It has been more than ten years since the Greek government bond crisis was looming over the EU. Many observers saw this event as the starting point of a never-ending story. However, the recent past of Greece has been rife with positive aspects. Most recently, in August 2022, after twelve years, the EU’s “Enhanced Surveillance” (formerly known as “Troika”) of Greece came to an end, as the required reforms had been for the most part successfully implemented. The focus is now on the upcoming elections in Greece.

Last obstacle of a 13-year challenge

Many regard the imminent parliamentary elections on 21 May as Greece’s last big obstacle to regaining the country’s investment grade rating. This would be a turnaround after Greece had been downgraded to “junk” (or, more formally, sub- or non-investment grade) level in 2010 in the largest restructuring of a sovereign in history. To achieve an investment grade rating, much depends on whether the next government maintains the pace and implementation of structural reforms and fiscal discipline.

Political stability put to the test

Looking back, one can conclude that policy failures had exacerbated the government debt crisis. The crisis repeatedly caused governments in Athens to collapse, forcing the euro partners to intervene to prevent the country from falling into default. In recent years, however, Greece has managed to form stable governments, which has helped improve its debt profile.

The country’s political stability will now be put to the test in the upcoming parliamentary elections in May, as new electoral rules (in the form of a fully proportional electoral system) make it more difficult for parties to form a government and effectively rule out single-party governments. A fragmented government could thus lead to political paralysis, which is a risky scenario. Therefore, the likelihood of a second round of elections in early July is high.

At the moment, the New Democracy party of the incumbent Prime Minister Kyriakos Mitsotakis is ahead of the Syriza party of former Prime Minister Alexis Tsipras in all polls. According to the latest trends, however, the lead has narrowed due to the railway accident in February and the resulting protests, which were the biggest the country had seen in decades.

