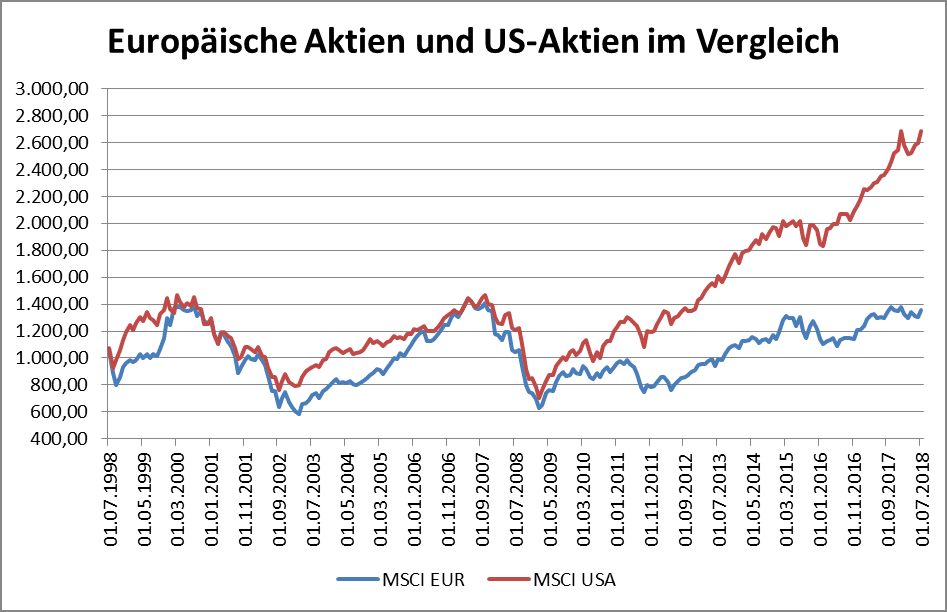

The performance of European equities in the year to date has been disappointing. While in the USA stock exchanges are going from strength to strength, European share prices have been stagnating. In fact, a long-term analysis even shows that an European equity index has not posted any significant gains in the past 20 years, net of dividends. US equity investors, on the other hand, have earned more than 160 percent over the same period, or 5 percent per year, again net of dividend returns.

In the following, we take an in-depth look at the development. The euro equity index has remained within a bandwidth of 600 and 1,400 for almost 20 years. At the moment, we are close to the upper limit (see fig. 1).

Fig. 1, Source: Thomson Reuters Datastream

Note: Past performance is not indicative of future development.

This prompts two crucial questions:

- Was that it, and will we therefore be going through a setback in the coming weeks? Or will we see a breakout from this range?

- Why was that possible in the USA as early as in 2012, but we still have not seen it in Europe?

The first (two-pronged) question is difficult to answer. However, we can respond to the second one on the basis of company earnings, profitability, and the composition of the index.

