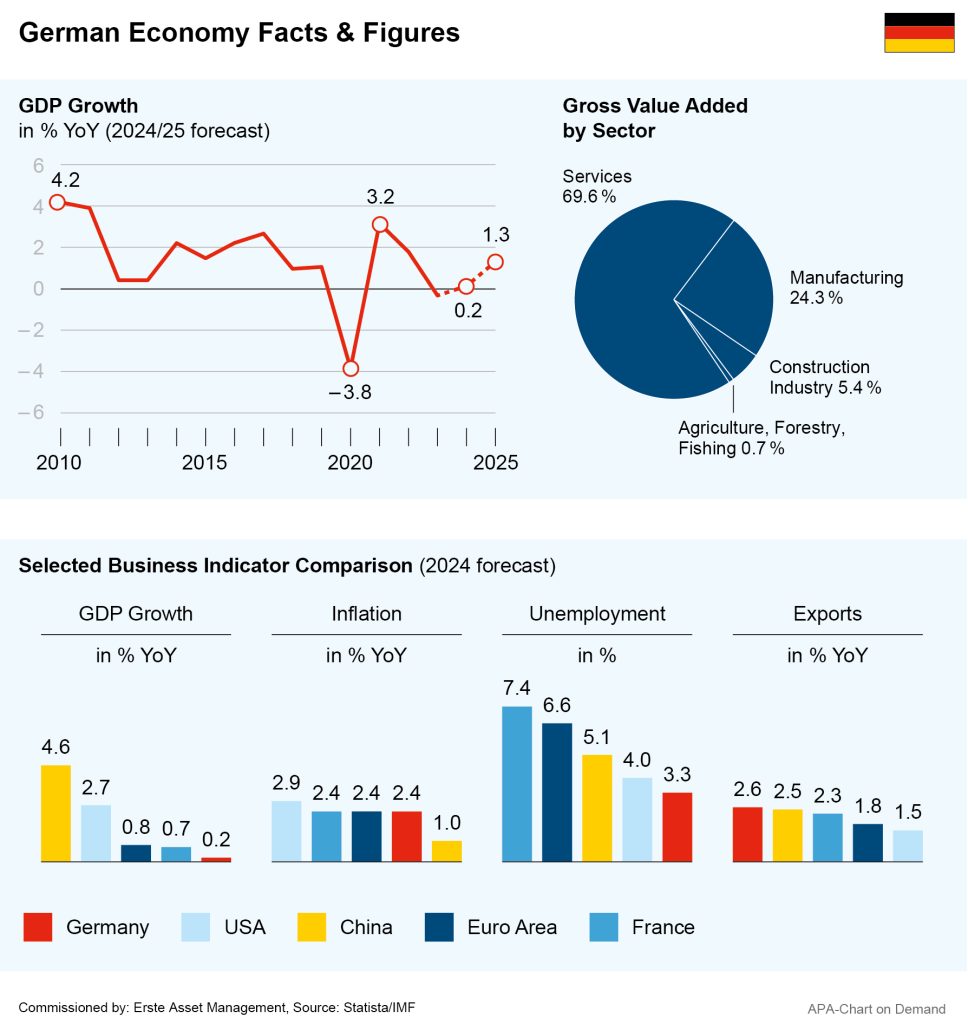

According to economists, the economy in Germany appears to have overcome its slump and is now picking up speed again, after the country had slipped into a “technical recession” in the previous year. After a period of slight growth at the outset of the year, the signs for 2024 remain positive, and German Bundesbank and Economics Minister Robert Habeck (Greens) expects a decisive upturn for 2025.

Several economic research institutes have also recently raised their economic forecasts for Europe’s largest economy, with Moritz Schularick, President of the IfW Kiel research institute, seeing “light at the end of the economic tunnel. There are increasing signs that the German economy will be able to break out of the recession,” said Schularick. Economists see rebounding private consumption and exports as the main pillars of the upturn.

Slight growth at beginning of the year

After a decline in late 2023, the economy in Germany grew slightly by 0.2% in Q1 compared to the previous quarter, chiefly driven by increased investment in construction (up 2.7%) and a rise in exports. At the same time, private consumer spending, an important pillar of the economy, fell by 0.4% compared to the previous quarter, adjusted for price, seasonal and calendar effects.

Some leading indicators declined slightly in June. The business climate index calculated by the ifo Institute fell by 0.7 points to 88.6 points this month. The ZEW research institute’s sentiment barometer rose to to 47.5 points, a slight increase by 0.4 points compared to the previous month. However, the assessment of the current economic situation surprisingly deteriorated by 1.5 points to minus 73.8 points.

