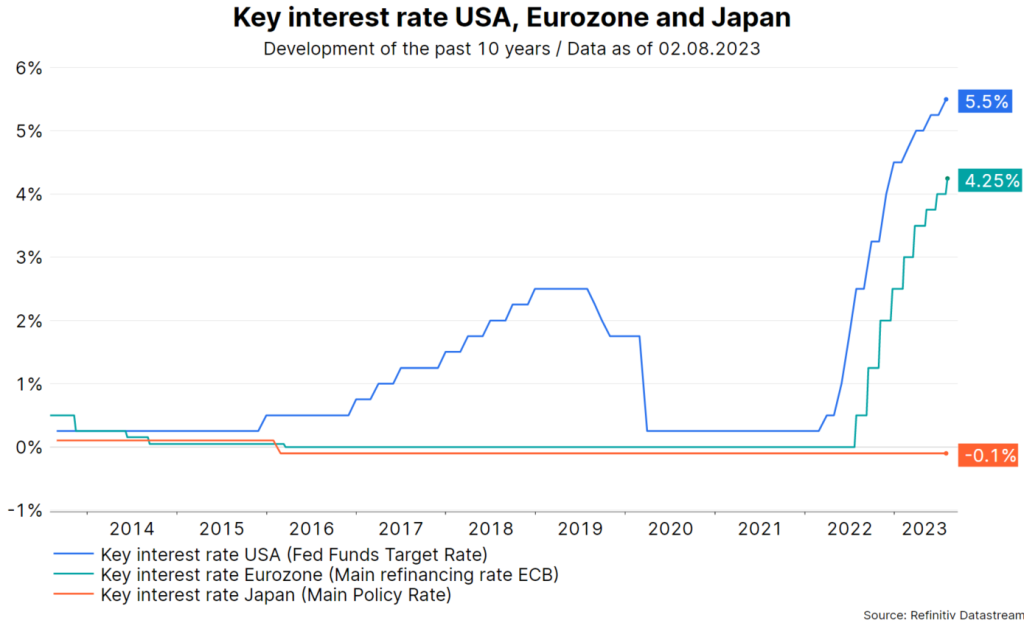

Last week was an important week for central banks with announcements from the Federal Reserve (Fed), the European Central Bank (ECB) and the Bank of Japan (BoJ). While Japan is only beginning to move away from ultra-loose monetary policy by loosening its grip on government bond yields, both the Fed and the ECB signalled that the end of the cycle is near – or may even have already arrived after last week’s rate hikes.

ECB hints at possible pause in rate hikes

The European Central Bank raised its key deposit rate for the ninth straight week by 25 basis points (100 basis points = 1%) to 3.75%, the main refinancing rate rises to 4.25%. This matched an all-time high last reached in 2000. However, the ECB omitted the previous statement that interest rates would have to rise further and instead said that further tightening would depend on whether economic data showed it to be necessary.

This leaves the door open for another hike at the ECB’s next meeting in September or a pause, with hikes perhaps resuming at a later date if inflation proves more stubborn than expected.

Fed holds out prospect of end to rate hikes

Meanwhile, the Federal Reserve has indicated that the end of its rate hike cycle is likely in sight after raising rates by 25 basis points at its meeting.

Note: Past performance is not a reliable indicator for future performance.

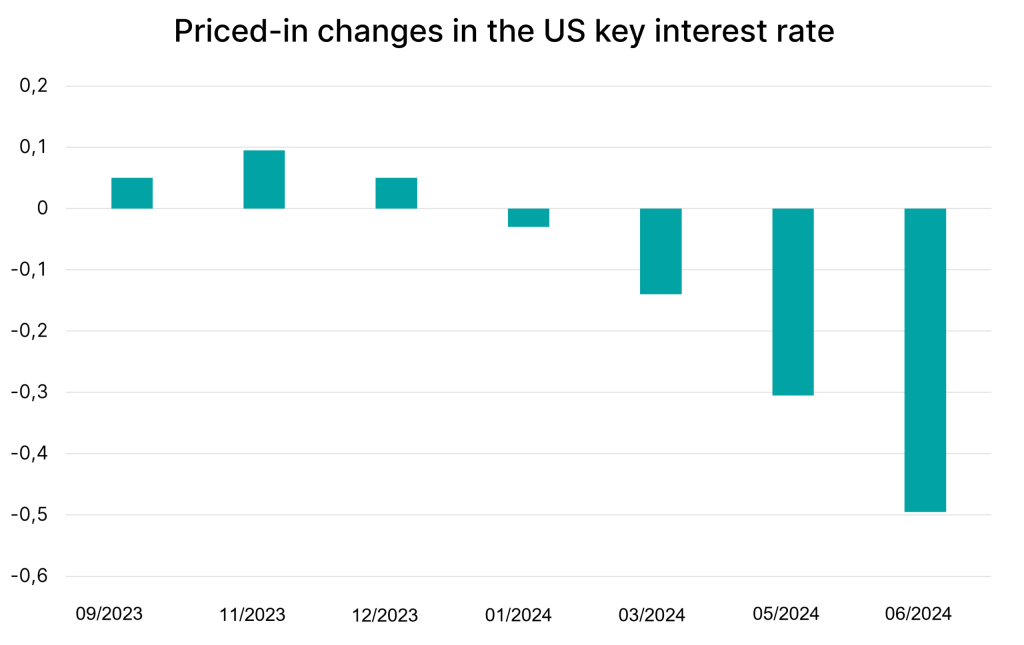

From today’s perspective, we think it is more likely that the ECB will have to raise interest rates again, while the Fed has probably completed its rate hike cycle. The markets are also not currently pricing in any further rate hikes in the US:

Note: Prognoses are not a reliable indicator for future performance.

China’s Politburo sends pro-growth message

In addition, the focus last week was on the conclusion of the July meeting of China’s Politburo. China’s leadership sent out a pro-growth message at this meeting. Although only few concrete details were announced and the wording did not amount to stimulus measures on a grand scale, the tenor is positive, where Chinese equities gained.

Around economic policy, the focus was on counter-cyclical measures such as an extension of tax and duty cuts, faster issuance of special local government bonds and the use of monetary policy tools. Officials acknowledged the need for further easing and will proactively address a comprehensive range of issues, from such as real estate to domestic consumption.

The policy bureau’s constructive tone could brighten overall market sentiment, in our view, but a sustained upswing in Chinese investments will require more than just supportive messages from the government. Rather, it will depend on how quickly the various authorities and local governments can take concrete follow-up action.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.