The topic of inflation has recently become less acute but continues to occupy private individuals – in wage negotiations and at the supermarket – as well as companies and the financial sector, the latter one via the outlook for the key-lending rates.

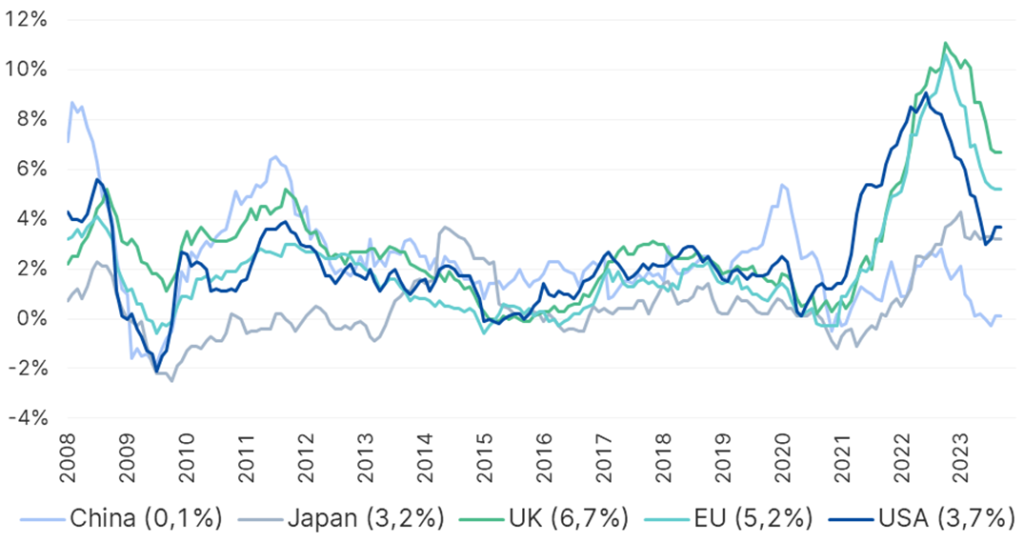

Inflation in the USA has peaked around June 2022, and in Europe around October 2022, as the following chart illustrates:

Inflation across various regions

Note: Past performance is no reliable indicator for future value developments. Data as of 27 September 2023

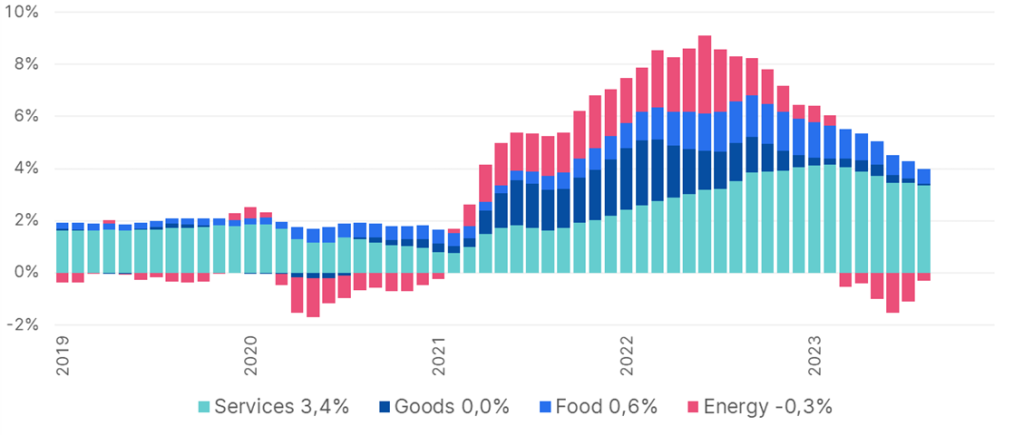

A break-down of US inflation reveals an interesting insight in terms of sources. In the chart, the turquoise line represents services with some catch-up demand potential after the pandemic, for example travel. Their impact is currently by far the largest. Dark blue shows goods and commodities whose share increased until around March 2022 and has decreased since then. Light blue is food, whose price increases are directly felt when shopping. And finally, in red, energy, i.e. especially oil and natural gas. The price increases in the wake of Russia’s attack on Ukraine have done their part. Overall, however, the influence of energy on inflation is something that fluctuates and can even reduce inflation at times.

Inflation in the USA: components

Note: Past performance is no reliable indicator for future value developments. Data as of 27 September 2023

To combat inflation, central banks around the world have raised key-lending rates both rapidly and sharply in order to dampen economic growth, as putting on the economic brakes usually takes pressure off prices.

