In the wake of the disruptions to key supply chains caused by the coronavirus pandemic, the Russian invasion of Ukraine and increasingly determined calls for economic decoupling from China, the EU and the US are now looking to Latin America as a key economic partner. These efforts are bolstered by the recent change of government in Brazil: with the election of left-wing former president Luiz Inacio Lula da Silva in October, the policy of international isolation pursued by his predecessor Jair Bolsonaro is likely at an end.

Lula, who has been in office since January, plans to end Brazil’s isolation and is counting on increased cooperation, both within and outside Latin America. This means that the largest economy in the region returns to the geopolitical stage.

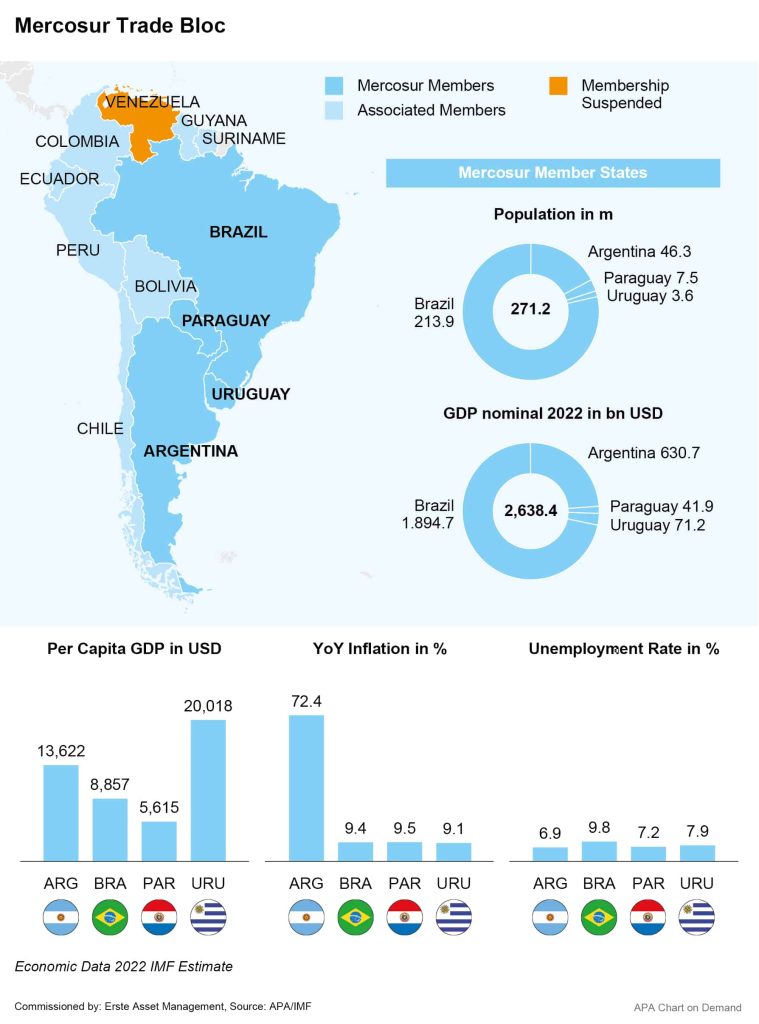

Brazil’s change of course also increases the chances for an early conclusion of the EU’s long-planned trade agreement with the Latin American Mercosur free trade zone. The Mercosur trade bloc includes Brazil, Argentina, Uruguay and Paraguay as member states, with seven further countries as associate members.

The EU has been negotiating a trade agreement with the Mercosur countries since 1999. Such an agreement would create a common market of more than 700 million people, covering nearly 20 percent of the world economy and 31 percent of global goods exports.

While a general fundamental agreement and a breakthrough were reached in 2019, the agreement’s conclusion failed due to unsolved political issues – particularly in regards to the protection of the Amazon rainforest. However, with the change of course in Brazil, but also in view of the Ukraine war and the growing concerns about dependence on China, the negotiations have gained new momentum.

