In line with the surprisingly strong economic indicators in the US, government bond yields have risen significantly in recent months. This is putting pressure on the prices of many classes of securities and intensifying discussions about how restrictive interest rate policy really is. Could the higher level of yields make the central bank’s job easier in the form of further interest rate hikes?

Strong employment growth

Reports on the US labour market in the month of September showed surprisingly strong and broad-based growth in non-farm payroll employment. In numbers: While the estimate was 170,000, “nonfarm payrolls” actually increased by 336,000. Moreover, employment growth in the previous two months was revised upwards by 119,000.

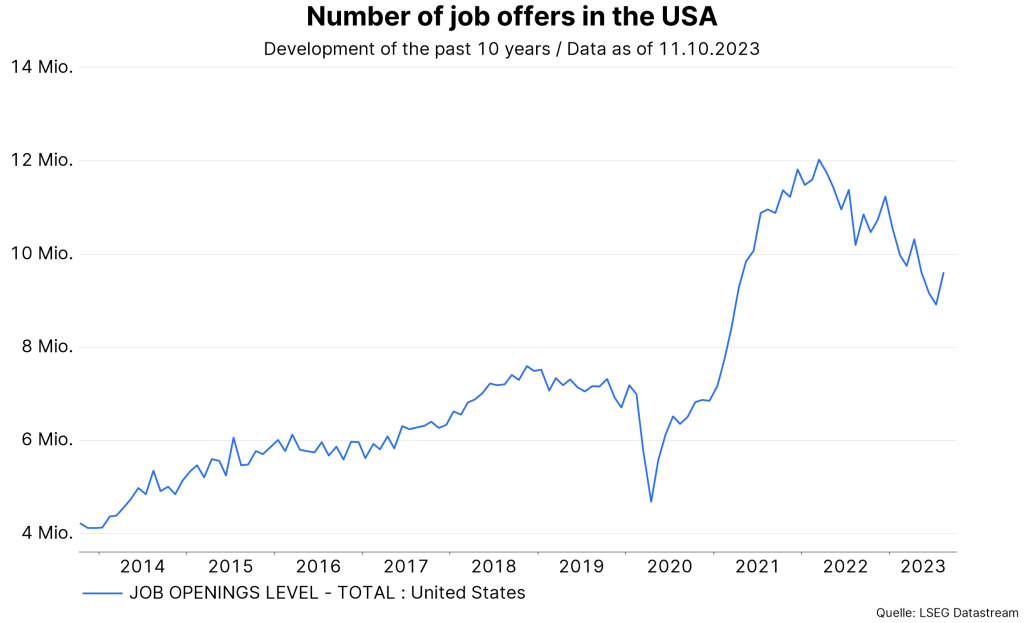

Other reports also surprised on the strong side. Job openings rose from around 8.9 million to around 9.6 million in the month of August and initial claims for unemployment insurance remained at a low 207,000.

Note: Past performance is not a reliable indicator for future performance.

The other key indicators were in line with expectations. The unemployment rate remained unchanged at a low level of 3.8%, while the labour market participation rate did not continue the rising trend with an unchanged value of 62.8%. Thus, there is still potential for improvement on the supply side. This is because the pre-pandemic value of February 2020 is still higher at 63.3%.

Falling inflation

In general, the reports contradict the assumption of a trend cooling of the very strong and tight labour market in the US. From the central bank’s perspective, however, such a development is necessary to alleviate the underlying inflationary pressure. Whether further key rate hikes are necessary for this, or whether a longer continuation of the existing key rate level is sufficient, will of course depend decisively on the inflation indicators.

Thus, the focus will be on the publication of consumer price inflation for the month of September tomorrow, Thursday. Both the headline and traditional core inflation (excluding energy and food) are expected to come in at 0.3% month-on-month. This would mean a continuation of the declining year-on-year inflation trend (to 3.6% and 4.1%, respectively).

