The interest rates seem to have been going one way for years – down. With the exception of a few corrections, the taboo has been broken for many years that bond yields should have to be positive all the time. The 10Y yield of German government bonds was negative for the first time in 2016.

This previously unthinkable situation seems to have become the new normal: the majority of government bonds in Europe and Japan are paying negative yields. The discussion of whether instruments such as savings books could bear negative interest has also entered the money market. What has led to this situation?

Receding rates of inflation

This phenomenon is well-known from the bursting of the speculative real estate bubble in Japan at the end of the 1980s. Weak consumer demand, not the least as a result of the ageing population, meets an ever more efficiently working production side. Globalisation has reinforced this effect around the world.

Due to the concentration of the production in regions and countries that have the best conditions for it a hitherto unseen volume of products was being produced at extremely low prices. This is one of the reasons why inflation – which has a significant influence on the level of interest rates – has been falling continuously in recent decades.

Past performance is not a reliable indicator of the future performance.

Expansive monetary policy of central banks

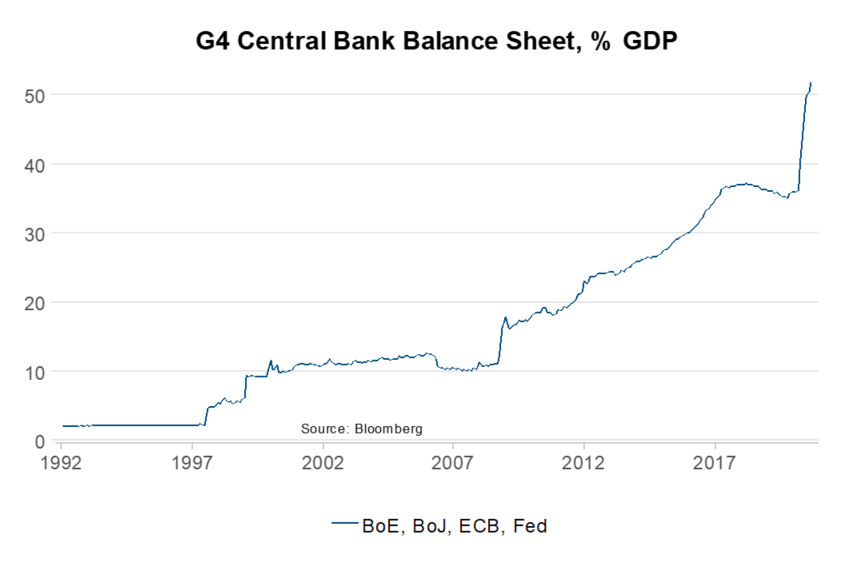

A further important factor was the necessary expansive policy of the central banks – especially the ECB – after the recent big financial crisis in 2008. In order to safeguard the Eurozone and the euro, government bonds from all euro countries, but especially from the periphery were being bought. Deflation was the big worry then, whose solidification would have set off a downward spiral of the economy.

Thus, the intention was to attain the inflation target via the various purchase programmes while at the same time keeping interest rates low for states. It was important to gain time for necessary structural reforms without having to pay excessive interest on the already relative high government debt.

Effects on the demand side unclear

On the demand side, the jury is still out on the effectiveness of the low-interest-rate policy. Some observers claim that the savings ratio among consumers, for example for retirement provisions, is still up as no interest is expected on these savings. Higher savings ratios lead to lower consumption. On the other hand, demand for investment or consumer credit has reacted less significantly to lower interest rates than for example leveraged real estate transactions. This also affected prices both in private and commercial real estate.

States benefit from low interest rates

Nowadays, low interest rates seem to be crucial for government debt, especially given the necessary new debt taken out in the wake of corona. The stimulus and support measures have to be financed. Some politicians say that we can afford it, seeing that interest rates are at zero. While this is true, it should not constitute an incentive to deviate from the goal of a balanced budget after the crisis.

Past performance is not a reliable indicator of the future performance.

Low interest rates will be with us for longer

How long will interest rates remain low? For still a while, as it seems. The effects of the demographic development, the support by the central banks, and the weak consumer demand will probably last for longer. There are first signs of a stagnating trend in globalisation, and we have seen the re-emergence of regionalisation in recent months. This notwithstanding, it will probably take a few years until traditional savings books work for building capital again. Instead, we see more and more investment vehicles like equities, corporate bonds or such assets that promise a real gain in wealth.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.