While the sharp losses on the equity markets about two weeks ago have largely been recovered, they have shown one thing: the path for achieving the so-called soft landing of the economy is a tight one. The financial markets are still hoping for this scenario where economic growth in the USA would slow to below trend and the Eurozone would return to sustainable growth. At the same time, inflation would continue to fall slowly.

However, the downside risks, which have recently increased again, make it clear that this scenario is far from a foregone conclusion. It is not only the geopolitically tense situation in the Middle East that is a factor of uncertainty. The latest economic data from the USA has also been on the disappointing side. In any case, the past few weeks have brought some new insights, also for positioning in the second half of the year.

Shock waves from Japan

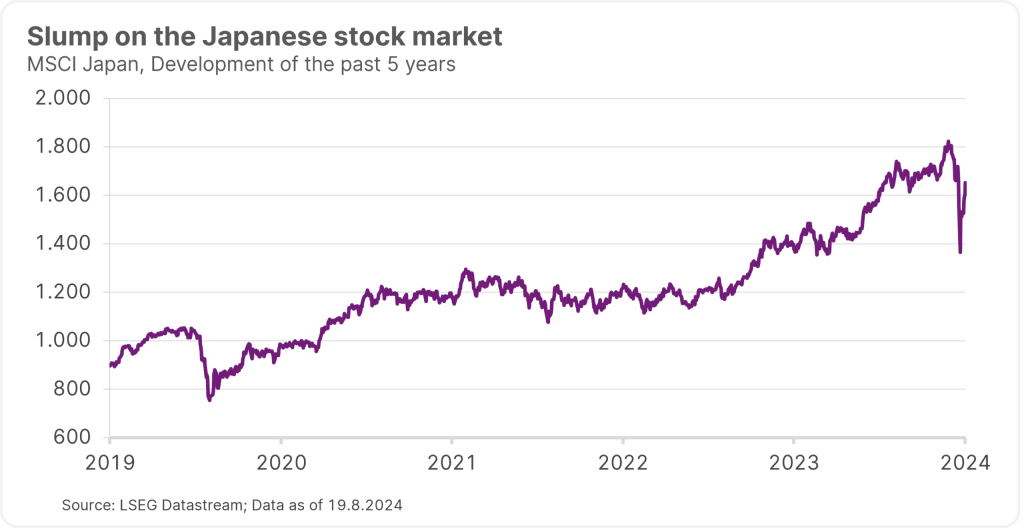

The market turbulence originated in Japan at the beginning of August. Surprising interest rate hike signals from the Japanese central bank caused real shockwaves in the financial system. To a certain extent, the reason for this was the undervaluation of the Japanese yen, which had been exacerbated in previous years by the ultra-loose monetary policy in Japan. While key-lending rates were raised in many other countries, they remained at 0.1% in Japan until recently.

As a result, the yen was increasingly used as a funding currency for investments that yielded higher returns: large institutional investors had taken out loans in yen in order to invest these funds in equities or other asset classes. This was reflected in the sharp rise in the volume of loans that Japanese banks had granted to investors from abroad.

However, after the Japanese central bank has raised the key-lending rate to 0.25% surprisingly early on and signalled possible further increases, the interest rate differential between Japan and the rest of the world is now narrowing. As a result, the yen exchange rate is appreciating, and the aforementioned debt financing is coming under pressure. The result was the cancellation of many of these so-called yen carry trades, which caused unrest on the equity markets and in some cases resulted in substantial losses.

Please note: past performance is no reliable indicator of future value development.

Weaker US job market weighing on the sentiment

In addition to the carry trades in Japan, burgeoning concerns regarding a recession have also dominated market activity recently. In the USA, growth risks have increased, primarily due to the weakening job market. From January 2023 to July 2024, the unemployment rate in the United States rose from 3.4% to 4.3%.

This triggered a recession indicator observed by many market participants, i.e. the so-called Sahm Rule. This barometer compares the three-month moving average of the unemployment rate with its lowest point over the past twelve months. In the past, the indicator has proven to be quite reliable in predicting a recession. With the latest US job market report, the ratio reached the decisive value of 0.5 percentage points for the first time since the coronavirus crisis.

This means that unemployment is still at a relatively low level. In the past, however, initial slight increases were often followed by a stronger rise in the unemployment rate, which was tantamount to a recession. The risk therefore manifests itself as a downward spiral: a reduction in employment would lead to lower incomes, which would dampen consumption. Companies would react by cutting jobs and reducing investment.