Yield increases

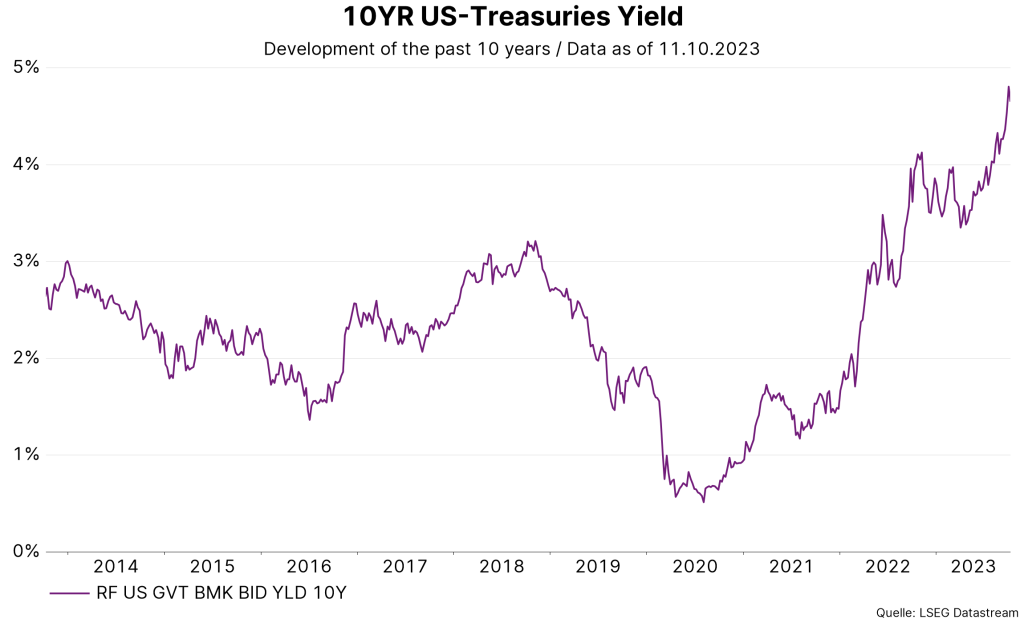

In addition to the importance of interest rate policy for growth and inflation, the implications of the rise in yields are increasingly being discussed. After all, the yield on the most important benchmark bond for most security classes, the ten-year US government bond, has risen from 3.3% at the beginning of April to currently 4.8%. What impact does this have?

Note: Past performance is not a reliable indicator for future performance.

1. Falling present value

Because higher interest rates reduce the value of future payments (dividends, coupons), asset prices come under pressure. Indeed, broad-based equity index prices have also been pointing down since early August.

2. Higher real yields

Because the (nominal) rise in yields has been almost exclusively accompanied by an increase in the inflation-adjusted yield, inflation expectations in the market have not increased. In fact, the real yield has risen from 1.05% to 2.48%, while the priced-in inflation (the “breakeven inflation rate”) has only increased by a few basis points to 2.32%. In the long run, from a market perspective, the central bank’s policy is thus sufficiently restrictive to achieve the inflation target; allowing for a certain margin of error.

3. Bear Steepening

Because long-dated yields have risen more than short-dated yields, the curve inversion has decreased. In such a curve inversion, yields on short-dated bonds are higher than those on long-dated bonds. Since July 2022, the two-year government bond yield has been higher than the ten-year bond yield. Historically or statistically, this inverse shape of the yield curve is a good indicator of an impending recession.

The restrictive interest rate policy weakens economic growth. However, the decreasing curve inversion, which is driven by yield increases on long-dated bonds and is known in the trade as bear steepening, could mean that interest rate policy is not as restrictive as thought. This is suggested by the still good growth indicators. Alternatively, the risk premium could have risen.

4. Higher maturity premium

Because the premium for holding long-dated bonds has also increased, the rise in yields cannot only be attributed to higher expectations for long-term real economic growth. According to the Adrian / Crump / Moench model, the premium has risen by just over one percentage point since the beginning of April to currently 0.26%. The explanations for this lie on the supply and demand side.

The US central bank is reducing its holdings of US government bonds and mortgage bonds to the tune of 95 billion US dollars per month. This policy of quantitative tightening removes an important demand driver from the market. At the same time, investment activity could increase in the long run due to structural changes. The buzzwords are: Digitalisation, defence, the energy turnaround and near / friendshoring. In addition, political polarisation could mean a generally loose fiscal policy (high government spending).

5. Negative feedback loop

The rise in yields leads to a deterioration in the financial environment (higher mortgage rates, higher corporate bond yields, lower equity prices, firmer US dollar). Does this environment create a negative feedback loop from financial markets to economic activity?

The US Federal Reserve has built a useful model in this context. It estimates how supportive or dampening the change in the financial environment is for real economic growth over the next twelve months. According to the model, the change in the financial environment over the past twelve months has no effect on economic growth. However, if the financial environment of the past three years is taken into account, the model estimate results in a reduction of real economic growth by almost 0.6 percentage points. While this is a substantial value, it is far from levels that would trigger a recession. Because the data series end with August 2023, the future values are likely to be somewhat higher, but will not change the general statements.

Conclusion

What conclusions can be drawn from this? On the one hand, the strong growth indicators in the USA are an indication that interest rate policy is not having a particularly restrictive effect. Secondly, a determining reason for the rise in yields since the spring is probably an increasing risk premium. And third: Even taking into account the deterioration of the financial environment, the dampening effects on the economy are not particularly large. The decisive factor now is whether inflation will continue to fall even without further key rate hikes.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.