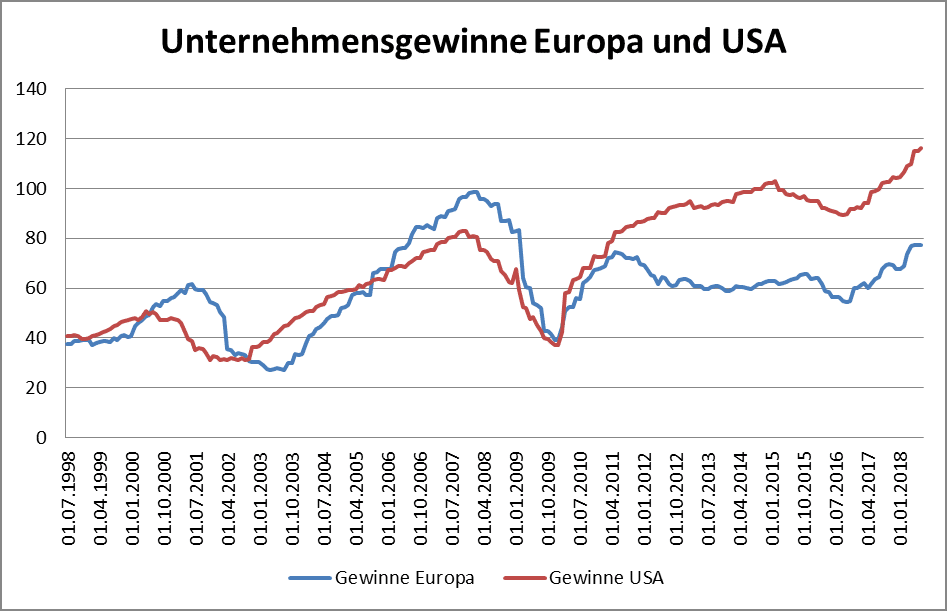

Earnings development in the USA and Europe (euro region):

A long-term analysis of earnings and valuations in the USA and Europe teases out interesting insights as to why US equities have outperformed their European peers in recent years.

Fig. 2, Source: Thomson Reuters Datastream

Note: Past performance is not indicative of future development.

Greece and the euro crisis were dampening the European stock exchanges

Up until the financial crisis in 2009, earnings were going more or less in sync in the USA and the Eurozone (slightly more cyclically in Europe, but still in line with the trend). While the first recovery from 2009 in the wake of the financial crisis was unfolding in synchronicity between the USA and the Eurozone, Europe had to face another crisis in 2011 – the euro crisis featuring Greece. It left clear marks on the earnings scenarios of European companies (especially among banks). The discrepancy in the earnings development in the USA and the euro region is reflected in fig. 2. Whereas US earnings increased clearly from 2011 to 2015, company earnings declined in Europe. Only from 2016 onwards did the two curves re-join a parallel pattern. On aggregate, US company earnings have almost tripled within the past 20 years (i.e. +5.4 percent p.a.), while in Europe the increase was (only) and average +3.6 percent per year. The share price increases in the USA have largely been driven by earnings. While earnings in Europe have picked up as well, valuations have decreased significantly, which has caused share prices to stagnate.

