The IFO business climate index calculated by the Munich-based IFO Institute is regarded as the most important German economic indicator. At 115.1, the value released for June last week was the highest since the launch in January 1991. It was also clearly above the value that had been expected by the financial analysts on average. The signs for substantial economic growth in Germany seem favourable.

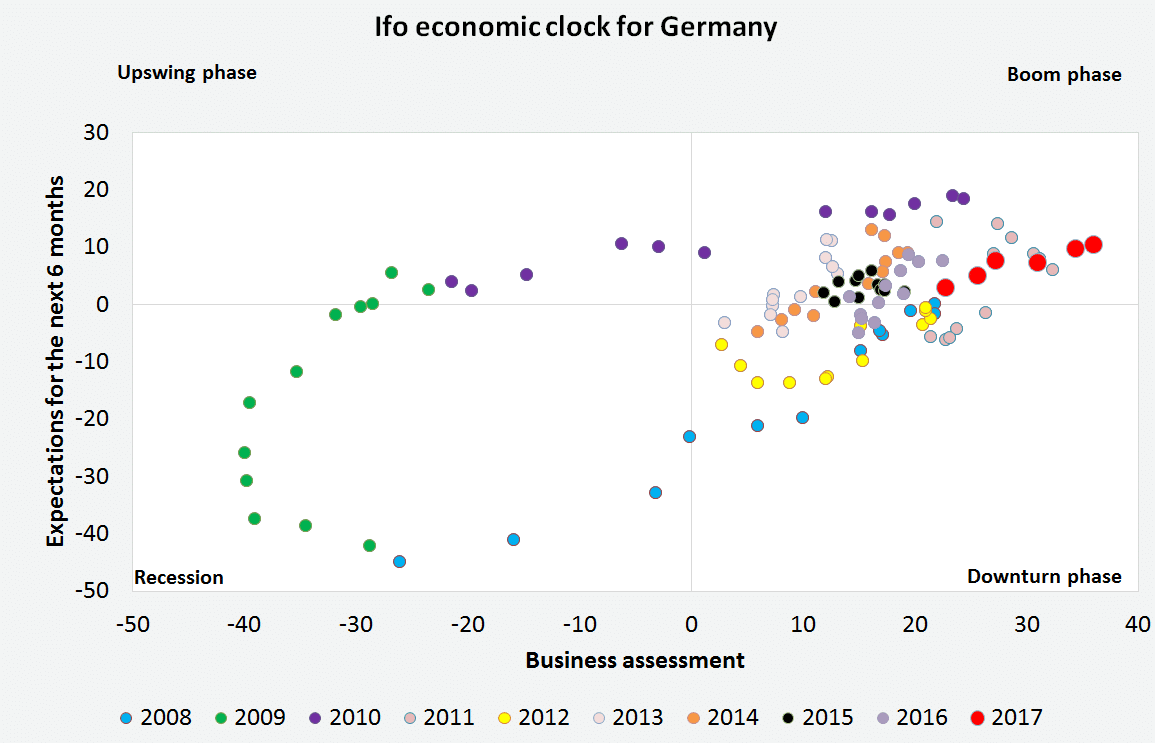

From my point of view, this leads me to two questions: “What does that mean for the markets?” and “What is the outlook for the economy?” In order to answer these two questions, I would like to use a very simple illustration of the two components of the IFO index, i.e. the current assessment of the business environment and the expectations for the coming six months. The illustration is also known as IFO business-cycle clock. It simply derives the current position in the economic cycle from the relative position of the two components.

- If both the current business climate and outlook are clearly positive, the German economy is in a boom phase.

- If the current assessment and the outlook are negative, the economy is in a recession.

- In the downturn phase, the current assessment is positive, whereas expectations are starting to decline.

- The upturn phase looks exactly the opposite. While the current assessment is still negative, expectations are decidedly more optimistic.

As the chart below suggests, the German economy is currently in a boom phase.

Sources: EAM, Datastream

What does that mean for the markets?

