The stock exchanges have been moving sideways and down for weeks. There are of course enough uncertainty factors such as the Greek crisis, the correction on the Chinese stock exchange, and the expected interest rate increase in the USA that can serve as explanation. However, one factor that has (so far) been left out of the equation is the fact that company earnings are hardly growing. The increase on stock exchanges is fundamentally justified if the valuation levels are rising across the board without earnings growth (e.g. price rises due to the low interest rates) or if company earnings themselves are rising (thus justifying the valuations). The interest rates can actually not fall any further, which means that the stock exchanges cannot get any impulse from that end.

How does the other factor, earnings growth, look? There is no clear answer to that question. Some market participants are rather sceptical. In the following I will try to shed some light on these factors, company earnings and earnings momentum.

Worldwide quick recovery of company earnings after the financial crisis

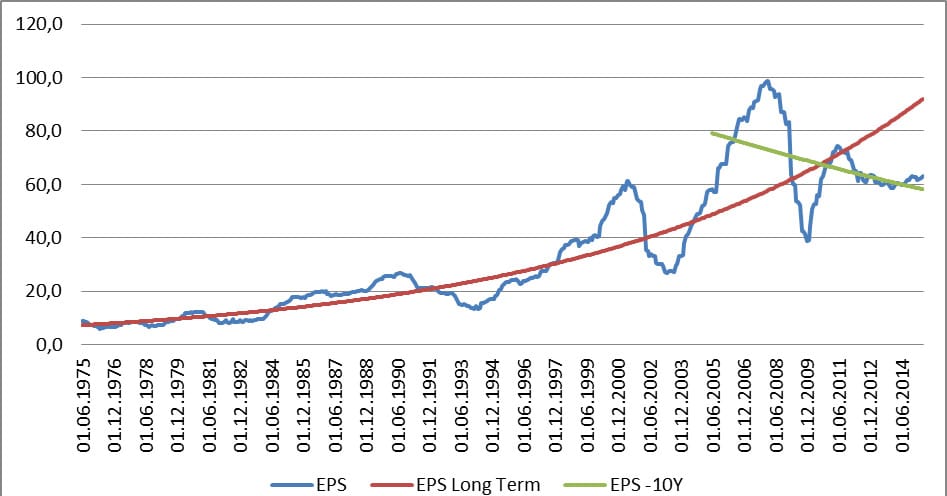

Published earnings (EPS), long-term earnings trend (EPS long term), and company earnings generated on average over the past 10 years (Shiller method) 1975 – 2015

The chart highlights the fact that over the past 40 years (June 1975 – June 2015) company earnings have been rising at a relatively stable rate of 5.3% per year (long-term earnings trend – red line), taking into account cycles. After the financial crisis (2008) company earnings saw a relatively quick recovery, embarking on a trend that has been held for the past three years. However, over the past four months, earnings have been sliding slightly but steadily. This is a warnings signal that we have to keep an eye on: without earnings growth, no further price increases can be justified, given the current valuation. Only once earnings start rising again can a price increase be fundamentally justified.

Earnings growth only in some sectors

Earnings growth has become a rare commodity in the current environment, but it still exists – albeit only in specific sectors. Among them are the IT sector, the financial industry, and consumer goods. Especially consumer goods have continuously reported falling earnings in the past months, and we may have seen the beginning of a trend reversal. The high-flyer of the past months, i.e. the biotech sector, has recorded earnings growth of 100% in less than three years. But most recently it has recorded falling earnings, joining the traditional pharmaceutical companies. The situation in the energy sector is dramatic, with earnings falling by more than 30% in the past half year. Among the sectors that have incurred falling earnings are the industrial sector, raw materials, and telecoms.

The European earnings lack momentum

Earnings (EPS) generated in Europe (ex UK), long-term earnings trend (EPS long term), and company earnings generated on average over the past 10 years (Shiller method) 1975 – 2015

While Europe has rising earnings to show for in contrast to the global trend, said trend lags expectations. There is currently a significant gap between Europe and the long-term EPS trend (red line). In fact, earnings are back at the level of 2000, i.e. of 15 years ago!

Will earnings boost again?

The expansive monetary policy of the European Central Bank and the recently weak euro should facilitate a significant boost of earnings for companies. However, falling demand from the emerging markets, in particular from China, somewhat contradicts this scenario.

The general question is whether a return to the long-term earnings growth trend will be possible in the short run. The growth sectors of technology and biotech are underrepresented in Europe. In order for earnings to return to their long-term trend growth, they would currently have to rise by 47%. For the time being, this is unlikely to happen.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.