Autor: Tamas Menyhart, Fund Manager Equities, Erste Asset Management

Autor: Tamas Menyhart, Fund Manager Equities, Erste Asset Management

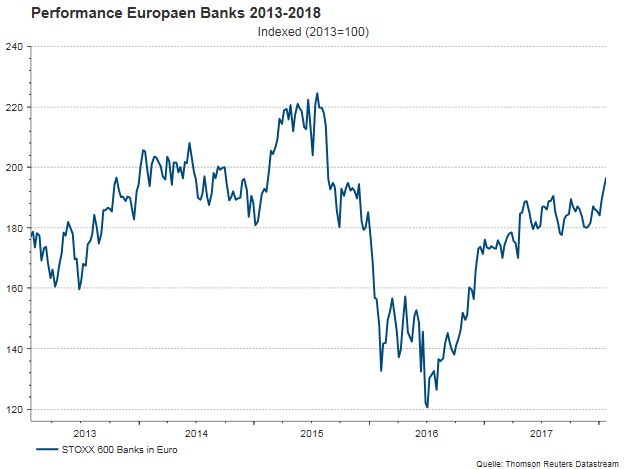

European banks (as measured by the Stoxx 600 Banks Index) had a decent year in 2017: the index climbed more than 8%, slightly outperforming the broader European market (Stoxx 600 Index).

The strongest positive impulse came from the French elections in April last year, where the populist threat was successfully defeated by Emmanuel Macron, arguably the most market-friendly candidate among the contenders. A robust European economy and a solid business sentiment throughout the year also helped banking shares go higher.

Note: Past performance is not indicative of future development.

New regulations

For banks, the year 2018 started with a massive wave of regulatory changes taking effect. Investors hope that this set of new regulations will mark the end of the regulatory tightening cycle, which started after the global financial crisis. The most important new rules include IFRS 9, Basel 4 and MiFID 2.

IFRS 9, which requires banks to book future expected losses earlier, had been anticipated for months. The majority of banks guide for manageable effects on their capital positions.

The long-awaited output floors (the minimum risk weight an internal model has to yield vs. the standard model) of the new Basel 4 regulation have been agreed upon at the end of 2017. We have yet to wait for detailed guidance from banks how the new rules will affect capital and earnings, but most analysts share the view that the final outcome was more favourable for the sector than feared.

And finally, MiFID 2 was introduced at the beginning of 2018, which mostly affects investment banks and asset managers with the goal of increasing cost transparency for clients.

Strong Eurozone economy and ECB-tapering push yields higher

In addition to more clarity on banking regulation, the Eurozone economy kicked off the year with strong numbers: Eurozone PMIs – which measure the business confidence of purchasing managers – are at multi-year highs. At the beginning of the year the ECB reduced its monthly asset purchases to EUR 30bn, down from EUR 60bn. This action eases the downward pressure on bond yields.

Higher bond yields

German bond yields reacted positively to this news, and the progress made on forming a new grand coalition in Germany also helped yields moving higher. In the US, the 10Y yield reached its highest level since the beginning of 2015 a few days ago, driven by a strong economy and the recently passed tax reform. It is worth noting that in a global context it seems as if, finally, the historically low-rate policies of the central banks are slowly turning, with the Fed hiking rates three times last year, accompanied by recent rate hikes from the Bank of Canada, the Czech central bank, and the Bank of England. Higher rates and yields are important for banks, as they help lifting the net interest margin (the difference between interest earned on loans and interest paid on deposits), one of the main revenue sources of banks.

European banking shares have started into 2018 with a very strong performance

Due to the above-mentioned developments, European banks have started the year very strongly, gaining almost 7% and outperforming the broader European market by more than 3%. The Stoxx 600 Banks Index now stands at its highest level since 2015, but is still down more than 63% from its pre-crisis peak. As a comparison, the US-Banking Index (BKX) is only 5% away from its level reached in 2007.

Outlook for 2018 positive, Italian elections are the main risk

From an equity perspective, European banks are in a good position: valuations are below those of the average European market, they have been lagging market performance for years after the crisis, and they are set to benefit from higher inflation, higher rates and a strong economy. Also, the strength of the euro – which appreciated by more than 14% in 2017 against the US dollar and continues rising – is hurting the export sensitive sectors, but does not necessarily affect bank earnings in a negative way. Therefore, everything points to another strong year for European banking shares.

The biggest (foreseeable) downside risk stems from politics. Italy – the 3rd largest Eurozone economy with an elevated debt-to-GDP-ratio and a high share of non-performing loans in its banking sector – will be holding general elections on March 4th. A victory of the populist 5-star movement could seriously dampen the positive sentiment in the Eurozone. However, recent polls suggest the populist party will not be able to form a government.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.