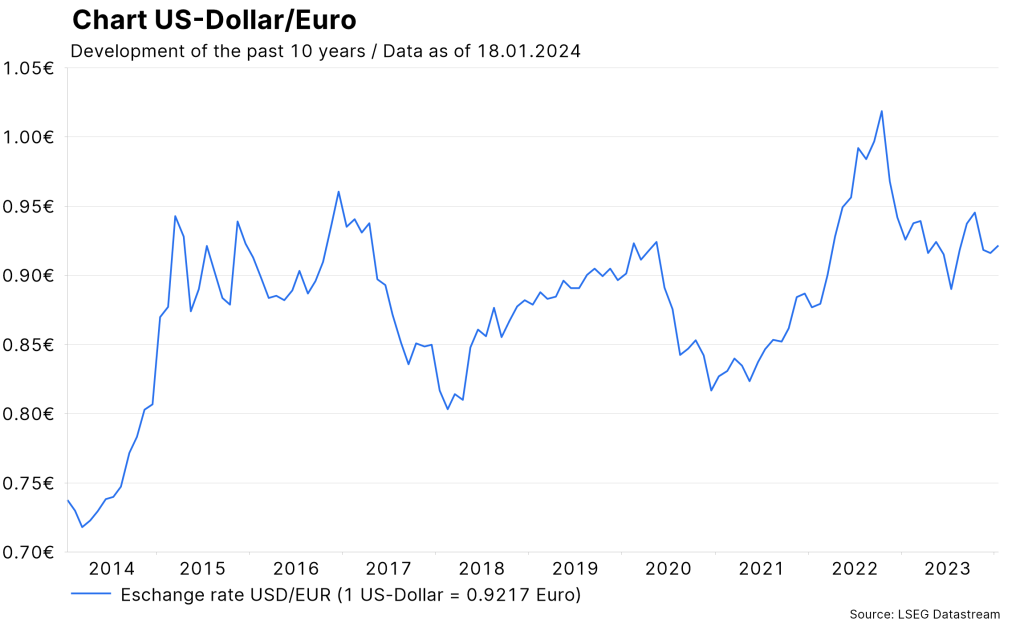

As long as the prospect of a soft landing dominates the economy, equities could be more attractive than bonds. Should this soft landing occur, the US dollar, which has been firm to date, would tend to weaken and commodity prices would show a slight upward trend.

As the year progresses, for example in the second half of the year, a disappointing slowdown in real economic growth (in the USA) and a further decline in inflation could in turn increase the attractiveness of bonds compared to equities, put pressure on commodity prices and support the US dollar.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.