Europe currently commands fair valuations, while US valuations are above average

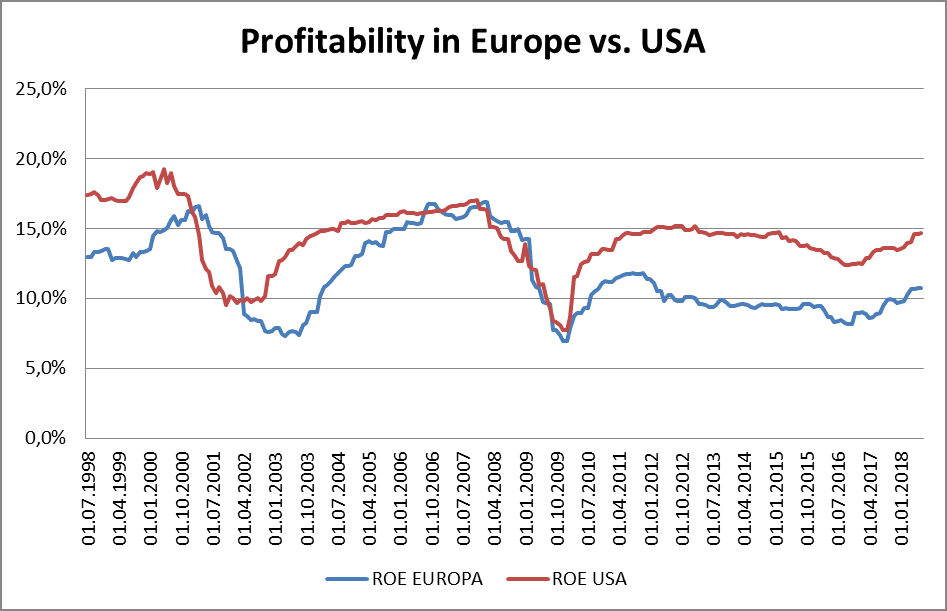

20 years ago, the current PE ratio amounted to 22.7x in the USA. In Europe, it was even slightly higher than that at 23.6x. Now, US valuations are at 1998 levels. In Europe, they have fallen to 17.5x. This is not the least due to the banking sector, which was traded at a PE of about 18x 20 years ago and which is at 12x today. Another example is the automotive sector, which todays is traded at 7.5x as compared to 18x in 1998. Another erstwhile heavyweight, the telecoms sector was traded at a PE of 32x back then; at 16x, it is currently at half that level. Overall, this new valuation level means that Europe is now on par with the average value of the past 40 years, whereas the USA is 20 percent above the long-term average. Profitability is the reason why we have seen a revaluation in Europe but not in the USA.

Europe with relative upside potential

“Europe is cheaper than the USA, which means that European shares hold relative upside potential and should be catching up.” We hear this statement frequently, but it is completely wrong! Do not get fooled by such misjudgements. US shares are expensive because their quality in terms of profitability is higher. Higher profitability justifies high valuations. As fig. 3 illustrates, US companies are as profitable again as they were prior to the financial crisis in 2008/09. European companies, on the other hand, have failed to recover by the same degree.

Whoever claims that European shares are holding upward potential relative to the USA really means that Europe’s profitability is adjusting to that seen in the USA. This is not unlikely as the period of 2003 to 2007 shows, but we cannot see such development at the moment.

Fig. 3, Source: Thomson Reuters Datastream

Note: Past performance is not indicative of future development.

Europe has more cyclicals, the USA more technology

Another difference between the USA and Europe is the composition: Europe is clearly higher weighted in value shares than the USA. There are more cyclical companies in the index than in the USA. This would actually be advantageous in a strong economic environment. However, in recent years, many value shares have underperformed the index by a wide margin. Investors have preferred technology shares for a while now, i.e. the so-called FANG shares (named after facebook, Amazon, Netflix, and Google). These companies are underrepresented in Europe. As long as investors focus on technology, the European market will find it hard to outperform its US peer.

“Shall I (still) buy European shares?”

Generally speaking, it is difficult to pinpoint the “right” moment to buy and sell on the stock exchange. After six years of bull market, it is legitimate to wonder whether boats have been missed. To paraphrase Warren Buffet, the best time to buy shares is when one has money to invest, ideally in regular intervals like on the basis of a fund savings plan.

But there are parameters that can be used for decision-making and that do suggest buying:

- European equities are fairly valued

- Earnings are on the rise

As long as earnings are rising, further share prices increases are very likely given that European equities are fairly valued. Why, then, have share prices not increased in 2018 if earnings are up? That is a justified question that is not easy to answer. Investors are currently avoiding cyclical equities – that is a fact. This means that a majority of investors expect a significantly weaker economy and thus falling earnings. This may be the case, but not necessarily! An alternative explanation for the weakness of value shares is that in times of strongly disruptive changes many companies are being shunned (Tesla vs. traditional automotive sector, Amazon vs. traditional retailers, Netflix vs. network operators etc.).

Whether it pays off to invest in European equities instead of their US counterparts depends on whether technology shares remain among investors’ favourites; and on whether the economy will be experiencing a noticeable downturn in the coming months or whether it will pick up particularly in Europe. As pointed out earlier, Europe is value-heavy and thus more sensitive to the economic cycle.

Investors keeping or opening positions in European equities operate on the following premises:

- There is a rotation from technology shares to cyclicals

- The economy is about to pick up in the coming months

- There will be no euro crisis (specifically, a crisis in Italy will be averted)

- The profitability gap to the USA can be reduced

If you cannot get on board with these premises, you are better off betting on a broadly diversified portfolio. If at least two of the aforementioned premises were to materialise, European equities could be outperforming their US peers.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.