High inflation

The global economy is facing the effects of the pandemic and the war in Ukraine. The most obvious development is high inflation (OECD area: 9.6% y/y in May), triggered by imbalances between supply and demand. Last week, consumer price inflation in the U.S. rose to 1.3% month-on-month in June. Year-on-year inflation was 9.1%.

Low unemployment rates

In part, economic growth (demand) has recovered faster than expected, boosted by very expansionary fiscal and monetary policies. This can be seen, among other things, in the low unemployment rate in the OECD area (5% in May). But the supply side itself has also deteriorated. Supply chains remain impaired and energy and food prices have risen significantly.

Key interest rate hikes

Central banks try to prevent an inflationary spiral by raising key interest rates. The aim of higher interest rates is to weaken demand to such an extent that inflationary pressure falls. The goal of central banks is to achieve a soft landing. In the past, however, key rate hikes have often triggered a recession.

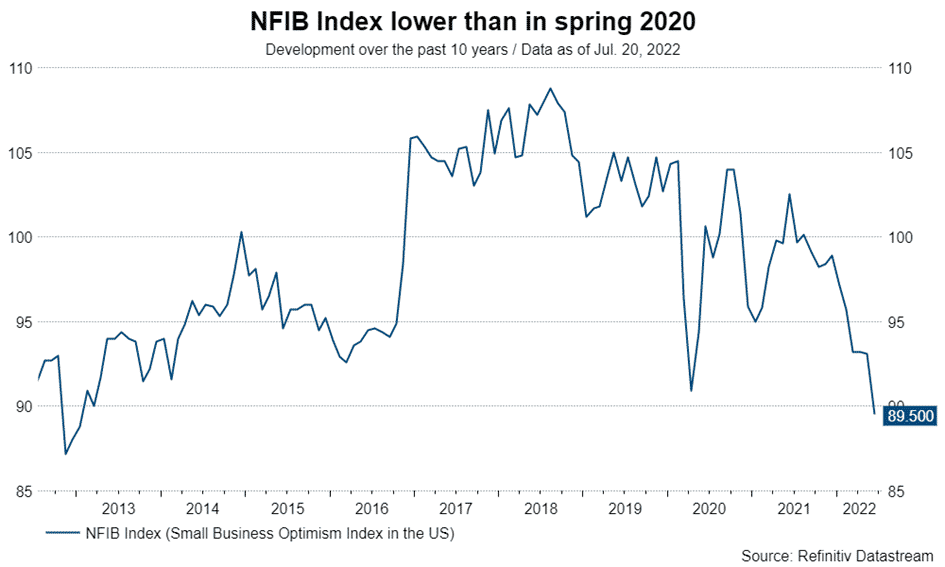

Falling sentiment

Meanwhile, the effects of high inflation are visible. The loss of purchasing power is reducing consumer and business sentiment. Last week, the mood of small and medium-sized businesses in the USA (NFIB index) fell below the level of spring 2020. The same applies to expectations for the German economy (ZEW index).

Increased probability of recession

In addition, two important US-based indicators provide evidence of an increase in the probability of a recession. First, the benchmark 10-year Treasury bond yield has already been below the two-year yield for two weeks (most recently by 0.2 percentage point). Second, initial claims for unemployment insurance show a slight upward trend after reaching a very low level in March. This week, the preliminary purchasing managers’ indices for July in particular will provide an important update on the economic situation.

Strong US dollar

In general, the US dollar is strong against many currencies, not just the euro. Against a basket of currencies adjusted for inflation differentials, the US dollar has reached its highest value since the fall of 1985. This value is referred to as the real effective US dollar. In September 1985, the G5 countries even agreed to devalue the dollar in the Plaza Accord. Even without taking inflation differentials into account, the US dollar is strong. Currently, the nominally effective dollar has reached its highest value since spring 2003. However, the dollar is still far from its 1985 level.

When a country A (USA) becomes more attractive than country B (eurozone), capital flows into country A (USA). The result is a strengthening of the currency of country A (USA) compared with country B (euro zone). It is important to distinguish whether this is a cyclical movement or whether it is a long-term, or structural, shift in fair value.

There are several reasons for the shift in attractiveness toward the US dollar. First, the USD has the characteristics of a countercyclical currency. When global economic indicators fall, the USD has historically exhibited a strengthening tendency.

Second, interest rate parity provides a simple but not always accurate explanation. When interest rates rise more in country A (the US) than in country B (the eurozone), the currency of country A (the USD) strengthens. However, because the long-term “fair” value of the exchange rate does not change (the purchasing power parity), an exchange rate level is eventually reached (a strong USD), above which the higher interest rates of country A (USA), just offset the expected weakening of the currency of country A (USA).

Mega interest rate hikes

The reality, however, is more nuanced. More and more central banks are accelerating their exit from ultra-expansionary monetary policy stances. The Federal Reserve has already raised its key interest rate (upper band) from 0.25% in early March to 1.75%, while for the European Central Bank the first moderate rate hike is not expected until next Thursday (discount rate by +0.25 percentage points to -0.25%). In addition, last week the strong increase in the US consumer price index reinforced expectations for a Fed rate hike of 0.75 percentage points on July 27. In June, the key interest rate was also raised by 0.75 percentage points. Last week, Canada’s central bank raised its key interest rate from 1.5% to 2.5%. Speculation for a “mega” rate move in the US as well, however, was dampened by the decline in long-term inflation expectations in the University of Michigan’s consumer sentiment report (from 3.1% in June to 2.8% in July).

Interest rate differentials between the US and the eurozone show a widening only for this year. The market-priced three-month interest rate differential for December 2022 widened from 1.36 percentage points in early January to 2.62 percentage points most recently. The priced interest rate differential for December 2023 is only 1.56 percentage points and is even slightly below the level at the beginning of January. At 1.74 percentage points, the yield spread between government bonds with a ten-year maturity is also at the same level as at the beginning of January.

Strong currency increases purchasing power

The idea behind this is as follows: Rapid interest rate hikes support the currency. This reduces inflationary pressure because it dampens import prices. This impact channel is particularly relevant at present, because a good part of the high inflation comes from the external side. The firmer the currency, the more inflation is dampened in the medium term, which is why the central bank has to raise the key interest rate to a lower level.

Two structural euro problems

However, the euro faces two other additional problems. First, because there is no common economic and fiscal policy in the euro zone, there is a residual risk of a breakup of the euro zone. The current government crisis in Italy also points to this. The ECB is currently tinkering with an anti-fragmentation instrument. Details are expected next Thursday at the ECB meeting. Second, Europe is dependent on gas supplies from Russia. If gas supplies through Nord Stream 1 do not ramp up this week, the likelihood of a severe recession in Europe increases. But even if gas supplies are ramped up, a permanently higher energy price level looms for Europe. The higher costs mean lower competitiveness. This implies a decline in the long-term fair exchange rate between the US dollar and the euro.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.