Trade conflicts, political uncertainty and volatile markets: the first quarter was a tough one. But away from the headlines, there are sectors that are growing structurally – with environmental technologies at the forefront. Nevertheless, this sector is not immune to the losses in the market. What is the outlook for environmental technologies? We talked to the two fund managers of ERSTE WWF STOCK ENVIRONMENT and ERSTE GREEN INVEST, Clemens Klein and Alexander Weiss, about current developments, risks and investment opportunities.

The markets have recently come under severe pressure and volatility has increased significantly. What happened?

Clemens Klein: The recent tariff announcements by the US government under Donald Trump have caused nervousness worldwide. Within two days, the US stock markets lost over 10%, which was the sharpest decline since the Covid crisis. What is special about this is that in the past, it took unforeseen crises to cause such extreme market reactions. This time, however, it was a press conference by the most powerful man in the world, which was also pre-announced.

Alexander Weiss: This shows how strongly political decisions are currently affecting the markets. Uncertainty is poison for the markets and currently there is an unprecedented level of uncertainty among investors regarding the tariff issue: inside. The ‘Economic Policy Uncertainty Index’ is currently at its highest level since the pandemic. And the crazy thing about it is that all of this is being driven by one nation, or rather one person: Donald Trump.

What are the long-term consequences of this?

Clemens Klein: Economists agree that tariffs have a negative impact on the global economy. They have an inflationary effect because price increases are passed on to the end customer. On the other hand, the affected countries react with counter-tariffs, which ultimately escalates into a major trade war: one side increases tariffs, the other reacts – and so on. Many now expect a recession in the US.

Alexander Weiss: The overall economic situation is one thing, but what does the tariff dispute mean for investors and companies? The risks have increased. Companies have little planning security, investments are at risk of being postponed and location decisions could be put on hold for the time being. The longer the sword of Damocles hangs over the markets, the more negative the impact on companies and ultimately on profits. Trump’s normal approach is to increase the pressure on the other side in order to be in a better negotiating position for one of his deals. It is quite possible that most tariffs will be negotiated away and that many countries will make concessions to the US. However, if these deals do not materialise quickly, the situation on the stock markets is likely to remain tense.

How do these political risks specifically affect the environmental technology sector?

Alexander Weiss: The political uncertainty is being felt in all areas of the stock market – and the clean-tech sector is no exception. In particular, the subsidies that came through the Inflation Reduction Act (IRA) are under discussion here. The package has provided a powerful boost to the expansion of renewables in the US. With the exception of the expected cuts in the areas of offshore wind and electric vehicles, very little concrete has been heard on the subject, but the Trump administration will try to extend tax breaks for high earners and companies – and to do that, you need savings.

Clemens Klein: But we still don’t think that the Inflation Reduction Act will be repealed altogether. Even before the US election, many Republicans had come out in favour of the IRA, not least because the package created many jobs in traditionally Republican states. Most recently, the number of Republican supporters in the House of Representatives has risen again. It is also a fact that demand for electricity in the US is growing strongly – all forms of energy will play a role here, including renewables.

Are there any sectors you are watching particularly closely during this volatile phase?

Clemens Klein: Some stocks in the water sector from our funds, as well as more defensive energy suppliers, were less affected by the sell-off in equities. This is because these companies generate the majority of their revenues in their home market and are therefore less affected by tariffs. These include companies such as EDP Renovaveis, Acciona Energia, American Water Works, but also companies in the recycling sector such as Republic Services or Waste Management.

Alexander Weiss: It was mainly stocks in the energy sector that could not escape the general losses on the market. But there are also companies that have potential in the current phase. In the solar segment, there have been US tariffs of up to 200% on solar cells and modules from China for quite some time. In 2024, tariffs were also imposed on parts of Chinese companies that have outsourced their production to countries such as Cambodia, Malaysia, Thailand and Vietnam. In the case of Vietnam, these are as high as 271.45%! In response to the multitude of trade barriers, American companies in the solar sector have already brought most of their value chains back to the US. The IRA even promoted this step with its own tax credit to create incentives for these companies.

