Articles about “Sustainability”

Erste Group is first financial institution to commit to the European Commission’s Green Consumption Pledge

As the first financial institution in Europe, Erste Group has joined the European Commission’s Green Consumption Pledge initiative to accelerate its contribution to a sustainable economic recovery. The Green Consumption Pledge is the first initiative delivered under the New Consumer Agenda and part of the European Climate Pact.

Focus on ESG risk – the EU approach

From the coldest winter in Beijing’s recorded history to the storm in Texas that surprised the world – extreme weather phenomena remind us again and again of the invasion of climate change into our daily routine. Climate risk can no longer be ignored and has to be taken into account in asset management as well. […]

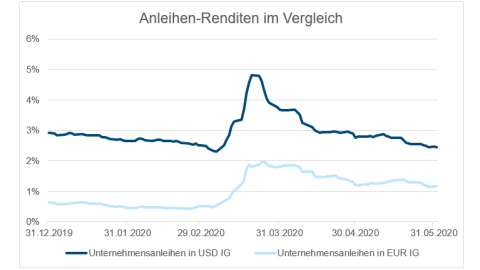

Impact bonds are here to stay

It started with the first climate awareness bonds of the European Investment Bank. Even back then, the issue proceeds were earmarked for explicitly sustainable projects of the supranational bank. In recent years, the volume of such bonds has increased rapidly. The issue volume rose from USD 300bn in 2019 to USD 500bn in 2020. The […]

Emerging Markets corporate bonds: sustainability turns into a factor of success for investments

Corporate bonds from emerging markets: environmental focus and calling out companies on their sustainability efforts are turning into a success factor. Senior professional fund manager Péter Varga explains the latest trends and developments.

What are the characteristics of a good sustainability fund?

The strong market growth in recent years of sustainable investment products has produced a variety of investment strategies that makes it hard to recognise such investments at first glance. Is there any relief in times where every player on the financial market is talking about sustainability? Guest commentary by Roland Kölsch, Qualitätssicherungsgesellschaft Nachhaltiger Geldanlagen.

Sustainability – a critique of a success story

The term “sustainability” can be found in the 2019 annual reports of all 20 ATX companies – and usually more often than terms like “profit” or “efficiency”. What the reference to sustainability means specifically is not always clear.

How do rating agencies assess sustainability?

To many companies, ESG is still a relatively new field, which is why it is important to understand how rating agencies evaluate sustainability and how the approach has changed over the years.

German government approves EUR 130bn stimulus package to “emerge from the crisis with a bang”

Germany’s government wants to cushion the consequences of the Corona crisis with a massive economic stimulus package. This show of strength is intended to revive the economy and consumption of citizens and avert a severe recession.

Erste Asset Management integrates sustainability in funds and on corporate level

Erste Asset Management expands on its pioneering role in the area of ethics and environmental issues. The company is taking the next step by making sustainable criteria an integral part of a large number of its investment decisions.

Mobile hen houses and high-tech: the AUGA Group

High water consumption, pollution of soils and destruction: These are just some of the criticisms of conventional agriculture. The AUGA Group shows that it can be done differently!

Searching for the hair in the (chicken)soup

ESG analysts look beyond traditional key ratios like cash flow and growth rates. They take a closer look and take into account the social and environmental aspects of a company.

The king is dead, long live the king

The king is dead, long live the king. Time for our former Head of SRI Gerold Permoser to draw a summary and write a final ESG review.

Meat consumption and how it is connected to antibiotics in beef (Editorial)

“I just wanted to tell you, your cow Elsa is dead.” An old sketch as an excuse to bring up bad news. What this has to do with meat consumption and antibiotics, you will read in our new post.

Global risks: ghost drivers

An old saying in the industry says: fund management is risk management. The risks that need to be managed have changed noticeably and have become global ecological risks.

Cognitive dissonance in climate policies

If an important actor dissolves his cognitive dissonance by not only repressing the problem, but simply denying it, then this also has global consequences. The most important global decision-makers currently regard ESG (Environmental, Social and Governance) risks, above all environmental risks, as the greatest risks. Read more about cognitive dissonance in our new ESG Letter about Global Risk.

Climate risks: why we are not adjusting fast enough

The consequences of climate change are becoming clearer by the day. 3 of the top 5 risks for the economy are classified as hailing from the climate category.

A very boozy Christmas

Who doesn’t know it – sitting together in a boisterous atmosphere, with a glass of champagne in your hand. Or two. Christmas is the celebration of joy, of Christmas markets, and of excessive alcohol consumption: a good reason for us to dedicate this ESG Letter to the topic of alcohol.

