The environment for the financial markets remains fraught with heightened uncertainty. This is because the further development of several negative trends is not sufficiently foreseeable. This applies, among other things, to the development of inflation and real economic growth. There will probably be no foreseeable positive trends with low fluctuations. This speaks in favor of high fluctuations in asset prices.

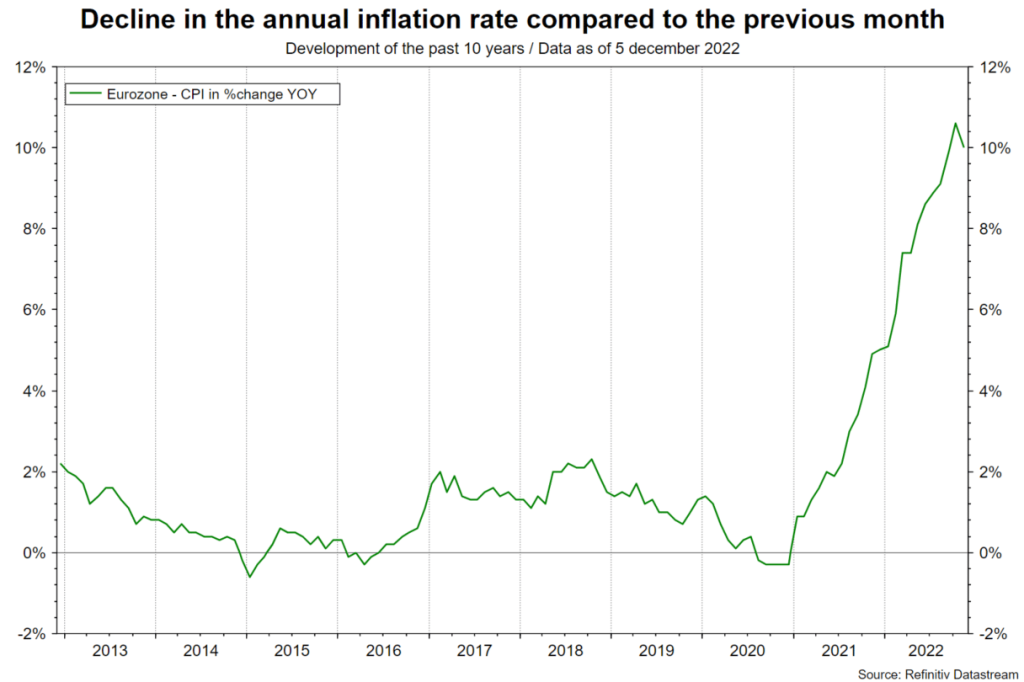

Falling inflation rates

Indications of falling inflation rates in the coming months increased further last week. In the eurozone, the flash estimate for consumer price inflation in the eurozone for the month of November showed a 0.1 percentage point drop in month-on-month terms to 10.0% year-on-year. In October, inflation had still risen by 1.5% month-on-month. The main reason for the decline in inflation was the fall in energy prices.

In the US, the deflator for personal consumption expenditures excluding food and energy prices (the core rate) rose by only 0.2% month-on-month to 5.0% year-on-year in October (after 0.5% p.m. / 5.1% p.a. in September). In Germany, import prices fell for the second month in a row on a monthly basis (-1.2% p.m. / 23.5% p.a.). In the global manufacturing purchasing managers’ report, selling prices show falling inflationary pressures, while delivery times have continued to fall. And in the US ISM Purchasing Managers’ Index for the manufacturing sector, purchase prices have retreated to a very low level (43.0).

Scope for pause

After all, the declining inflation momentum increases the scope for central banks to reduce the pace in the rate hike cycle as well as for an early pause (probably in Q1 2023) on already restrictive interest rate levels. Central banks are aware of the lagged effect of monetary tightening on economic activity. This was also the picture painted by U.S. Federal Reserve Chairman Powell in a speech last week.

