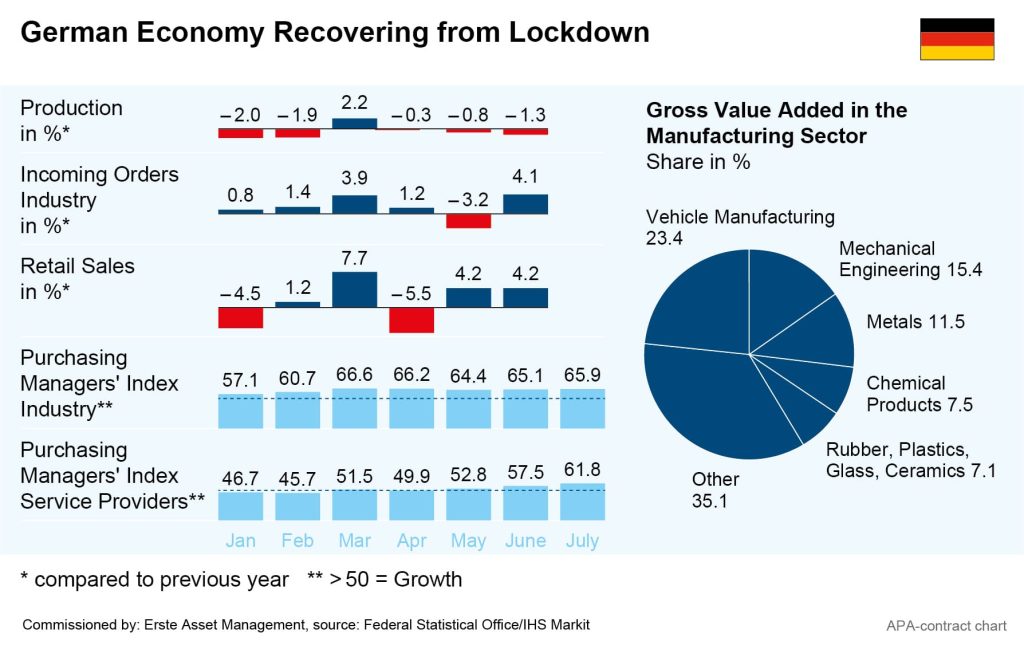

Germany’s economy is showing growth again, marking a recovery from the pandemic-induced slump at the turn of the year. In Q2, the country’s gross domestic product (GDP) increased by 1.5 per cent compared to the previous quarter, after a drop of 2.1 per cent in Q1. However a detailed look reveals a mixed picture: while service providers and retailers are benefiting from the easing of the pandemic measures, industry is being held back by material shortages and supply bottlenecks.

Still, orders in the industrial sector have recently increased further: according to the latest data from Germany’s Federal Statistical Office, price-adjusted new orders in June surprisingly rose by a significant 4.1 per cent compared to the previous month. Economists had expected an average increase of 1.9 per cent, less than even half that figure. Orders are thus already 11.2 per cent above the level of February 2020, the last month before the start of the lockdowns.

High demand in the IT and optics sectors contributed to this, but the mechanical engineering sector – an important factor in German economy – is also recording an increase in orders. The German Mechanical Engineering Industry Association (VDMA) recently reported a 29 per cent increase in orders for the sector in the first half of the year.

However, the high demand is not yet reflected in production and sales; persistent supply bottlenecks are slowing down Germany’s industry. Production in the manufacturing sector surprisingly shrank by another 1.3 per cent in June. The business climate index calculated by the German ifo Institute also dropped by 5 points to 22 points in July.

Chip shortage slowing down automotive industry

The background to this development are the continuing shortages of intermediate products and raw materials such as containers, computer chips and construction timber. According to a survey by the ifo Institute, 83.4 per cent of companies felt the lack of intermediate products in July. According to the survey data, this is the biggest shortage of materials in 30 years.

In addition to manufacturers of electrical appliances, the automotive industry – an economic mainstay for Germany – is particularly affected by the continuing shortage of computer chips. Because of the semiconductor shortage, car manufacturers are currently unable to manufacture as many cars as they could sell. Accordingly, data from the German Federal Motor Transport Authority show that new car registrations fell again by about 25 per cent to 235,400 vehicles in July.

Despite good business figures, the car manufacturers themselves have recently warned of the consequences of the chip shortage. Volkswagen, for example, is preparing for a “very challenging” Q3 in view of the shortage, citing supply bottlenecks in South-East Asia in particular, where production stoppages have occurred in several countries with important locations for the semiconductor industry due to the recently newly flared-up pandemic. BMW was also cautious in its outlook, despite presenting stronger-than-expected Q2 figures: semiconductor shortages and higher commodity prices are also likely to put a damper on the second half of the year, the group warned.

Retailers and service providers benefit from reopenings

On the other hand, the retail and service sectors have been performing positively recently as a result of the lifted or eased restrictions. Measured by the IHS Purchasing Managers’ Index, German service providers showed unprecedented growth in July: the index, calculated by the IHS Markit institute on the basis of monthly surveys, rose by 4.3 points to 61.8 points compared to the previous month. Above 50 points, the barometer signals growth.

This is already being reflected in the labour market. “Many businesses have hired additional staff at record speed,” said Markit economist Andrew Harker. This means that unemployment continued to fall further in July, the first drop in 15 years in what is traditionally a weak holiday month. Normally unemployment rises in many sectors in July due to summer holidays, but this effect has now been overcompensated by the strong recovery in the labour market.

German retailers naturally felt the end of the lockdowns and the effect of store reopenings particularly strongly, with revenues, adjusted for inflation, increasing remarkable strongly by 4.2 per cent in June. Economists had expected a 2.0 per cent increase at best. While the lockdown regulations had still caused losses of 6.8 per cent In April according to the Federal Statistical Office, the first reopenings in May were then reflected in a 4.6 per cent increase.

DAX near record high, delta variant and inflation remain uncertainty factor

On the stock exchange, the economic recovery was initially accompanied by new record highs, but the market has recently shown itself to be indecisive. For weeks now, the German DAX index has been hovering just below the record high of 15,800 points it reached in the summer. The good prospects many sectors have shown are contrasted by concerns about the rapid spread of the coronavirus delta variant. Service providers in particular fear the looming threat of new lockdowns.

Added to this are fears about the inflation that would accompany an economic upswing and the threat of countermeasures by the central banks in the form of a gradual departure from their current monetary policy of supporting the economy. The recent rally in commodity prices, which is increasingly reflected in final products and thus consumer prices, has contributed to this development.

In July, German consumer prices rose by 3.8 per cent YOY, the strongest price increase since 1993. “Particularly responsible for the further increase in the inflation rate in July 2021 is a base effect, which is due to the coronavirus-related VAT rate reduction in July 2020,” experts from the Federal Statistical Office explained. The German government temporarily lowered VAT rates in 2020 to combat the economic consequences of the pandemic, which made many goods and services cheaper. This effect is now reversing.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.