The US Federal Reserve is expected to start a rate-cutting cycle on Wednesday. At least, this is indicated by the numerous statements made by Fed members. However, this cycle has already seen the start of rate cuts being priced in several times, only to be followed by a disappointing inflation surprise shortly thereafter. This time, too, core inflation (the total consumer price index excluding food and energy for the month of August) rose by 0.3% month-on-month. The estimate was 0.2%. However, the trend of the numerous indicators for underlying inflation is clearly pointing downwards. On an annualized basis, core inflation rose by only 2.5% year-on-year. Excluding the estimated component “owner’s equivalent rent”, inflation would be significantly lower. In July, the European Central Bank’s consumer price inflation (HICP) for the US was only 1.7%.

Why key interest rates are falling now

The key points of the upcoming interest rate cuts have already been outlined by some Fed members:

- The risks have shifted away from inflation and towards employment. Therefore, monetary policy must be adjusted accordingly

- It is time to lower the target range for the federal funds rate at the next meeting.

- It is likely that a series of cuts will be appropriate.

- A further weakening of the labor market is not desirable.

- Determining the pace of interest rate cuts and ultimately the overall reduction in the key interest rate are decisions that lie in the future.

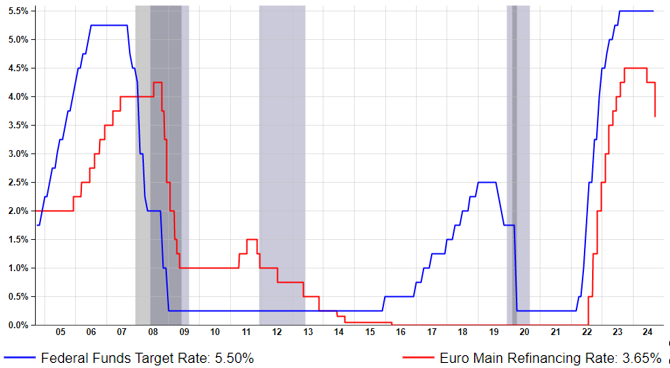

Key Interest Rates Developed Markets

By the end of 2025, US key interest rates could fall to 3%

In April, market prices still only reflected a moderate downward adjustment of the key interest rate (minus 1 percentage point to 4.5% by the end of 2025). In the meantime, however, we can speak of an interest rate cut cycle. It is not clear whether the key interest rate will be cut by 0.25 or 0.5 percentage points next Wednesday. In any case, the market prices indicate an equal probability for both events. One argument in favor of a 0.5 percentage point cut is that the central bank no longer wants to appear restrictive. This means a rapid reduction to a neutral level. At the end of 2025, the key interest rate could be 3% (one percent real neutral interest rate plus two percent inflation).

ECB delivers “hawkish” interest rate cut

Last Thursday, the European Central Bank (ECB) cut its key interest rate for the second time this year. The key interest rate (deposit facility) was cut from 3.75% to 3.5%. A clear difference to the US Federal Reserve (Fed) is noticeable in the guidance of market expectations (forward guidance). In order for inflation to return to the medium-term inflation target of 2 percent in the near term, sufficiently restrictive key interest rates are necessary. By contrast, the Fed’s signals imply a reduction to a neutral level. In doing so, it will continue to pursue a data-dependent approach. The ECB thus continues to have little confidence in its forecasts. By contrast, the Fed’s signals point to a series of cuts.

ECB forecasts with weaknesses

In any case, the projections for inflation assume a decline in core inflation (total number excluding food and energy) from 2.9% this year to 2.3% in 2025 and 2.0% in 2026. The weakness of this expectation is the persistently high inflation in the service sector (August: 4.2% year-on-year). Economic growth is expected to increase from 0.8% in 2024 to 1.3% in 2025 and 1.5% in 2026. The driving factor behind this should be the rising real incomes of households, which should lead to higher private consumption. This expectation has already been in place for this year, but it has been disappointed.

Slow ECB rate cuts to 2% in 2025

As long as the eurozone continues to show slight growth, the ECB is likely to lower key interest rates only slowly. This means a further interest rate cut in December this year. A key interest rate of 2% could be reached by the end of 2025. This value corresponds to a rough estimate for a neutral level (zero percent real neutral interest rate plus two percent inflation).

Loss of competitiveness in the EU

However, cuts in the key interest rate can only help to a limited extent. One important structural deficit in the European Union is stagnating productivity. Mario Draghi’s report on the competitiveness of Europe (“The future of European Competitiveness”), published by the European Commission on September 9, can be interpreted as a wake-up call. “The EU has reached a point where, without action, it will endanger either its prosperity, the environment or its freedom.” Among other things, Mario Draghi proposes massive investments in innovation as well as the expansion and further integration of the European capital market. As long as the measures are not implemented, growth figures for the gross domestic product of less than one percent will no longer be an exception.

Structural problems in China

China is facing several problems: weak domestic demand, the downward adjustment in the real estate sector and overcapacity. The recently published economic data for August point to continued low growth in the third quarter and persistently negative inflation. Total credit growth continued to fall (total social financing in August: 8.1% year-on-year, down from 8.2% in July). The increase in the net issuance volume of government bonds made a significant contribution to this. The growth of bank loans weakened further from 8.7% year-on-year to 8.5%. The credit impulse (change in loan growth relative to nominal economic growth) has now been negative since February. Industrial production also weakened further (August: 4.5% after 5.1%).

Among the various sub-categories, export-oriented and high-tech companies posted strong growth. Retail sales growth remained below industrial production growth at 2.1% year-on-year (July: 2.7%). This continues to keep prices under pressure. Investment activity weakened further (January through August: 3.4% year-on-year). Real estate investment continued to contract sharply (10.2%). The estimate for real GDP growth this year is 4.6%. The risks are to the downside. China is no longer the global growth engine.

The structural problems in China and the European Union are increasing the importance of the US for the financial markets. Economic growth of 2.5% is expected in the US this year, which in the baseline scenario weakens to 1.7% next year. At the same time, inflation is falling towards the central bank target, causing the Fed to rapidly lower the key rates to a neutral level.

Conclusion

This environment is generally favorable for risky asset classes such as equities. However, downside risks (recession risks) have increased in the US in recent months due to the weakening labor market. For this reason, we have underweighted equities and overweighted bonds.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.