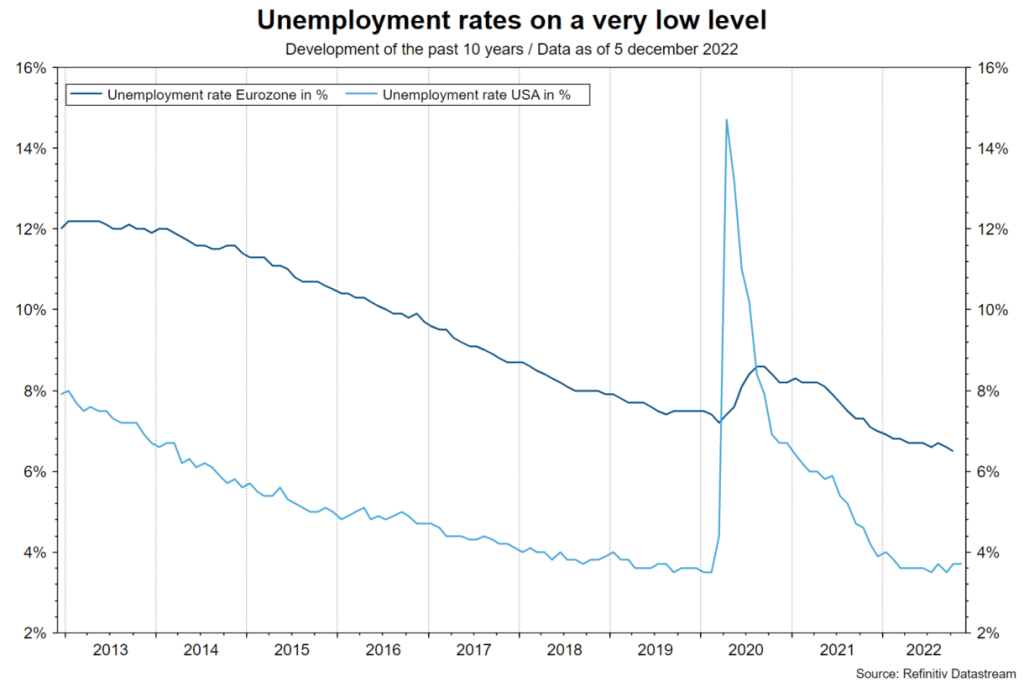

Low unemployment rates

However, uncertainty about the extent of the decline in inflation next year remains considerable. First-round effects are diminishing, but the risk of possible secondary-round effects remains. This is because inflation expectations or inflation persistence may already have risen permanently. Above all, the firm labor market could be a source of increased wage inflation. In the OECD area, the unemployment rate for the month of October was 4.9% (close to the all-time low). In the eurozone, the unemployment rate fell to just 6.5% (all-time low) in October. In the USA, the rate for the month of November was 3.7% (close to the cyclical low of 3.5% in September).

Falling inflation without recession?

Hopes that inflation can fall sufficiently without a recession (rising unemployment rate) triggered by the central bank were dampened last week. This is because the labor market report in the U.S. showed a further decline in the participation rate (share of the labor force in employment or in unemployment) to 62.1%, strong employment growth (+263,000) and, above all, an acceleration in the growth of average hourly wages (0.6% p.m. / 5.1% p.a. after 0.5% p.m. / 4.9% p.a.).

Since mid-October, rising hopes for continued falling inflation rates have supported both stock and bond prices. However, the tight labor market means increased risks of secondary round effects. To contain these, central banks could raise key interest rates further after the pause in the rate hike cycle. This would increase the risk of a recession in the medium term (H2 2023 to 2024). Relying on the rosy scenario of persistently falling inflation (disinflation) would be bold.

Imminent recession risks

The theme of the transition phase from inflation as the dominant factor to at least also economic growth also received confirmation last week. The global Purchasing Managers’ Index for the manufacturing sector continued its downward trend in the month of November (overall figure: 48.8). The subcomponent production (47.8) indicates a contraction in the global manufacturing sector. The ratio of new orders (falling trend) to inventories (rising trend), which continued to fall, has reached a very low (recessionary) value of 0.92.

The key question for the immediate growth outlook is how resilient private consumption and the services sector are. After all, in the U.S.A., growth in real personal consumption expenditures has increased in recent months (October: 0.5% p.m.). The global purchasing managers’ index for the service sector on Monday will provide an important update in this regard.

Higher risk premiums

In technical terms, in an environment where liquidity is no longer abundant because central banks are raising policy rates and uncertainty is kept at a high level by multiple drivers (geopolitics, economy, climate), the (required) risk premium for different asset classes is likely to be higher than in the past. Even though the outlook for some asset classes seems favorable next year (for example for bonds), the higher expected volatility will reduce the price appreciation potential.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.