Interest rate hikes (a burden on the economy) have historically been followed by interest rate cuts (a relief for the economy), also as an expression of the cyclicality of the economy, which is actually normal: stronger and weaker phases alternate. Ultimately, however, this change should never be too abrupt, and instead remain as predictable as possible.

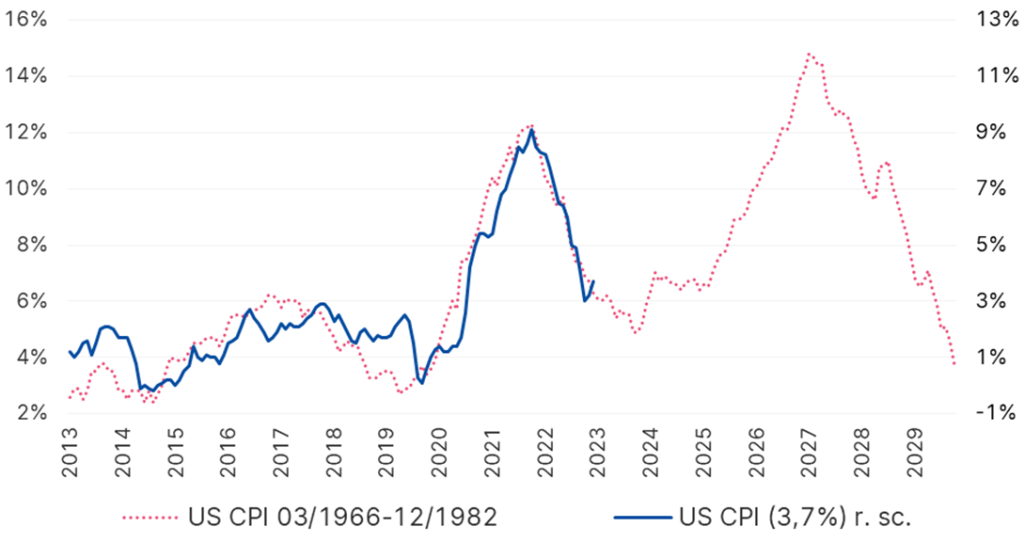

Is therefore now an interest rate cut imminent? At some point certainly, but possibly not in the foreseeable future. In the worst case, inflation would have only supposedly been brought under control, only to return afterwards. This has happened very rarely in the past, but it did happen, for example, in the period 03/1966-12/1982. The two oil shocks of 1973 and 1979 occurred during this period:

Inflation USA 1966-1982 vs. today

Note: Past performance is no reliable indicator for future value developments. Data as of 27 September 2023

It is crucial for the central banks to avert this nightmare scenario. The chart shows that our inflation problem would be perpetuated until 2029 (!) if we were to extrapolate the past into the future.

