It’s all about interest rates in the financial markets this week.

Last week, the central bank in Poland made a surprisingly large cut in the key interest rate. Not long ago, an unchanged key interest rate was signaled. In contrast, the strategy of many other central banks is far more prudent.

A dove

The central bank in Poland (NBP) surprised the markets last week with a sharp cut in the key interest rate. The interest rate was cut by 0.75 percentage points to 6%. Analysts’ estimates were for either an unchanged rate or a 0.25 percentage point cut. Not long ago, the central bank was signaling that it would not consider cutting rates until consumer price inflation fell into the single digits. Admittedly, in August inflation was “only” 10.1% year-on-year. However, the guidance on market expectations (forward guidance) also included that key interest rates would probably be lowered in small steps. The central bank justified the big step by saying that the first rate cut should have taken place three months ago. The economic argument was that weaker-than-expected demand would also lead to a faster decline in inflation. In fact, GDP contracted by 3.7% quarter-on-quarter and 0.5% year-on-year in Q2. The upcoming parliamentary elections in October may also have entered into the considerations.

Several hawks

In contrast, the central bank in Australia left the key interest rate unchanged at 4.1%, as expected. At the same time, the inflation-hawkish tone was maintained. Key phrase: “Some further tightening of monetary policy may be required.” The Bank of Canada also left the key interest rate unchanged as expected (at 5%). Justification: The best way to address the risks of too much and too little policy rate hikes is to leave the rate unchanged, it said. However, the description of inflation still sounds concerned: “The longer high inflation persists, the greater the risk that high inflation becomes entrenched.”

Stagflation in the Eurozone

The euro zone is in a difficult situation. While inflation is falling only slowly, the economy is stagnating. In August, consumer price inflation excluding food and energy – the traditional core rate – was still 5.3% year-on-year. Gross domestic product grew only very slightly in the second quarter (0.1% quarter-on-quarter and 0.5% year-on-year). Credit volumes have already been stagnating since summer 2022. The important survey-based indicators (European Commission economic confidence, purchasing managers’ indices) have already fallen to such low levels that the model-based estimate for GDP in the third quarter (the nowcast) suggests a contraction.

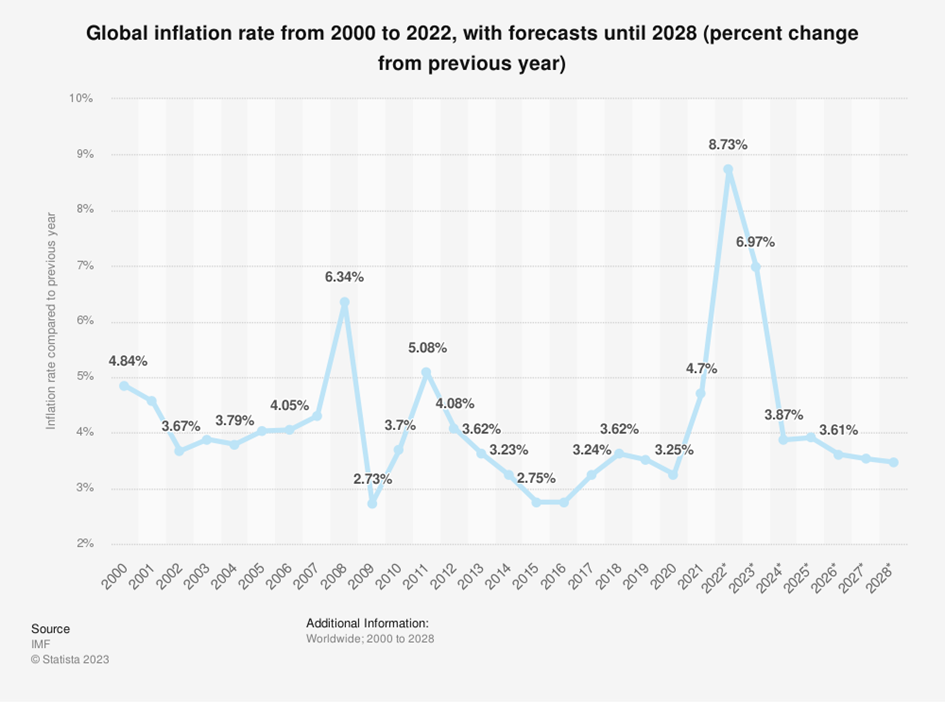

Chart legend: According to a forecast by the International Monetary Fund, global inflation should weaken significantly in the next few years.

Legal note:

Prognoses are no reliable indicator for future performance.

Three criteria for the ECB monetary policy

In the design for monetary policy, the ECB applies three criteria:

– inflation dynamics (disappointingly slow decline),

– inflation forecasts (are above the 2% target)

– impact of monetary policy.

With the latter, the central bank could argue a pause. President Lagarde has underlined that the central bank will proceed in a data-dependent manner (little confidence in forecasts). What is uncertain is how much influence the central bank has had in slowing the economy. That is, there is considerable uncertainty about how restrictive monetary policy actually is.

Weaker demand

In theory, however, weakening demand reduces the risk of a wage-price spiral. The pricing power of firms declines, and a weaker labor market reduces the bargaining power of workers. Separately, more frequent supply-side shocks caused by deteriorations on the geopolitical front could keep inflation at too high a level, as President Lagarde opined in a recent speech.

No interest rate hike

For the meeting of the European Central Bank next Thursday, the average of analysts does not expect any change in interest rates (deposit facility: 3.75%, main refinancing rate: 4.25%). Market prices also reflect an unchanged interest rate. The numerous speeches by Council members in recent weeks have been mixed. A key rate hike in a stagnant economic environment would certainly be an opportunity to underline the commitment to achieving the inflation target.

However, amid the tension between deflationary pressures in China (producer prices in August: minus 3.0% year-on-year), recession risks in the euro zone and strong growth in the USA (Atlanta Fed nowcast: annualized 5.6% in the third quarter), the European Central Bank is likely to adopt a wait-and-see approach and not raise key interest rates.

The lagged effect of monetary tightening on economic growth and inflation is variable in terms of both duration and magnitude (long and variable lags). Put more simply, forecasts do not work satisfactorily, which is why the central bank looks to published economic data. Now growth has weakened. Although the effect on inflation is uncertain, there is scope for a wait-and-see stance with a hawkish tone on inflation.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.