The most important central bank of the world, the US Fed, increased the Fed funds rate on 21 March and also published projections for economic key indicators. Even though this does not sound like much, the implications for the markets are significant.

Cycle of rate hikes

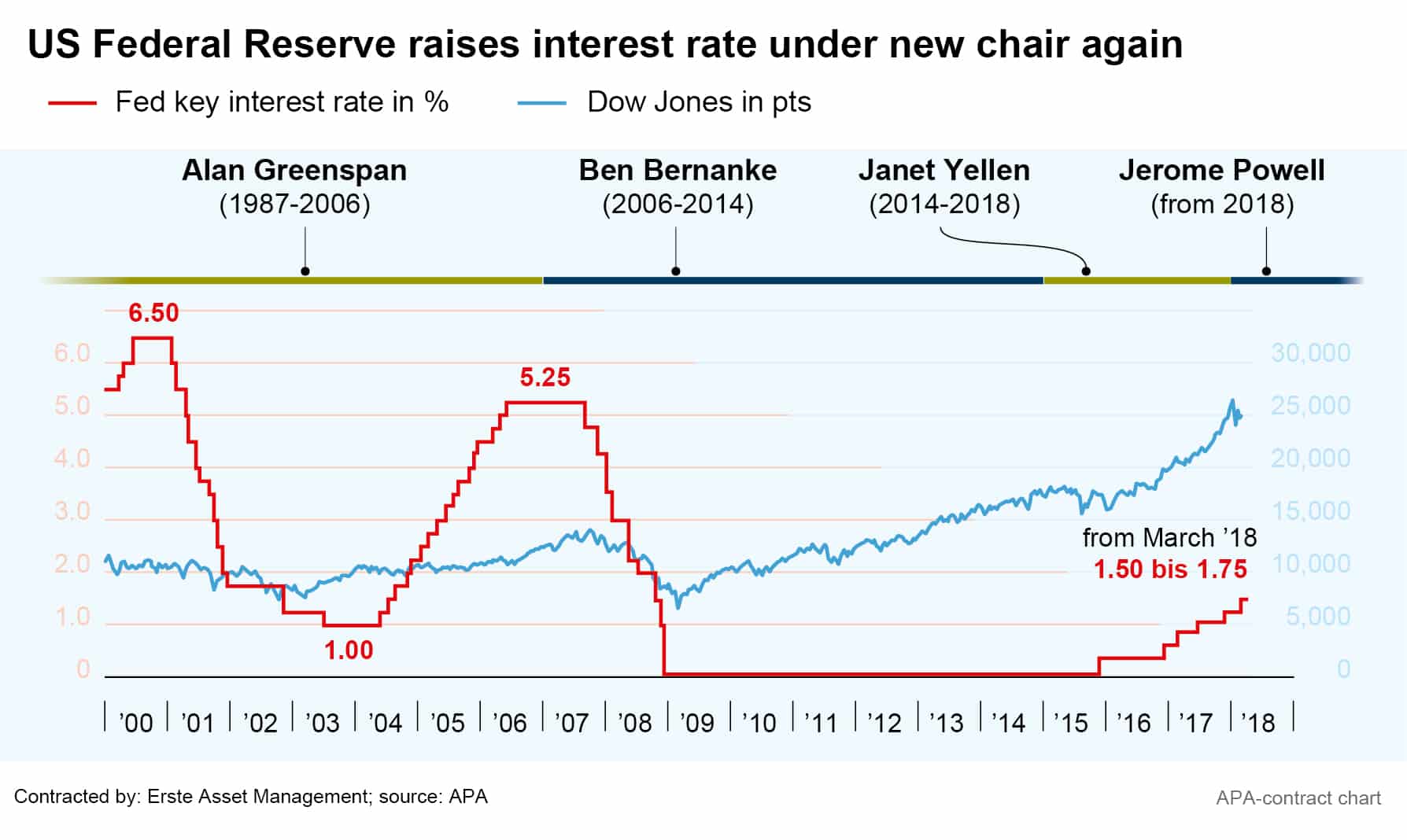

The target band of the Fed funds rate was increased by 0.25 percentage points to a range of 1.50 – 1.75%. This is the sixth increase of this cycle, which was started at the end of 2015. Economic growth is becoming gradually more self-supporting, i.e. it requires less support from the monetary policy.

Restrictive interest rate level

The natural key-lending rate is an important concept for the monetary policy. That is the level that is neither supportive nor dampening for economic growth and inflation. The central bank estimates this interest rate at 2.9%. Remarkably, the forecast for the end of 2018, 2019, and 2020 is 2.1%, 2.9%, and 3.4%, respectively. This implies a moderately restrictive Fed funds rate in about two years.

Boom phase

The projections of economic growth and unemployment rate suggest the continuation of the economic boom. In the foreseeable future, i.e. until 2020, economic growth is expected to exceed potential growth (i.e. the growth rate expected for the long term). As a result, the capacity utilisation of resources in the economy will continue to increase and exceed the long-term optimum level. In other words: while the actual unemployment rate at the end of 2020 is expected at only 3.6% (currently 4.1%), the structural unemployment rate (i.e. the non-accelerating inflation rate of unemployment) is envisaged at a higher level (i.e. 4.5%).

Weakening growth

However, there are two flies in the ointment of this favourable environment:

- Potential growth is still seen at low levels (1.8%), i.e. productivity growth remains low. The currently strong economic growth is of a cyclical nature.

- Both the Fed funds rate and economic growth are subject to normalisation. We are currently at the peak of the economic cycle, i.e. the acceleration phase of economic growth is over, and the growth rate is expected to gradually decline in the coming years (GDP growth 2018: 2.7%; 2019: 2.4%: 2020: 2.0%; long-term: 1.8%).

Low inflation

Despite the persistent boom phase, inflation remains low. Core inflation is expected to rise from the current, low level of 1.5% p.a. to 1.9% (end of 2018) and 2.0% (end of 2019), respectively. Technically speaking, the Phillips curve, which describes the relationship of unemployment rate and inflation, is very flat, but not horizontal.

Conclusion

- The currently booming economic environment increases the optimism of the central bankers. The forecasts for economic growth, the Fed funds rate, and (minimally) the inflation rate have been revised downwards slightly relative to December 2017.

- The level of the Fed funds rate will remain supportive for the risky asset classes for a while.

- The uncertainty with respect to the estimates of the neutral interest rate, the structural unemployment rate, and the relationship of unemployment and inflation (Phillips curve) is a substantial one. The low inflation pressure in particular allows the central bank to proceed cautiously in this context. Some market participants had expected to see a revision from three to four rate hikes this year. This has not happened (yet).

- The combination of rate increases and an expansive fiscal policy (expansion of the budget deficits) often suggests an appreciating currency. At the very least, the US dollar abandoned its downward trend at the beginning of the year.

- One of the most important economic indicators is the difference between long and short-term government bond yields. A big difference implies an economic upswing. A negative difference is called an inverse yield curve, which often indicates a recession. The difference is still positive at the moment. However, the projections for the Fed funds rate (3.4% at the end of 2020) and the neutral interest rate (2.8%) suggest a further closing-in on the zero line.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.