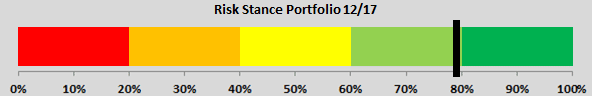

Earlier this week, we convened the last Investment Committee of 2017. The general risk appetite of the team has not changed vis-à-vis the previous month (from 78.85 percent to 79 percent on our 0 – 100 percent scale). The team continues to see the future optimistically, with a resulting “risk on” stance.

Source: Erste AM

For the first time, we asked the individual members what risk stance they were expecting for the Committee overall. The result: on average, team members tended to think they were taking more risk than the group. While the team members are still optimistic we regard this as ambitious in comparison with the market. From our point of view this is another indicator as to how far the current cycle has come already.

Risk of correction on the rise

The following discussion focused mainly on two topics. On the one hand, the tax reform in the USA should enable US companies to boost their profits in 2018. On the other hand, the valuations of many asset classes are being perceived as high. The risk of even relatively unimportant events triggering a correction has thus increased. All in all, the good economic performance still suggests optimism, and to allocate significant weights to risky asset classes in the portfolio. That being said, the air is getting thinner.

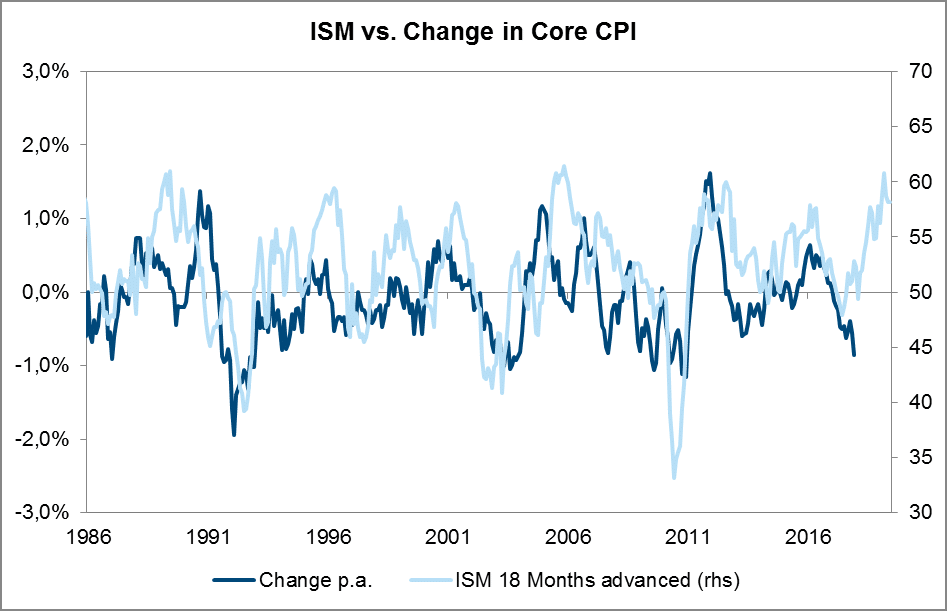

Our inflation outlook for 2018 made up a large part of our discussion. In summary, a lot of signs suggest that the rate of inflation will rise by about 0.5 percentage points next year.

Reasons for higher inflation in the USA

- The good economic situation

- Less pressure from the labour market

- The weaker US dollar

- Higher import prices

- Higher commodity prices

As an example, please have a look at the following chart that juxtaposes the ISM index, i.e. the sentiment index of 400 US purchasing managers (18 months from the present), and the core inflation rate. In view of the most recent economic development, higher inflation rates would not come as a surprise.

ISM = Institute of Supply Management, CPI = Consumer Price Index

Source: Erste AM

Note: Past performance is not indicative of future development.

US central bank could come under interest rate pressure

If this forecast were to be matched or even exceeded, the US central bank would come under pressure to raise interest rates more significantly than currently expected by the market (N.B. December 2018 Fed Fund futures are at 1.795 percent) or communicated by the Fed itself (mean of the Fed Dots for end-2018: 2.125 percent). This would definitely be negative for US Treasury bonds and instruments with a higher beta* relative to them, such as government bonds or corporate bonds with investment grade rating.

*Beta is the ratio that measures the relative bandwidth of fluctuation of a security with respect to the overall market.