Prospect of rate cuts, with one exception

In any case, the weakening job market and the further decline in inflation are fuelling expectations of interest rate cuts in the USA in the near future. According to Gerhard Winzer, Chief Economist at Erste Asset Management, the US key-lending rate could be reduced from the current 5.5% to 3.0% by the end of 2025. In the Eurozone, too, many an indication would suggest further interest rate cuts. Winzer expects the deposit rate to be lowered from the current 3.75% to 2.0% by the end of 2025.

The Bank of Japan is the notable exception here: as already described, the key-lending rate is likely to continue to rise. Our current expectations are for a level of 0.75% by the end of 2025.

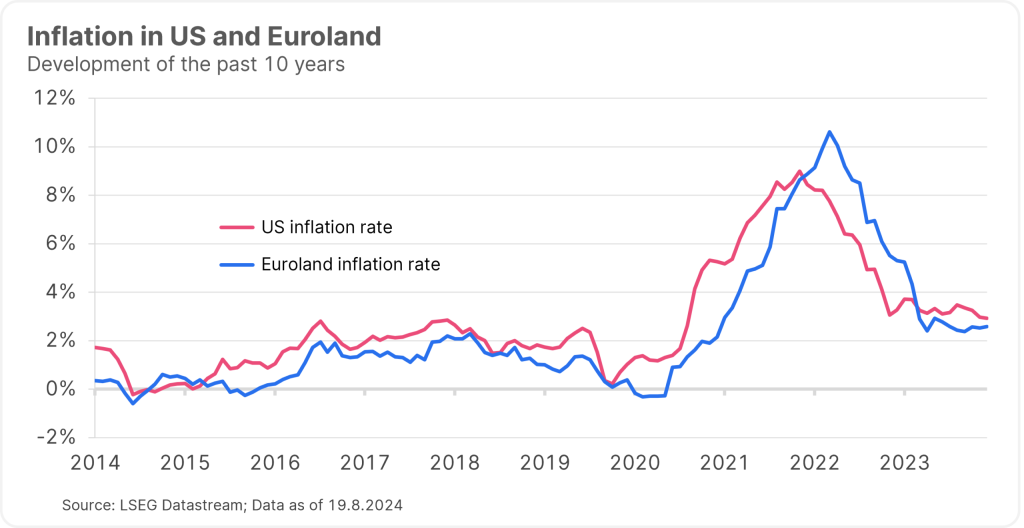

Expectations for the development of inflation from here on out are all pointing in one direction: downwards. Inflation in both the USA and the Eurozone is likely to remain above the central banks’ target of 2% in the coming year. With 2.3% for the USA and 2.2% for the Eurozone, chief economist Winzer expects inflation to come close to the central bank target in 2025.

What is our positioning strategy for the second half of 2024?

The soft landing, i.e. a gradual decline in inflation without the outbreak of a recession, is currently considered the most likely economic scenario, even if it is not yet possible to conclusively assess whether it will actually come to pass. It would certainly be positive for risky asset classes such as equities.

However, the recent losses show that there are still some downside risks that could lead to selling pressure. The tense geopolitical situation in the Middle East adds to the mix as an additional uncertainty factor.

We therefore slightly cut the equity component in Erste Asset Management’s mixed funds as a result of the uncertainty starting in Japan in order to reduce risk. At the same time, we overweighted bonds in the portfolios. On the one hand, this is due to the persistently high interest rates at the short end (inverted yield curve) and the continuing economic risks. On the other hand, there appears to be a negative correlation between equity and bond prices on the market again: losses in equities can therefore be partially cushioned by bonds.

Investing in bonds with a fixed term

Adding bonds to the portfolio can therefore make sense in the current environment. High-yield bonds in particular offer an interesting risk/reward ratio due to the increased risk premiums (spreads). Investors can invest in this segment with our newly launched ERSTE LAUFZEITFONDS HOCHZINS 2029 IV bond fund, for example.

The fund can be subscribed to from 2 September at Erste Bank and savings banks as well as online. It invests primarily in high-yield bonds and offers the advantage of a fixed term. It should be noted that investing in securities entails risks as well as opportunities.

Risk notices

The fund pursues an active investment policy and does not follow a benchmark. The assets are selected at our discretion, without any constraints to the latitude of judgement on the investment company’s part.

Warning notices according to the Austrian Investment Fund Act of 2011

ERSTE LAUFZEITFONDS HOCHZINS 2029 IV may invest a significant portion of its assets under management in demand deposits or callable deposits with a maturity of a maximum of twelve months as defined by sec 72 of the Austrian Investment Fund Act of 2011.

In accordance with the fund terms and conditions approved by the Austrian Financial Market Authority, ERSTE LAUFZEITFONDS HOCHZINS 2029 IV intends to invest more than 35% of assets under management in securities and/or money market instruments from public issuers. For a detailed statement on these issuers, please refer to the prospectus, section II, sub-section 12.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.