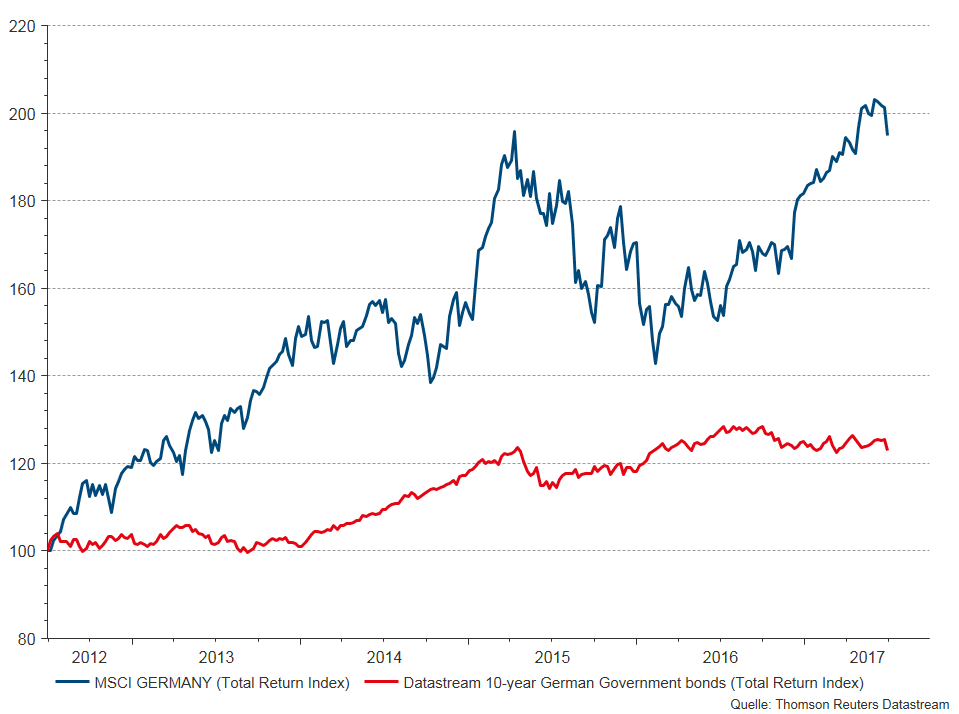

The table in the following shows the average return of shares (MSCI Germany) and of 10Y German government bonds (Datastream Benchmark 10Y Total Return index) from January 1992 to June 2017, broken down by phase. In a boom phase as described above, shares would yield and average return of 14.6% per year, while government bonds would only yield 2.5% per year.

More interesting than the absolute figures is the ratio of return and risk indicators throughout the various phases. We can see clearly that shares have very low risk/return ratios during downturn and recessionary phases. These, in turn, are the phases when government bonds would show particularly attractive return/risk ratios.

Performance of the German equity market (MSCI Germany Total Return) and the 10-year-German-Government Bond market (Total Return Index) – 06/2012 – 06/2017

Source: Thomson Reuters Datastream; 3.7.2017

Please note that past performance is not a reliable indicator for future developments.

Performance and risk (i.e. standard deviation) for the German equity and bond market (1992-2017)

| Equities | Recession | Expansion | Boom | Downturn |

| Monthly performance | 0.1% | 2.0% | 1.2% | -0.6% |

| Monthly risk (std. deviation) | 7.0% | 6.0% | 4.2% | 6.4% |

| Annualisierte Performance | 1.6% | 23.8% | 14.6% | -7.2% |

| Annual risk (std. deviation) | 24.3% | 20.7% | 14.4% | 22.2% |

| Return/Risk-Ratio | 0.07 | 1.15 | 1.01 | -0.33 |

| Bonds | Recession | Expansion | Boom | Downturn |

| Monthly performance | 0.8% | 0.4% | 0.2% | 1.0% |

| Monthly risk (std. deviation) | 1.6% | 1.5% | 1.5% | 1.8% |

| Annualised performance | 9.1% | 4.4% | 2.5% | 12.0% |

| Annual risk (std.deviation) | 5.7% | 5.2% | 5.3% | 6.4% |

| Return/Risk-Ratio | 1.60 | 0.85 | 0.47 | 1.89 |

Sources: Erste AM, Datastream; calculation based on monthly data

Please note that past performance is not a reliable indicator for future developments.

As pointed out earlier, the business-cycle clock currently shows a clear boom phase. Therefore, you would want to invest in shares rather than bonds. This is one of the reasons why the weighting of shares is currently high while bonds command a very low weighting in the asset allocation of our mixed funds.

What is the outlook for the economy?

The image of the clock implies an ongoing nature – clocks keep turning. Booms are followed by downturns. However, there are no signs for that in Germany at this point in time. In view of the extremely loose interest rate policy in the Eurozone, where the ECB has to keep in mind the average parameters of the euro area countries, nothing suggests that the ECB would want to rain on the German economic parade. From my point of view, Germany is therefore likely in for a hot summer –not only literally, but also in terms of economic performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.