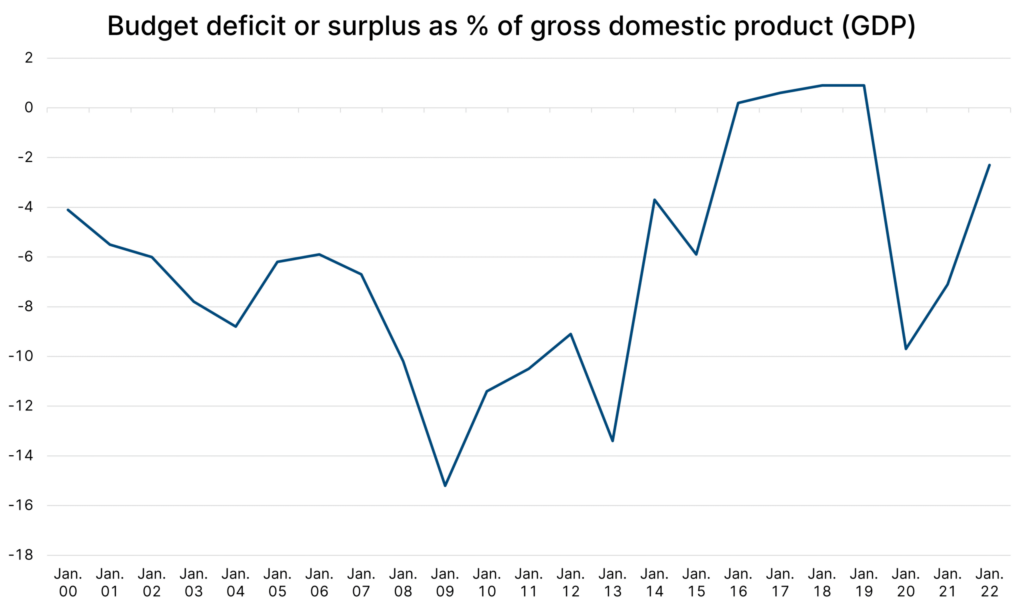

Fiscal discipline and consolidation

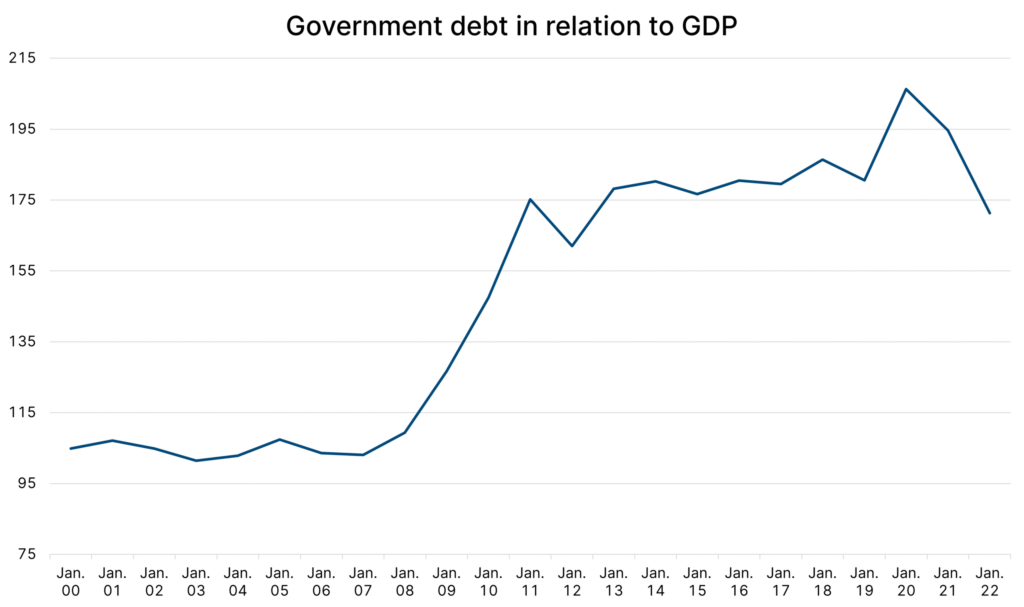

Since the downgrade to sub-investment grade, Greece has been the recipient of three bail-out programmes, which in part had conditions of fiscal discipline tied to them. This improved the picture a few years after the government debt crisis, but recent events (pandemic, invasion of Ukraine by Russia) have clouded said picture again. Still, Greece has managed to achieve budget surpluses in some of the recent years and to transform its financial sector.

A positive trend is also emerging with regard to public debt, which is on the decline and has been supported by a tailwind of strong growth.

Even though positive developments in Greece have repeatedly emerged in the recent past, there is still reason to be cautious. The Debt Sustainability Monitor 2022, published by the European Commission in mid-April, provides an overview of the short-, medium-, and long-term challenges facing EU member states in terms of fiscal sustainability.

With regard to Greece, the report paints a mixed picture. Long-term risks have been assessed as low and unchanged from the previous year. In the medium term, fiscal sustainability constitutes a risk. Short-term risks play a minor role and have decreased year-on-year, supported by robust growth.

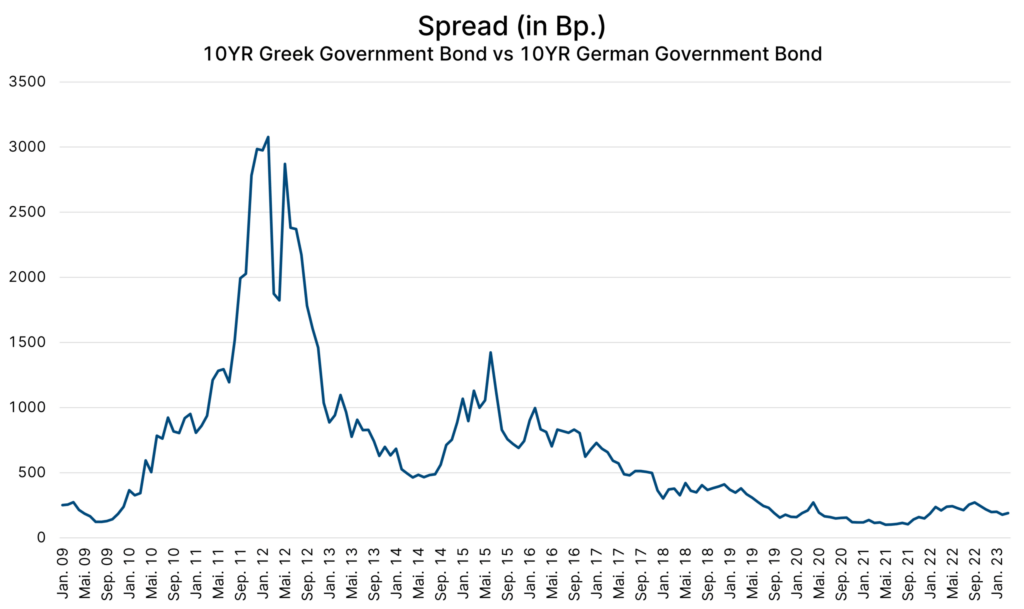

Positive sentiment on the capital markets

A significant range of indicators relating to Greece suggest that the capital markets are prudent towards Greece. One example is the spread of 10Y Greek government debt over a 10Y German government bond.

The chart above illustrates the fact that the positive sentiment on the capital markets can be explained by ever narrowing spreads on a 10Y Greek government bond relative to a 10Y German government bond.

To get a sense of what a potential upgrade to investment grade could mean for Greece, Portugal can serve as a case in point. When Portugal was upgraded to investment grade in 2017, the yield spread over neighbouring Spain – also an investment grade issuer – narrowed by 36bps within a week.

The fact that some of the focus of investors has switched back to Greece has also been substantiated most recently by the new issue of a 5Y government bond, which was oversubscribed almost sevenfold.

Outlook: uncertain remainder of 2023

Although social, political, and economic risks have increased recently, the economic fundamentals of Greece are on the positive side. However, the risk of two elections in a short period of time could lead to increased volatility. Provided that the parliamentary elections in May go off without major turbulence and the new government both continues ongoing reforms and keeps an eye on Greece’s debt sustainability, there should not be much standing in Greece’s way back to the desired rating upgrade to investment grade.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.