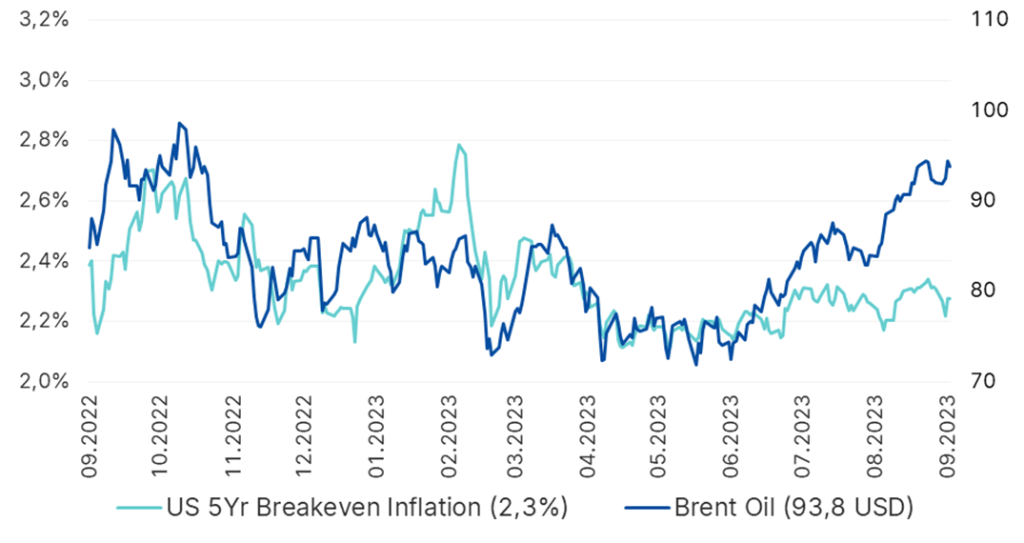

Speaking of oil: the world economy is much less dependent on oil than it was in the 1970s, but the influence of oil on prices still exists. Through producer prices on the one hand, with energy as a production factor. But also, via the so-called inflation expectations. They tell us what level of inflation is expected in a few years. Central banks monitor these values closely because people should literally not get used to high inflation. After all, the measures taken by central banks today are aimed at bringing inflation in the future back to its target value. This also comes with a question of credibility: a high inflation expectation in the future would mean that people have lost confidence in the central banks’ toolbox and economic policy.

It is understandably difficult to predict inflation five years from now. Therefore, respondents (knowingly or unknowingly) fall back on the oil price, as shown in the following chart. In blue: the oil price; in turquoise: inflation expectations in five years. A certain synchronisation of the two lines cannot be denied.

Crude oil price and inflation expectations in the USA

Note: Past performance is no reliable indicator for future value developments. Data as of 27 September 2023

Lamentably, the oil price has picked up again in recent months, as can be seen on the right edge by the blue line. This may pull inflation expectations along sooner or later, which would not make the central banks’ work any easier.

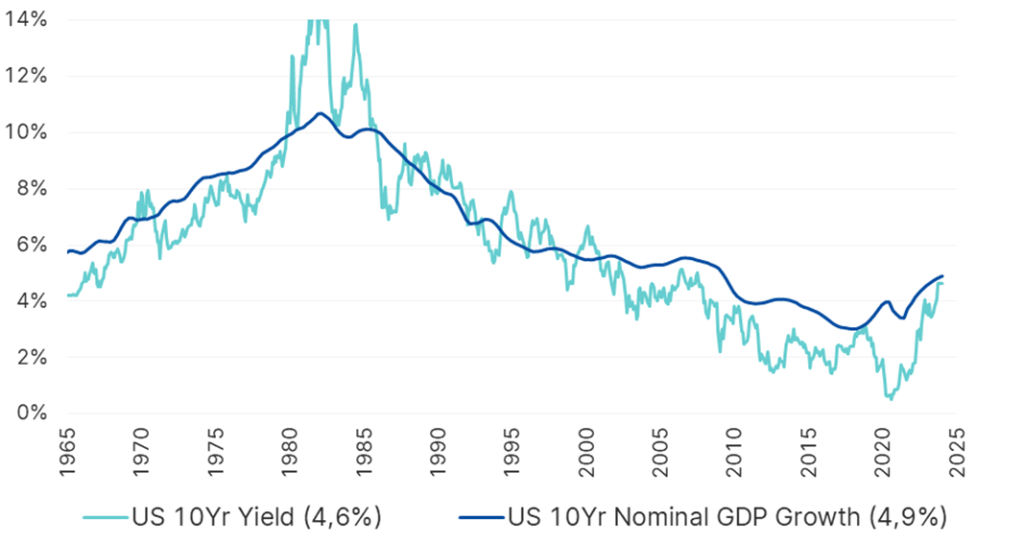

Interest rates, or rather government bond yields, are related to economic growth (as mentioned earlier, higher interest rates dampen growth). The following chart shows that growth in the USA, calculated as an average over ten years, has picked up strongly recently.

Treasury bond yields vs. economic growth USA

Note: Past performance is no reliable indicator for future value developments. Representation of an index, no direct investment possible. Data as of 27 September 2023

Therefore, excessively strong economic growth can bring disadvantages in that it already carries the seeds of a slowdown, so to speak, through rising interest rates, even independently of inflation.

