The European media has been paying attention to unorthodox economic policies in Hungary for years, supporting or opposing them depending where they stand on the political spectrum. At the same time Hungarian decision makers always stress they represent the normality. Here comes the question: should we finally expect both monetary and fiscal policy normalization in the following years?

What do I mean on normal fiscal and monetary policy and where do the signals point to? Normal fiscal policy means a policy mix based on professional economic competence that supports sustainable growth and long term competitiveness of the country. Normal monetary policy requires a credible, independent central bank to tackle inflation and provide financial stability.

Source: MNB; Erste Research; per 28.2.2019

A look behind the numbers

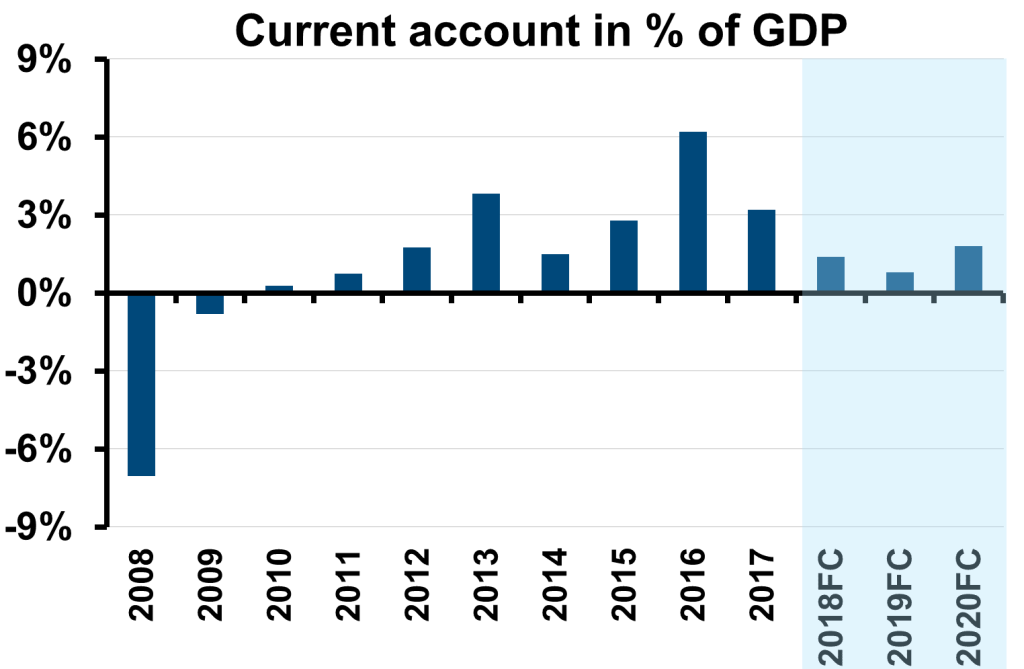

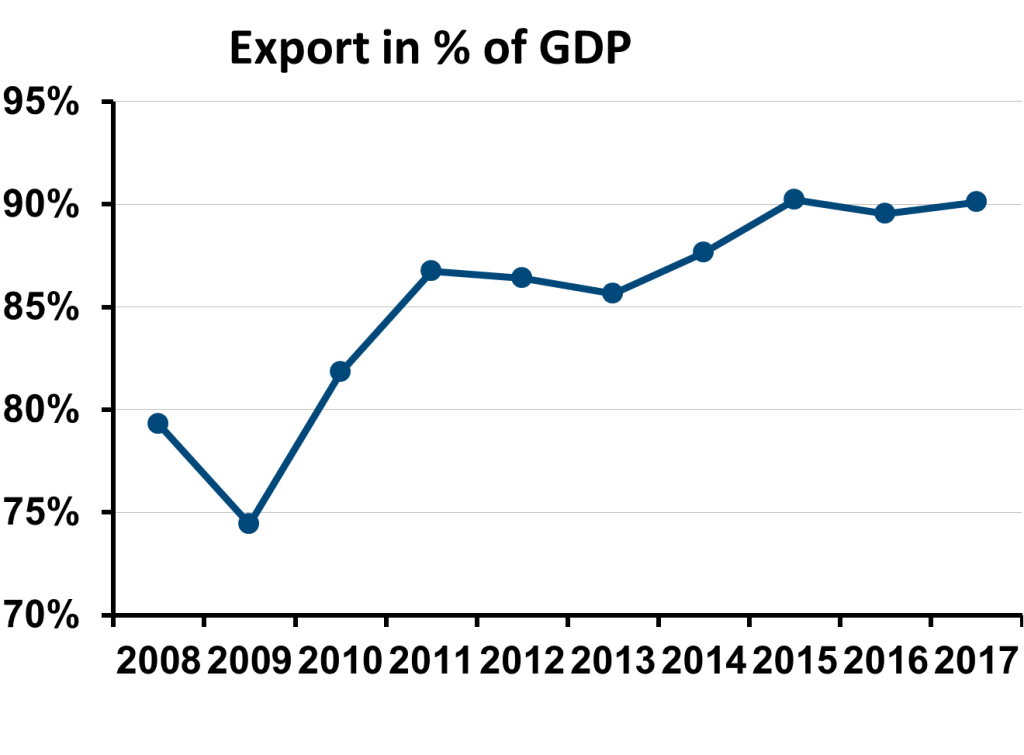

On the field of fiscal policy we experience that the main macro numbers are improving and under control during the Orbán government, debt to GDP is slowly shrinking, central government deficit is around 2% of GDP in the last 5 years and current account surplus is reached year by year, employment is on all time high. The numbers look nice but we should look behind the numbers to evaluate long term sustainability. The structure of the economy has barely changed, still multinational industrial investments and production and very cyclical building sector activity pushes the growth above potential. Hungary is still very exposed to global growth and economically still vulnerable, although the biggest rating agencies have acknowledged that Hungary made huge progress on being more resistant to economic shocks. S&P and Fitch has just upgraded Hungary to two notch above investment grade.

Source: Weltbank; Feb 2019

Time to prove monetary policy is sustainable

The Orbán era monetary policy looks similar. There are plenty of results such as significantly declining gross and net external debt, low inflation, low yields and stable Forint. Two factors played significant role: globally loose monetary policy environment and slowly but gradually improving credibility of the central bank although this belief is rather based on the achievements than on the independence of the institution.

Now comes the time for the governor and for the staff to prove that the progress the Hungarian monetary policy reached is sustainable. Perfect timing of life is that Governor Matolcsy has been just appointed for a second 6 year long term. Even in the end of last year there was a rumor that Governor Matolcsy prefers being a minister who is responsible for national economic strategy, but it looks that Mr. Orbán follows the old sport principal: Never change a winning team!

Conclusion

We expect that keeping the hard won credibility of the national bank requires monetary normalization slowly to begin in this year. The tone of the central bank has already changed, they stress that as the economy reached potential growth level, the monetary policy must focus solely on inflation targeting and tax adjusted core inflation trend is used as main proxy for monetary policy direction. Time will show whether this new 6 year mandate will be successful or not, let’s hope for the best, but keep our powder dry!

Disclaimer:

Forecasts are not a reliable indicator for future developments.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.