What does climate change have to do with alcohol? – Investment Board

The big chateaux in the Bordeaux region, Hofbräuhauses, and abbey distilleries: alcohol is a distinctive cultural good. It is not by accident that big events are always accompanied – and fuelled – by alcoholic beverages.

How organic is the vineyard?

Everybody is talking about organic wine. Commercials claim it is better for the environment, because the conservation-minded way of handling nature safeguards the habitat of a diverse range of organisms.

“Alcohol addiction is a chronic illness”

An addiction or alcohol dependency is a chronic illness that can manifest itself in numerous layers of problems. Intervention regimes have to take these into account by approaching the situation from a medical, psychological, and social angle. Dialog in Vienna offers such a comprehensive approach. Find out more in this blog post.

Alcohol producers against excessive consumption – Engagement

Alcohol enjoys a special privilege. No other drug is as socially accepted. This also manifests itself in the special status it is invested with by law: while cannabis – a market whose legal side is estimated to grow from USD 9.5bn in 2017 to USD 32bn by 2020 – is legal in only a handful of states, tobacco is subject to ever-more stringent regulations. By comparison, alcohol producers are relatively free to pursue their business.

Everything was better in the past!

The Austrian term “Komasaufen“, which refers to the practice of binge drinking, received the “Doublespeak Award” 2007. The award followed significant media coverage and discussion on the alcoholic excesses that young people were engaging in with extremely sweet alcoholic beverages.

Certified Erste AM Funds

The Erste AM RESPONSIBLE funds are subject to constant scrutiny with regard to their sustainable quality.

The primal fear of “Profiling”

Many people harbour an undefined fear of psychologists. Maybe it is the fear of someone being able to look inside them and know what they are thinking. And, let’s be honest: how many times didn’t you think: “Thank God nobody knows what I am thinking right now”? But that was in the past. Nowadays, Google, Facebook, Amazon et al. know quite well what we are thinking. Apparently even better than we do ourselves or the people close to us.

Big data as a powerful tool – Investment Board

We communicate a great deal on social networks. For example, how nice our breakfast is or even the view from a very tall mountain we just climbed. Unfortunately, social networks operators are much less willing to communicate when it comes to the handling of gained user data.

This is where the term “commitment” comes in – in our new ESG article, we explain what it means.

Contra Big Data – When the algorithm knows too much

“If you have nothing to hide, you have nothing to be afraid of”. What is at the core of this argument? More on our blog.

The Physicists

Big Data contains a lot of good, but also a lot of controvery. Just think of social scoring, for example. Your friends, your media consumption, your daily habits, everything you do is recorded, evaluated, and channelled into a rating.

Certified Erste AM Funds

The Erste AM RESPONSIBLE funds are subject to constant scrutiny with regard to their sustainable quality.

Hey Mrs. Robinson

Editorial: Gerold Permoser, CIO and CSIO of Erste Asset Management, comments on the topic of this issue.

The Life of Plastics – Investment Board

The Erste AM Investment Board gives a form to the responsive dialogue with and among sustainability research agencies.

“Disposable plastic is mostly responsible for plastic waste in the seas”

Interview with Axel Hein, marine expert at WWF Austria.

Company of this edition: Tomra Systems

The Company of the Month is selected due to recent developments and in connection with the topic ”Plastic”.

Plastic planet

79 % of the produced plastic waste are currently spread across the environment or in landfills. More facts about plastic can be found here…

Plastic in our Environment

The world consumes resources more quickly and at larger quantities than our population is growing.

A Brief History of Rubber

Lasting Words: “Everything used to be better. What is plastic today was natural rubber back then,” says Gerold Permoser, CIO and CSIO of Erste AM.

Responsible investment universe

The definition of the investment universe is the most important step in the construction of a fund

Certified Erste AM Funds

The Erste AM RESPONSIBLE funds are subject to constant scrutiny with regard to their sustainable quality.

World Water Day 2018: Smoke on the water – the water footprint of sustainable investments

The World Water Day was first introduced on 22 March 1993. The goal was to anchor the meaning of water and thus the efficient use of this critical resource in the collective consciousness. Despite the long history, the importance of water from the point of view of risk has only recently gained in relevance.

Market and fundamentals

Weak growth Real global economic growth was surprisingly weak in Q1. The preliminary estimate for the annualised growth rate of Q4 2014 to Q1 2015 is only 1.5%. This is mainly due to disappointingly weak growth of the GDP in the USA (+0.2%), in China (+5.3%), in the UK (+1.2%), and in Japan (+1.5%; estimate). […]

What has become of the “oil x 20” rule?

The oil and gas sector is the backbone of the Russian economy. It contributes roughly a quarter to the Russian GDP, and it accounts for almost two thirds of exports. Oil and gas companies represent almost 60% of the market capitalisation of the Moscow stock exchange. It therefore makes sense to analyse the performance of […]