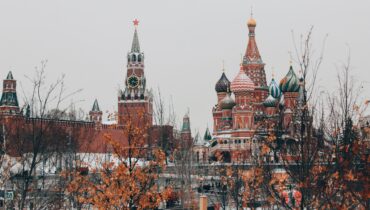

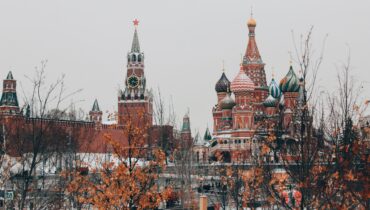

Last Friday saw the West’s first reaction to the invasion. Both the US, the EU and the UK announced sanctions against Russia. These mainly target Russia’s largest banks, oligarchs and the export of technology goods to Russia.

Last Friday saw the West’s first reaction to the invasion. Both the US, the EU and the UK announced sanctions against Russia. These mainly target Russia’s largest banks, oligarchs and the export of technology goods to Russia.

The Russia/Ukraine conflict is keeping the markets in suspense. Everything is possible – from continued diplomacy in order to contain the escalation to harder sanctions in case of a more comprehensive invasion. The volatility on the financial markets will remain high.

The risk of an escalation of the geopolitical conflict between Russia, Ukraine and NATO has risen further in recent days.

Erste Asset Management was yet again ranked first among the Austrian investment companies last year. Assets under management in Austria had increased by 16.6% y/y to EUR 47.7bn as of 31 December 2021.

We have seen some extraordinary years speaking about equity and multi asset performance. Interest rates were low, volatility – representing the average daily price changes – was comparably low. What is the situation today?

Energy prices are going through the roof at the moment. The causes are both political and economic. Shares in the energy and commodities sector offer potential for further price increases.

Waves of infections will continue to influence economic activity and the markets. What will happen in China, what are the inflation risks and will it be volatile? Our chief economist Gerhard Winzer has drawn up 10 theses for the year 2022.

Italy is about to elect a new president of state. The election that will be held from 24 January 2022 in several ballots is going to determine the successor of the current, 80-year old President Sergio Mattarella, whose mandate expires in February 2022. This was announced by the president of the chamber of deputies of […]

We are now into the third year of the pandemic. Since the spring 2020 collapse, economic activity and markets have shown exceptional resilience. This is not to be taken for granted. After all, the list of potential negative influences (“challenges”) is long.

Interview with Dr. Manfred Frühwirth, Vienna University of Economic and Business Administration What is Behavioural Finance? Behavioural Finance is located at the interface of finance and psychology. As a rule, Behavioural Finance investigates how irrational behaviour (most often on the investors’ part) affects asset prices on the capital market. 2a) Are there any examples of […]