On 3 April, we held our monthly Investment Committee meeting. Only three weeks after the previous one – three weeks that were tightly packed with issues, as we can see in the performance data of the most important asset classes. Equities and high-yield bonds have lost value, whereas Eurozone government bonds and emerging markets bonds have recorded gains. An upside-down scenario, compared to previous months.

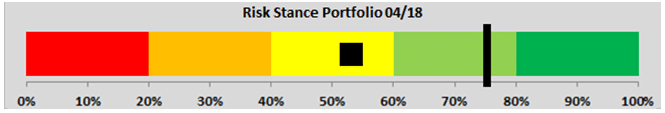

However, we have become slightly more cautious with regard to the assessment of the market (52% instead of 55%). My interpretation is that most Committee members are trying to reconcile two different approaches here. As Daniel Kahneman said, this might be a case of “quick thinking, slow thinking”. On the one hand we know that in the current phase of the cycle we have to stay on course, on the other hand, our brain stem is telling us: “Danger! Liquidate position!” Very often in such situations, the impulsive behaviour wins. I think that not the least due to the discussion of the issue by the Investment Committee, it will be possible/easier to act rationally and not listen to this impulse.

The next part was, as always, the presentation on the current momentum by our Chief Economist. In summary, these were the most important points:

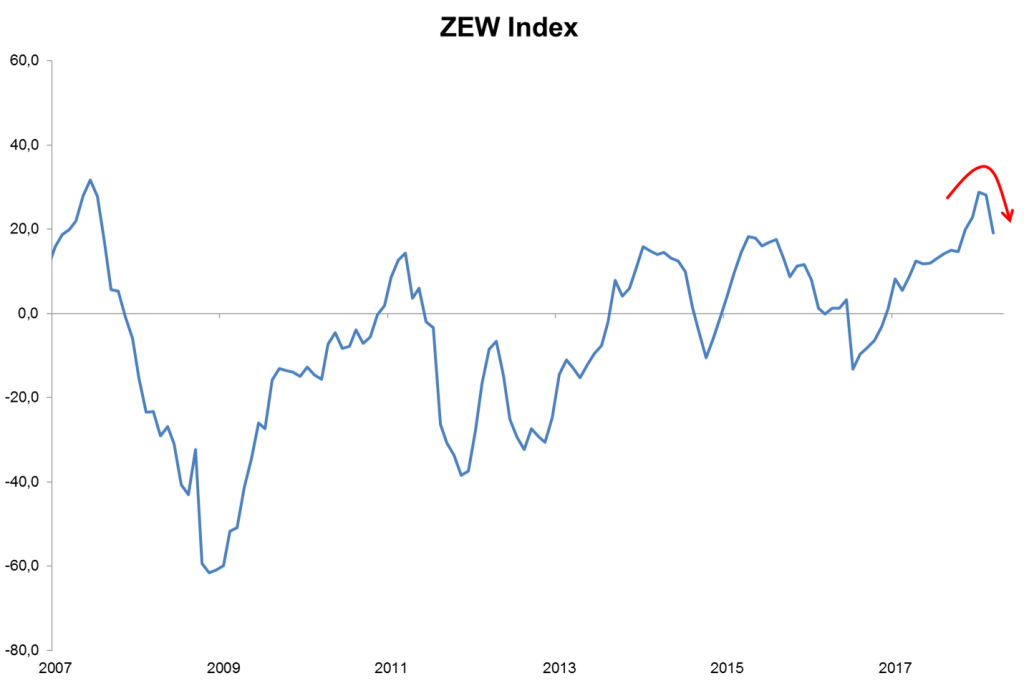

- We are in a textbook late boom phase. The economy is still growing strongly on a broad basis. At the same time, the momentum is rolling. The following chart shows the average of numerous similar indicators as calculated by ZEW Institut (Zentrum für Europäische Wirtschaftsforschung; Centre for European Economic Research); it depicts the average assessment of the current business climate and the expected business climate for the USA, the Eurozone, Germany, France, Italy, the UK, and Japan. It shows how the index has increased over the past months and remained above the values that we had grown accustomed to since 2008. The index is still clearly above the zero line, which suggests continued expansion. At the same time, the line has now started to dip. We all know the typical economic cycle and thus the phase after the boom, i.e. recession. The question in the coming months will be at what point in time we will have to accept it.

Source: EAM, Datastream

- The monetary policy is becoming noticeably more restrictive. Most recently, the Bank of Japan also announced that it was thinking about an exit strategy for its asset purchase programme. The ECB is expected to terminate its programme also in the coming twelve months, and the Fed, the Bank of England, and the Bank of Canada will soon raise their rates.

