The environment for the financial markets has improved, although some developments continue to give cause for concern. This is mainly for three reasons:

- In the US, the “soft” landing scenario (falling inflation without recession) has become much more likely.

- In China, the overcoming of deflationary pressures has become somewhat more realistic due to the announcement of unexpectedly extensive stimulus measures (at the monetary and fiscal level).

- The dockers’ strike on the US East and Gulf coasts has been temporarily ended. This eliminates or postpones an important stagflationary risk (higher prices, lower growth).

However, any of the three points could be a game-breaker for the Goldilocks party in the markets. Stubborn inflation in the service sector, an escalation in the Middle East, the uncertainty surrounding the outcome of the US elections, a possible EU-China tariff conflict over electric cars or a weak manufacturing sector – there would be plenty of potential risk factors.

Boom phase

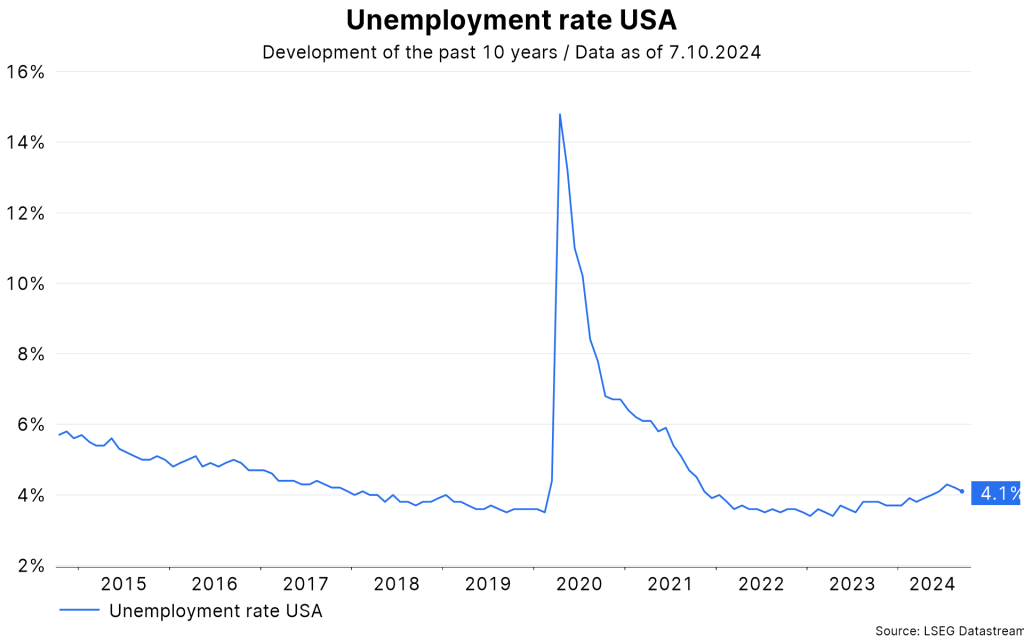

Last week showed one thing: economic growth in the US is above potential. The estimate for the third quarter is an annualized 2.5% (source: Nowcast by the Atlanta Fed). This means that the boom phase has continued into the third quarter. At the same time, labor market indicators have been pointing to a slowdown for months. Because the unemployment rate has the special characteristic of often being followed by a sharp increase after moderate increases, the risks for the economy were on the downside (= recession).

However, last week’s labor market data surprised on the upside with surprisingly strong employment growth and an unexpected decline in the unemployment rate. This has narrowed the gap between strong economic growth and the weakening labor market.

Strong employment growth

In detail: the number of new jobs created in the non-agricultural sector rose by 254,000 in September. This figure is well above expectations of 150,000 and above the figure for the previous month (159,000). The figures for the two previous months were also revised upwards. Before the September report, the three-month average of new jobs created had fallen to just 116,000. With the new September data, this figure has also risen to 186,000.

The unemployment rate thus fell for the second month in September (to 4.1%), after having trended upwards from January 2023 (3.4%) to July 2024 (4.3%).

At the same time, the participation rate remained unchanged at 62.7% over the last three months. Compared to January 2023 (62.4%), it is slightly higher. The reason for the increased unemployment rate is not a reduction in employment.

Rising wage growth

In terms of remuneration, average hourly wages rose by 0.4% month-on-month to 4.0% year-on-year. This is well above the recent July low of 3.6%. The rise in wage growth implies upward risks to the achievement of the inflation target (2%).

High productivity growth

However, the average weekly hours worked fell from 34.3 to 34.2. This means that total hours worked fell by 0.1% month-on-month. With the estimate for real GDP growth coming in at a high 2.5% annualized, the decline in hours worked implies a strong increase in labor productivity: 2.5% economic growth minus 0.8% hours worked (0.2% annualized) yields a gain of 1.7% annualized in the third quarter). Higher productivity eases inflationary pressure on the wage side.

Soft landing

However, some other survey-based labor market indicators continue to point to a slowdown. For example, the purchasing managers’ indices (PMIs) and “jobs plentiful minus jobs hard to get” in consumer sentiment. The divergence between these indicators and the strong increase in employment is difficult to sustain. One of the two sides will correct.

Moreover, too much weight should not be given to a single data point – in this case the September labor market report. All published economic data exhibit random fluctuations and are revised with subsequent more accurate estimates. Nevertheless, the US labor market data makes a “soft” landing scenario appear even more likely. This environment is favorable for risky asset classes such as equities. However, investment-grade government bonds suffer because both the speed and the overall extent of key interest rate cuts are lower.

No landing

However, the soft landing scenario involves not only avoiding a recession, but also sustainably achieving the inflation target. In this context, the publication of consumer price inflation for September will be in the spotlight in the coming days. Estimates point to a decline in the headline figure excluding food and energy (core rate: 0.2% mom, 2.3% yoy).

If the rise in inflation is higher than expected, the scenario of a failure to achieve a soft landing (inflation remains high) could be discussed more. In this scenario, the central bank has little scope to lower key rates. In this case, not only bonds but most asset classes would suffer initially.

Note: Please note that forecasts are not a reliable indicator of future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.