The corona pandemic has plunged the world into an economic crisis. Erste AM chief economist Gerhard Winzer analyzes the 10 most important points about recovery, economic policy, inflation and the duration of the slump.

The corona pandemic has plunged the world into an economic crisis. Erste AM chief economist Gerhard Winzer analyzes the 10 most important points about recovery, economic policy, inflation and the duration of the slump.

The world is in a state of emergency, with the corona pandemic constituting a global health, economic, and financial crisis. The term “Coronacession” has been created as a chimaera of corona and recession. The central question is how deep the emergency runs and how long it will last. The speed of the development is breath-taking. […]

The distortions on the financial market continue, and the prices of risky asset classes such as equities and corporate bonds with low credit quality are falling. Market prices have increasingly come to reflect a global recession.

Coronavirus: The economy is increasingly affected by the virus crisis. Will China’s economy be able to withstand the pressure despite resistance? Analysis by Erste AM chief economist Gerhard Winzer.

The recovery of the world economy has become more likely: First AM chief economist Gerhard Winzer gives an outlook on whether the trend reversal is done.

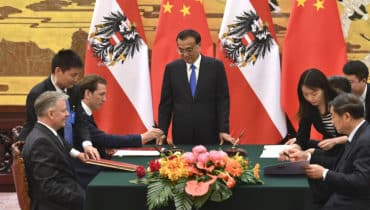

The recent confrontation between the USA and China in the areas of trade and currency management triggered temporary losses for risky asset classes such as equities. Are the negative implications of an ongoing USA-China conflict strong enough to set off a decline or even a recession?

Many asset classes recorded significant gains. At the same time, the falling tendency of numerous economic indicators has suggested a slowdown in GDP growth. How do these two go together?

China accounts for just under 16% of world gross domestic product, making it the second largest economy in the world. Can this success story be continued – what speaks for and what against it?

The trade war between China and the USA reaches a new stage. With the announcement by US President Trump threatening to raise the penalty for Chinese imports to 25 percent, the fronts seem hardened. Will there be an early resolution of the trade dispute and what does a further escalation mean for the global economy?

The majority of economic indicators point to a slowdown in global real economic growth.

How will this dichotomy between the market and the economic environment be resolved and will there be a stabilization?