When the US inflation numbers were released for May 2021, many market participants were surprised by the drastic increase in the consumer price index. In May alone, it was up 0.6%, which is substantial – especially when we take into account that in the previous months, inflation had been fundamentally insignificant.

As a consequence, many economists started to scrutinise inflation data and found that, with a share of 30%, used cars were the prime “culprit” in this trend. For the first time, new cars had the chance of gaining value instead of losing it after a certain period of operation.

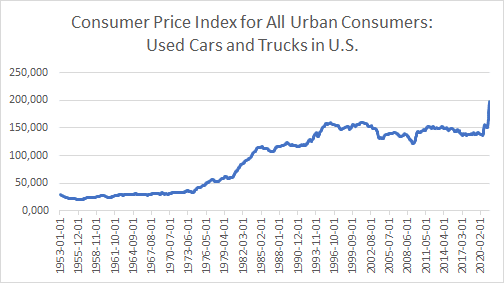

Consumer price index for used cars in US

Index 1982-1984=100 U.S. Bureau of Labor Statistics, Federal Reserve Economic Data, own graphic

There are numerous reasons for the strong price increases. The vehemence of the process is also remarkable.

The first reason is the covid-19 pandemic. When businesses came to a halt in April 2020, so did demand for rental cars. Many rental car companies were forced to reduce their fleet or, in some cases, sell it altogether to keep the balance sheet structure viable. Overnight, used car prices fell off a cliff.

As the vaccination programmes are making progress, rental car companies have started to build up their fleets again. The customers began to book individual, safe itineraries off the beaten path due to the still existing, latent risk of infection. This caused an uptick in demand for cars.

New cars are becoming scarce

The car manufacturers are having a hard time filling this increase in demand – as I know from first-hand experience.

As a father of two, I know that the demand for toys remains relatively constant over the life of a child. However, the toys themselves and the means of transport are growing alongside the child. Whereas the suitcase of the average father shrinks over time, children grow. Therefore, we decided to buy a new car this year.

Normally, you would expect the delivery of a new car within four months. In our case, we have to wait for eight months. The car dealer told me that many components suppliers are way behind their production targets. Given that many production lines had to close during the lockdown and these parts now have to be produced to close the gap, the sector cannot provide the usual delivery frequency while sticking to a just-in-time scheme. This is not only due to the often-quoted problem with outstanding deliveries of semi-conductors, but to issues across the entire supply chain.

Two to four million cars not built in 2021

Let us clarify this situation on the basis of some data. The production of a semi-conductor takes six weeks to three months, depending on the features. Taking also into account the fact that for this reason two to four million cars were not built in the first half of 2021, we find that there is a massive need to catch up. This gap will not be closed quickly.

Did you know that a modern, medium-sized car contained up to 1,400 computer chips? I did not. This number is going to increase further because of the development of self-driving cars and the trend away from a combustion engine towards electric vehicles.

This is also supported by the following chart, which compares the market of new cars with it used car counterpart. The new car market is slowly catching up and has also been on the rise since Q2 2021 as well.

The time has probably come for many car owners to buy a new car and/or to think about switching to a “clean” model. The climate plan of the European Commission (“Fit for 55”), which calls for the end of the combustion engine by 2035, forces the producers to rethink their strategy towards electric vehicles or alternative forms of propulsion.

New technologies will be available more easily and faster. Big cities have started to plant greenery in the inner urban areas due to climate change and to reduce the number of parking spaces.

CONCLUSION

The coming years will be very exciting, with the development making rapid inroads. Two things are clear: it will be sustainable and entail a quantum leap in technology. My old car has served me well in the past twelve years, but now it is time for a cleaner alternative.

Legal note:

Prognoses are no reliable indicator for future performance.