Economic research institutes raised their forecasts in June

Nevertheless, the overall outlook has improved. Several leading economic research institutes raised their forecasts for Germany in June, notably the ifo Institute: the economic forecast published by the Munich-based researchers in June for the current year sees gross domestic product increasing by 0.4% after the 0.2% figure given in March. For 2025, the researchers expect growth of 1.5%. “New hope is dawning,” said ifo economic director Timo Wollmershäuser at the presentation of the forecast, “the German economy is slowly working its way out of the crisis.” The second half of 2024 is likely to be significantly better than the first, while inflation will subside and the purchasing power of households will increase, Wollmershäuser expects.

The International Monetary Fund (IMF) also believes that the economy in Germany will see significantly higher growth rates again from 2025 to 2026, with the country’s economy presumably growing by one to 1.5 per cent, the IMF recently announced. The IMF particularly noted real wages rising again and praised the German coalition government for its response to the lack of Russian gas supplies in the shape of aid for consumers and the development of new energy sources. According to the IMF, this has helped to bring energy prices back down and inflation under control.

Recovery in private consumption should drive the upturn

The economic research institutes see the expected recovery in private consumption as a key driver of the economic upturn. Based on a recent survey of 9,600 participants, the Institute for Macroeconomics and Business Cycle Research (IMK) of the Hans Böckler Foundation, a trade union organisation, identified signs of an “imminent turnaround in consumption”. Rising incomes and purchasing power are also likely to be reflected in higher consumer spending. Employees’ real wages rose at a record pace in Q1, increasing by an average of 3.8 per cent from January to March compared to the same period last year, which according to the Federal Statistical Office marks the strongest real wage growth since the start of the time series in 2008.

Private households have recently been saving up significantly more than usual due to the high level of political and economic uncertainty. However, the spending reluctance should gradually decrease as real disposable incomes continue to rise, explained the RWI economists. “As the year progresses, the purchasing power of private households should continue to increase and the overall economic recovery should pick up speed as the consumer economy normalises,” explained ifo expert Wollmershäuser.

According to the DIW experts, wage increases in particular are likely to strengthen income security and increase consumer spending willingness. As a result, low-income households will also have higher incomes at their disposal, the DIW expects. According to many economists, the decline in inflation and the ECB’s first interest rate cut should also have a positive effect on consumer sentiment.

Positive signals from the industry, but customs dispute remains a potential risk

There have also been some positive signs for industry recently. Industrial production increased in April, and incoming orders have also gradually stabilised. The German electrical and digital industry, for one, is more optimistic about the future. In April, the sector recorded a 7 per cent year-on-year increase in exports to EUR 20.3bn. “After several declines since the second half of 2023, industry exports have recently increased again,” said Andreas Gontermann, Chief Economist of the industry association ZVEI. Exports to China saw a significant increase of 24.8 per cent to EUR 2.3bn in April.

The German mechanical engineering sector, in deep crisis for months, also sees the nadir as passed: in April, the key German industry recorded an increase in orders for the first time in a year and a half. Orders rose by ten per cent in real terms, mainly thanks to an increase in demand from abroad, according to the industry association VDMA.

However, according to the Bundesbank, exports will also increase starting in the second half of the year, although there is a potential risk to the upswing in the form of a tariff race. The automotive industry in particular could suffer from punitive tariffs, explained Oliver Holtemöller, Vice President of the IWH research institute. The EU Commission recently threatened to impose temporary punitive tariffs on EVs from China, to which Beijing could respond with its own tariff increases. According to Holtemöller, automotive companies would then be particularly affected by European tariffs on vehicles that German companies produce in China for the European market, putting a severe damper on the chances of expanding German exports.