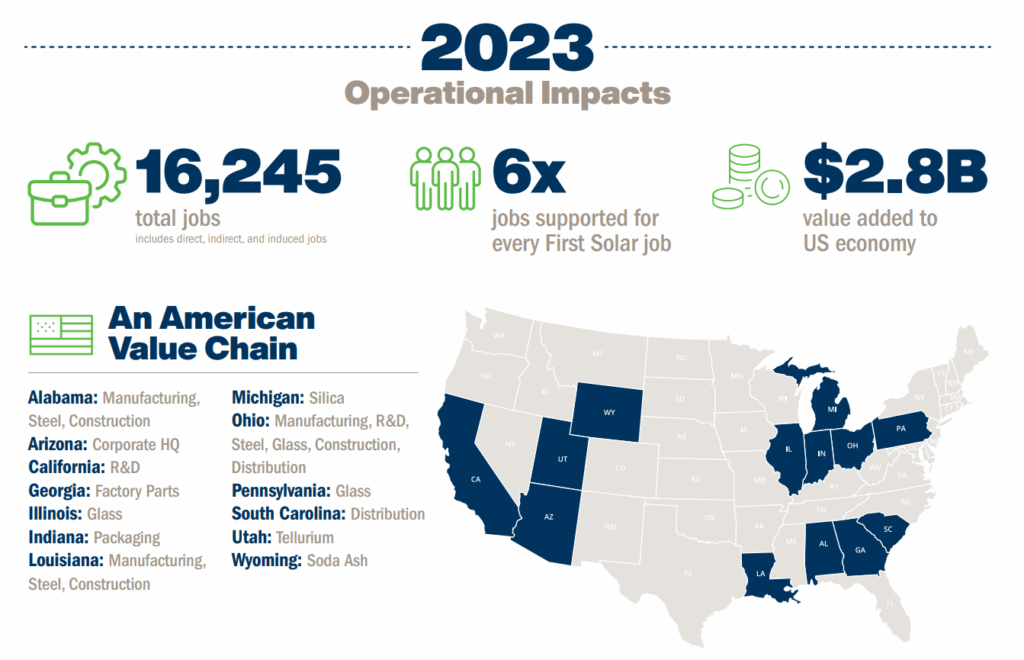

Clemens Klein: The prime example of this is First Solar, the largest producer of solar modules in the US and one of the top holdings in our funds. Virtually the entire value chain is in the US. Unlike its competitors, First Solar’s proprietary production process means that it does not rely on Chinese imports. First Solar has been benefiting from US protectionism in the solar sector for quite some time – so it makes sense that the stock is holding up better in the current environment. However, a lot also depends on the future of the IRA here. As already mentioned, we do not expect it to be abolished: the solar industry has created many jobs in recent years, especially in Republican states, the law is also very popular among Republicans, and, last but not least, it is also in line with the Trump administration’s aim of bringing production capacities back to the US.

(Note: The companies listed here have been selected as examples and do not constitute an investment recommendation. Please note that investing in securities involves risks as well as opportunities.)

Graphic: First Solar’s panels are a prime example of ‘Made in America’, Source: First Solar, Note: Past performance is not a reliable indicator of future performance.

How have you reacted to the latest developments in the two environmental equity funds?

Clemens Klein: We have used the disruptions of the reporting season to buy stocks that we believe offer potential. For example, we have increased our weighting in Shoals Technologies & Array Technologies. Both companies are currently very favourably valued and are hardly affected by tariffs, as the majority of their production and value creation takes place in the US; in the case of Shoals, as much as 90% of the materials for production are purchased in the US. In the case of HA Sustainable Infrastructure (HASI), we continue to take advantage of setbacks to expand our position. The company is in a very solid position and has been active in the renewable energy sector for over 30 years.

Alexander Weiss: The latest quarterly report of one of our top holdings, Nextracker, showed that renewable energy companies can deliver even in the current environment. Since the company went public in 2023, it has consistently exceeded analyst estimates – the share price rose by over 20% after the latest quarterly figures. The company has no debt and has already announced that it will let shareholders participate in its success in the future in the form of dividends or share buybacks.

(Note: The companies listed here have been selected as examples and do not constitute an investment recommendation. Please note that investing in securities involves risks as well as opportunities.)

How do you see clean-tech stocks developing?

Alexander Weiss: Strategic investors are increasingly taking advantage of the cheap valuations in the environmental segment for long-term acquisitions. This makes us feel positive. For example, private equity investor Brookfield Asset Management has recently announced several major deals in the renewable energy sector. A representative of the investor said recently: ‘We believe that the fundamentals for renewable energy are as strong as ever… the current disconnect between market noise and fundamentals presents us with a very good opportunity to make acquisitions at very attractive prices’.

Clemens Klein: We see the activities of many institutional investors in the renewable energy sector as a positive signal. The expansion of renewables continues to advance rapidly, even if this is still not reflected in share prices. Investors with a long-term horizon can use the current valuation situation to their advantage and build up positions.

(Note: Please be aware that investing in securities involves risks as well as opportunities.)

Risk notes ERSTE GREEN INVEST

The ERSTE GREEN INVEST invests worldwide primarily in companies in the field of environmental technology. The investment process of the fund is based on fundamental company analysis. Furthermore a measurable positive impact on the environment or society is paramount in the investment decision making. The selection of stocks takes place with a focus on companies in which an environmental benefit could be identified and which are primarily active in the areas of water treatment and -supply, recycling and waste management, renewable energy, energy-efficiency, mobility, transformation and adaption. A hedge against foreign currency risks is generally not provided, but is possible.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE GREEN INVEST as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE GREEN INVEST, consideration should be given to any characteristics or objectives of the ERSTE GREEN INVEST as described in the Fund Documents.

Risk notes ERSTE WWF STOCK ENVIRONMENT

The ERSTE WWF STOCK ENVIRONMENT invests worldwide primarily in companies in the field of environmental technology. The investment process of the fund is based on fundamental company analysis. The fund focuses on companies in which an environmental benefit could be identified and which are primarily active in the areas of water treatment and -supply, recycling and waste management, renewable energy, energy-efficiency and mobility. A hedge against foreign currency risks is generally not provided is possible. Since October 2006, a cooperation exists between Erste Asset Management and WWF (World Wide Fund for Nature) and the fund management is supported by an environmental advisory board, initiated by WWF. At the same time, Erste Asset Management donates part of the management fee to the fund. A measurable positive impact on the environment and society is paramount in the investment decision making.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE WWF STOCK ENVIRONMENT as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE WWF STOCK ENVIRONMENT, consideration should be given to any characteristics or objectives of the ERSTE WWF STOCK ENVIRONMENT as described in the Fund Documents.