Last Friday saw the West’s first reaction to the invasion. Both the US, the EU and the UK announced sanctions against Russia. These mainly target Russia’s largest banks, oligarchs and the export of technology goods to Russia.

Last Friday saw the West’s first reaction to the invasion. Both the US, the EU and the UK announced sanctions against Russia. These mainly target Russia’s largest banks, oligarchs and the export of technology goods to Russia.

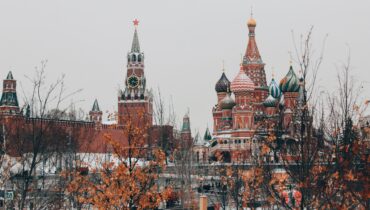

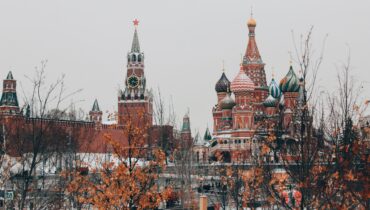

Russia launched a military invasion of Ukraine on Thursday. The financial markets are reacting with price declines, a rise in the price of crude oil, a fall in the Russian ruble and price rises in credit-sensitive government bonds. We provide an assessment of the current market situation.

The risk of an escalation of the geopolitical conflict between Russia, Ukraine and NATO has risen further in recent days.

Erste Asset Management was yet again ranked first among the Austrian investment companies last year. Assets under management in Austria had increased by 16.6% y/y to EUR 47.7bn as of 31 December 2021.

Inflation has risen sharply and the first interest rate hikes are expected from the Federal Reserve in the USA. What impact could this have on stocks?

We have seen some extraordinary years speaking about equity and multi asset performance. Interest rates were low, volatility – representing the average daily price changes – was comparably low. What is the situation today?

Waves of infections will continue to influence economic activity and the markets. What will happen in China, what are the inflation risks and will it be volatile? Our chief economist Gerhard Winzer has drawn up 10 theses for the year 2022.

We are now into the third year of the pandemic. Since the spring 2020 collapse, economic activity and markets have shown exceptional resilience. This is not to be taken for granted. After all, the list of potential negative influences (“challenges”) is long.

The most common form of supranational financial institutions are development banks, whose shareholders are usually the founding states. Investors’ exposure to bonds issued by development banks allows them to finance local infrastructure or climate projects at lower cost, which ultimately benefits the local population.

Just when it looked like a quiet end to the year on the stock markets, the emergence of Omicron shook investor confidence and led to a sell-off lasting several days. How has market optimism evolved since then? Our stock expert Tamás Menyhárt gives an outlook.