The global economy was confronted with two negative developments within two years: the Covid-19 pandemic and the Ukraine war. Erste Asset Management’s Chief Economist Winzer analyzes the stagflationary state of the economy.

The global economy was confronted with two negative developments within two years: the Covid-19 pandemic and the Ukraine war. Erste Asset Management’s Chief Economist Winzer analyzes the stagflationary state of the economy.

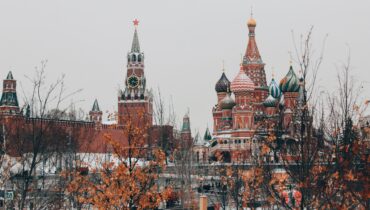

What are the effects of the sanctions imposed on Russia on our funds? Interview with Alexandre Dimitrov, Senior Fund Manager with more than 20 years of experience and special field of expertise: equity markets Russia and CEE.

Stocks posted significant gains on Wednesday after U.S. Federal Reserve Chairman Jerome Powell signaled that the central bank would begin raising interest rates this month. Stock markets interpreted this as a positive signal in the sense that the threat to growth posed by the war in Ukraine did not justify a change of course in monetary policy at the moment.

We want to highlight the possible impact of the war in Ukraine on investment decisions. In short, the conflict reinforces already existing trends. In addition, the global recovery scenario is still holding, but recession risks in Europe have increased.

Last Friday saw the West’s first reaction to the invasion. Both the US, the EU and the UK announced sanctions against Russia. These mainly target Russia’s largest banks, oligarchs and the export of technology goods to Russia.

Russia launched a military invasion of Ukraine on Thursday. The financial markets are reacting with price declines, a rise in the price of crude oil, a fall in the Russian ruble and price rises in credit-sensitive government bonds. We provide an assessment of the current market situation.

The Russia/Ukraine conflict is keeping the markets in suspense. Everything is possible – from continued diplomacy in order to contain the escalation to harder sanctions in case of a more comprehensive invasion. The volatility on the financial markets will remain high.

The risk of an escalation of the geopolitical conflict between Russia, Ukraine and NATO has risen further in recent days.