- Also, the US government seems to be set on starting a trade war. While since our last meeting exceptions to the announced tariffs have been decided on for Europe, more extensive measures were released for China. Thus, President Trump seems to be turning to the real enemy. In addition to the extent of the measures (USD 60bn instead of USD 4bn are now subject to the new regime), the composition of the US cabinet has also changed since our last meeting. The number of hardliners who think a trade war can be won has increased. Whoever thinks a war can be won, is also ready to fight it.

Overall, we are still in a situation that seems very favourable on the surface. The problem of the current environment is its asymmetry. Everybody knows the script of an economic cycle. It is all about how long one can stay on the gas in such an environment. The times of positive growth surprises are gone. At the same time, we can see the usual signs of this phase of the cycle, such as higher inflation, short but substantial set-backs in prices, and the broadening of the multitude of opinions. All of this is asymmetric. Many sources of negative surprises are juxtaposed by few sources for positive surprises. It is becoming more difficult to stand by one’s conviction.

This is how we entered the discussion about our risk.

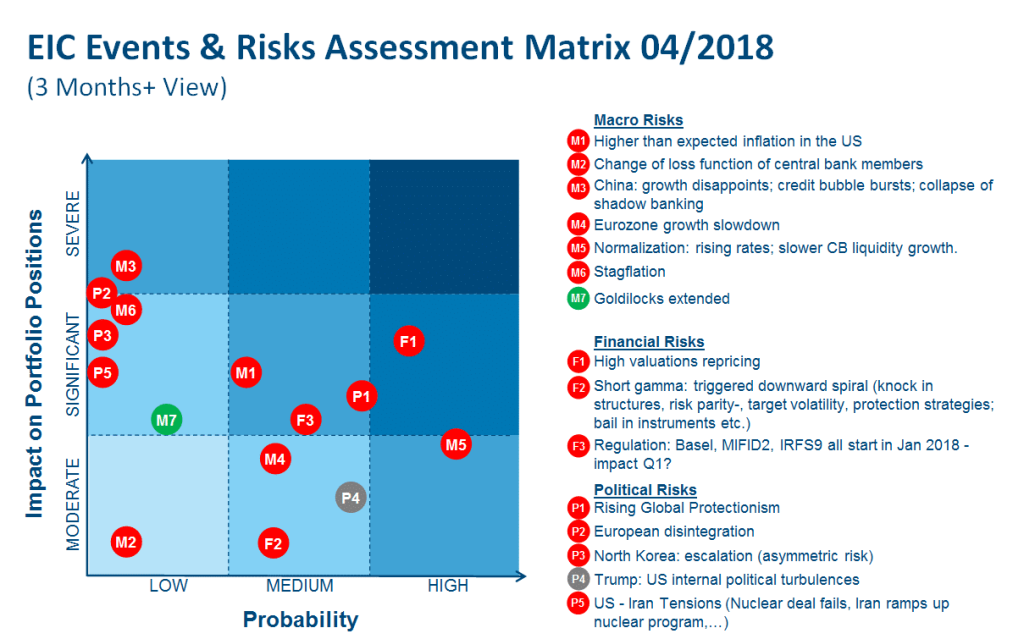

The biggest risk we can see is a price slump without a cause due to high valuations – not uncommon for this phase of the cycle. The argument is the same as before. Rational thought prescribes an overweight in risky assets, but the gut feeling becomes more and more queasy in doing so.

In terms of effect and probability, the next important risks are a global trade war, a strong increase in interest rates, and, the golden oldie, a hard landing in China. While this scenario only comes with a minor weighting, it has the biggest negative impact in absolute terms.

We are accordingly positioned against this backdrop:

- In the bond segment, we have reduced our positions in the past weeks. We are keeping interest duration short and spread duration neutral, with a long bias. Since the trend-following system has been long in the past three working days, the positioning with respect to interest duration is slightly long, as are all the models. From our point of view, the market for credits is still well supported. The search for yield continues, the redemption in Europe are 22% below last year in 2018, the ECB is still buying at this point and even increased the share of the CSPP within the APP above 20% in March. In the USA, the tax reform by the Trump cabinet should fill company coffers with more money. This prompts allocation to credits. However, we are currently making a conscious decision to withdraw from illiquid titles. If something were to happen, we would not want to be caught at the illiquid end of the market.

- We have not changed out asset allocation in the past three weeks. We remain prominently weighted in risky assets (equities from the developed and emerging markets, high-yield bonds). At the moment, we are not planning on using the low prices of the past days to buy and step up positions.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.