No clear upturn in sentiment on the German stock market yet

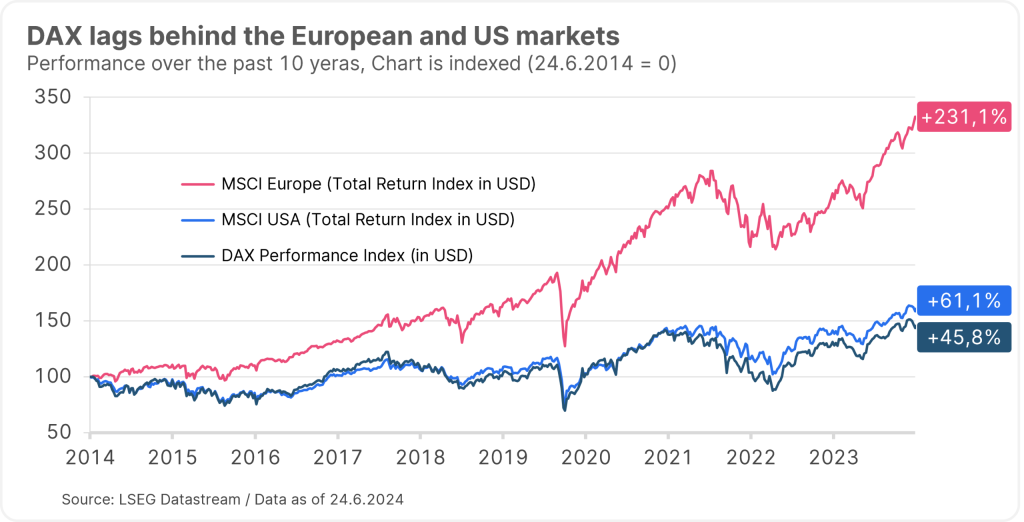

So far this year, there has been no clear upturn in sentiment on the German stock market. Since the beginning of the year, Germany’s leading index, the DAX, which comprises the country’s 40 largest listed companies, has recorded an increase of just over 6% (DAX Performance Index in US dollars). However, this means that the stock market barometer is lagging behind both the European market (up 8%; MSCI Europe Total Return in US dollars) and the US market (up 14.5%; MSCI USA Total Return in US dollars).

Since 2023, fantasies surrounding artificial intelligence have been the dominant theme on the stock market. Since then, the major US technology companies have been the main beneficiaries, meaning that these shares have also been a strong driver of performance on the US market. The German benchmark index has lagged significantly behind here – but one tech stock has also been one of the best performers in the DAX over the past 12 months: SAP (+46.1%). Only the housing company Vonovia (+49.4%) and the armaments group Rheinmetall (+91.8%) recorded a stronger performance in the DAX.

Investing in the European stock market

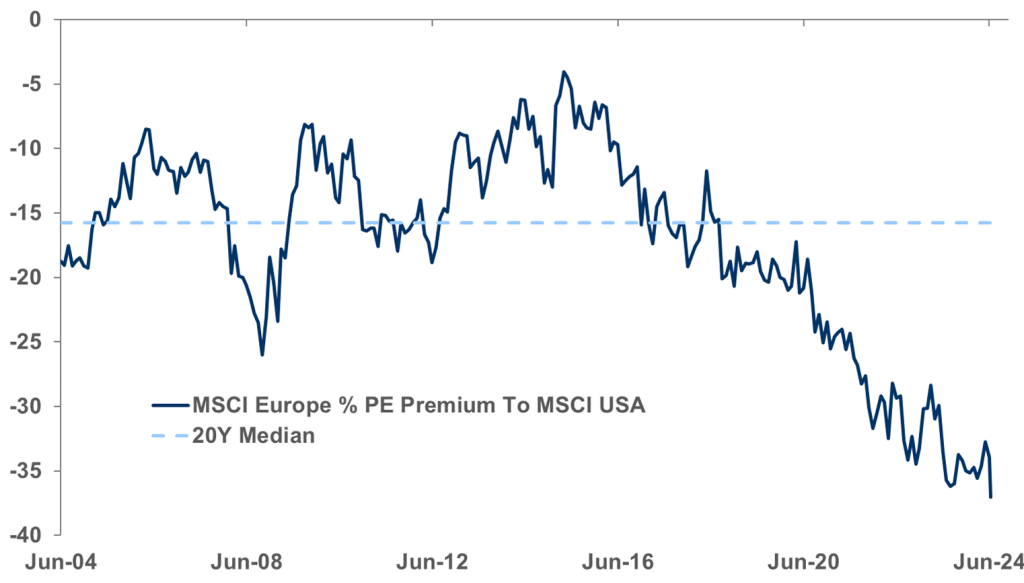

However, a look at the previous chart shows that it is not only German equities that are struggling to keep up with the US market. A look at the MSCI Europe, which currently comprises the 420 largest listed European companies, also shows that Europe has recently been unable to keep up with the US market in terms of performance. The relatively weaker performance also results in a significantly lower valuation level for European securities. The following chart shows the percentage difference between the valuation (PE ratio, price/earnings ratio) of US and European equities. The European market is currently valued around 40% cheaper than the US market. There has not been such a significant difference in valuation in the past 20 years.

Note: The chart shows the % difference between the price/earnings ratio of the MSCI USA equity index and the MSCI Europe equity index. Source: LSEG Workspace

At this valuation level, European (and therefore also German) equities could therefore definitely be worth a look for investors. The ERSTE RESPONSIBLE STOCK EUROPE equity fund is an example of a broadly diversified investment in the European market. The portfolio currently contains over 50 companies from Europe, including the German automotive groups Porsche and Mercedes-Benz Group as well as other DAX companies such as Adidas, Siemens, Allianz, Munich Re and SAP. All further information on the fund and how to invest in it can be found on our website.

Note: Please note that investing in securities involves risks as well as opportunities.

Risk notes ERSTE RESPONSIBLE STOCK EUROPE

Advantages for the investor

- Broadly diversified investment in European stocks.

- Participation in ecologically, morally and socially operating companies.

- Active stock selection based on fundamental criteria.

- Opportunities for an attractive increase in value.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the fund value can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. Please note that investing in securities also involves risks besides the opportunities described.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK EUROPE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK EUROPE, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK EUROPE as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.