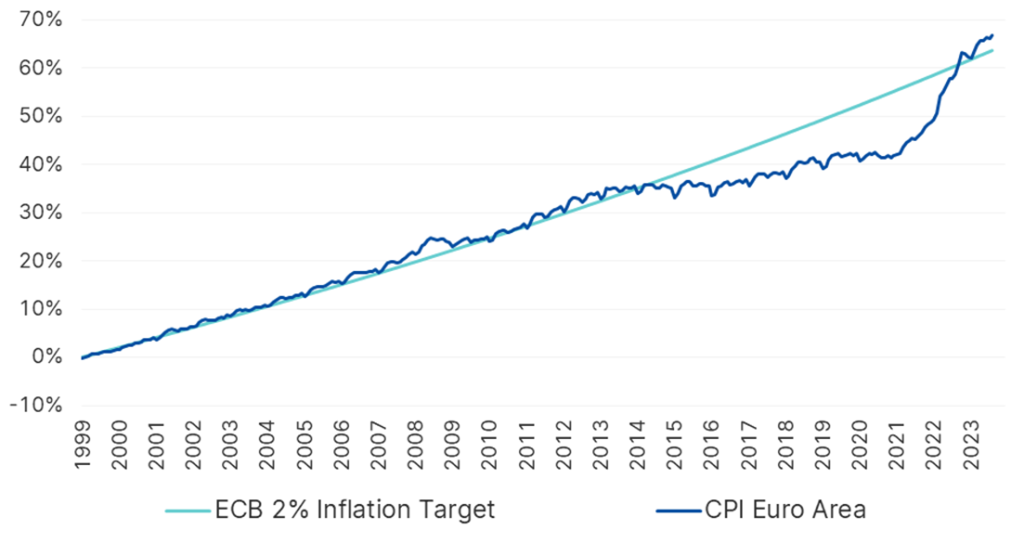

In Europe, we have experienced the inflation of recent years as massive, and voices are being raised suggesting that the ECB has not acted successfully. Interestingly, however, the current inflation was preceded by about eight years of inflation below the ECB inflation target of 2%, as the chart shows:

Inflation Europe vs. ECB inflation target

Note: Past performance is no reliable indicator for future value developments. Data as of 27 September 2023

Astoundingly, if you compare actual inflation with the inflation target of 2% since the introduction of the euro, inflation has only exceeded that target from around the beginning of 2023.

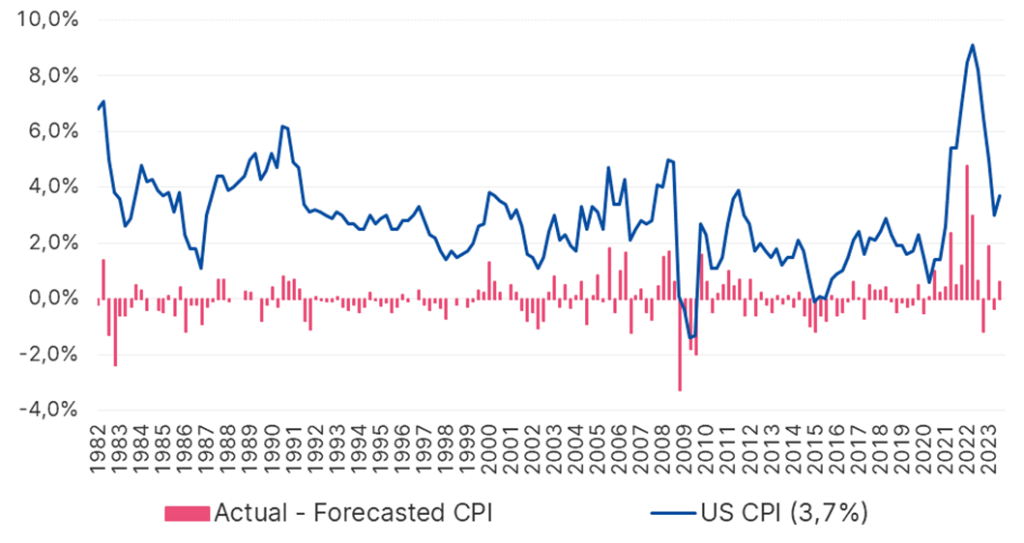

Either way, forecasting inflation is notoriously difficult. The following chart illustrates this: the blue line is actual inflation, while the red bars depict the values by which professional forecasters have been wrong. In 2022, actual inflation exceeded expected inflation by almost 5%, causing severe turbulence in the financial markets.

Actual inflation USA vs. forecast

Note: Past performance is no reliable indicator for future value developments. Data as of 27 September 2023

Speaking of surprises – recessions, i.e. slumps in economic growth, are always unwelcome surprises. Fortunately, their occurrence has decreased over the decades, as this chart shows using the US as an example. The periods shown in light grey each mark a recession in the USA:

Occurrence of recessions in the USA

Note: Past performance is no reliable indicator for future value developments. Data as of 27 September 2023

This means that the work of central banks has not been in vain, as economic stability is important – regardless of the specific design of the central banks’ objectives.

Conclusion

Inflation has been on the decline for about a year but has not yet reached the target value (in most cases 2%) again. It is therefore uncertain when the central banks will again be able cut rates and thus cause relief for the economy.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.