Bitcoin gains not sustainable

The second big discussion was about bitcoin. At our previous Committee, we decided to thoroughly analyse bitcoin as investment class and how one could invest in it. In the meantime, a number of instruments have cropped up that facilitate investments in bitcoin. Some of the members of our Investment Committee have already invested in bitcoin. Those happy few can celebrate a 115 percent gain since the previous Committee. Of course, such numbers make it difficult to scrutinise the issue seriously. To paraphrase Donald Rumsfeld, and with a touch of polemics, I would associate “Shock and Awe” with bitcoin. To word it politely, we do not regard the latest gains of bitcoin as sustainable.

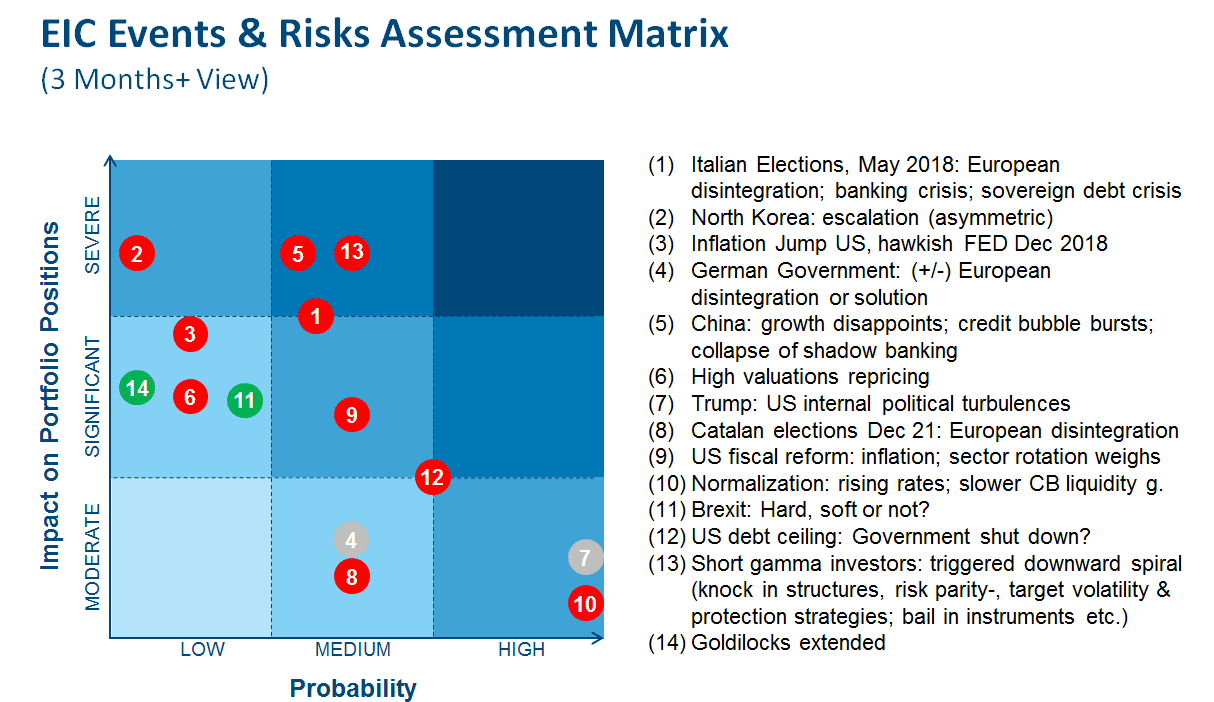

The last item on the agenda was the discussion of our event list. What topics will be driving the markets in the coming 12 to 18 months?

EIC = Erste AM Investment Comittee

Source: Erste AM

Note: Prognoses are no reliable indicator for future performance.

Prior to discussing the contents, I would like to explain the modus operandi of the matrix. The topics are in order of frequency of being named by the individual team members. This is what the numbers in the circles refer to. The colour of the circle indicates whether we regard the event as clearly positive (green) or negative (red) for the financial markets, or in between (grey). The Probability axis indicates how likely such a result of the event is. The axis Impact on Portfolio Positions shows how strongly the respective event could potentially affect our portfolio.

Elections in Italy as biggest market risk

The most commonly cited event risk were the elections in Italy, which according to the constitution have to be held by 20 May. A medium probability and a high impact of a result that is negative for the financial markets make the elections one of the big issues for the first months of 2018. After the elections in France, the Netherlands, and Germany and the end of the turbulences caused by the struggle for independence in Catalonia, the market has come to largely ignore the political risks in the Eurozone again. This results in the risk of getting caught on the wrong foot.

P.S. In the 24 hours prior to me writing this article (7 December 2017, 19.30), bitcoin has increased almost continuously for 23 hours by a total of 31 percent and has then dropped by 10 percent in the last 60 minutes.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.