EU Hopes for Early Agreement With Mercosur After Government Change in Brazil

German Chancellor Olaf Scholz kicked off his visit of Latin America around a month ago with an urgent call to get the stalled free trade agreement negotiations back on track. “The negotiations have gone on long enough,” Scholz said, mirroring the Brazilian president’s sentiments about reaching a quick conclusion to the free trade agreement.

The EU hopes to have the trade agreement signed by July. According to the AFP news agency, Commission Vice President Frans Timmermans stated this as the goal, referring to a joint summit planned for 17 and 18 July. Before that, however, political resistance in the EU and in Latin America must be cleared out of the way.

In Europe, environmental concerns still remain, as do protests from regional interest groups such as French farmers, who fear stronger competition and greater imports from South America. There have also been recent differences among the Mercosur member states. Argentina’s left-wing government wants to protect the domestic economy from international competition.

Brazil’s new president wants to play an active role in this matter. “We will work very hard with Argentina to conclude this agreement by the end of the first semester,” Lula said in a joint press conference with Scholz, having also recently signaled flexibility on the rainforest issue. In this matter, Germany pledged support for the South American country, announcing it will provide Brazil with EUR 200m for the reestablishment of institutions and projects for environmental and indigenous protection.

US Advocates Tighter Cooperation in North and South America

The United States have also recently placed greater emphasis on Latin America as an economic partner. In late January, in an online summit with representatives of 11 other countries, US Secretary of State Antony Blinken drummed up support for President Joe Biden’s plan to increase cooperation between North and South America. The US expect this to improve trade relations, but also to increase prosperity throughout the region and thus alleviate migration problems. At the same time, this initiative is also intended to put a stop to China’s growing influence in Latin America. Finally, both the US and the EU hope that improved Latin American relations will strengthen supply chains impaired since the coronavirus pandemic.

Latin America Plays Vital Role in Supply of Essential Metals for Future Technologies

Latin America is not only one of the world’s most important suppliers of many agricultural products such as coffee or soybeans, the region also plays a vital role in supplying many essential metals. Countries such as Chile and Peru are among the world’s largest producers of copper and silver, and the lithium deposits in the region are important for many future technologies. According to a report by the US Geological Survey (USGS), 56 per cent of the 89 million metric tons of lithium identified worldwide are found underground in the desert regions of Argentina, Bolivia, and Chile.

Lithium is considered the crude oil of the 21st century. The light metal is required for the manufacture of batteries for electric cars and is also found in cell phones and many other electronic devices. So far, China has been the main player in mining and processing lithium and other important metals in the region, but Europe and the US want to play a more active role going forward. The Lithium Triangle countries themselves also want to go beyond supplying lithium in the future and industrially utilise the metal locally – for example in the production of batteries for electric vehicles.

Is this the hour of the bonds after last year’s sell-off?

Having disappointed in recent years, hopes are high that Latin America also has something to offer investors. Now could be the time for bonds from the region. As the “Handelsblatt” reports, although 85 billion dollars flowed out of emerging market bonds worldwide last year – the strongest outflow ever – around 8-10 billion dollars have already come back since the beginning of December (Source: Handelsblatt, 6.2.2023). The recovery potential is correspondingly large.

The region has become more stable again. In the current issue of GEWINN, Péter Varga, fund manager for emerging markets corporate bonds, rates bonds from Mexico as “attractive”. The central bank there pursues a sensible monetary policy and fights inflation credibly. This is why the Mexican peso has held up best of all emerging market currencies against the strong US dollar. Many companies are thinking about moving their production facilities from China to Mexico (Source: GEWINN, March 2023 issue).

“Reforms foster growth.”

Péter Varga, Emerging Markets Corporate Fund Manager

Investing in emerging markets with ERSTE BOND EM CORPORATE

Launched by Erste Asset Management back in 2007, ERSTE BOND EM CORPORATE offers a broadly diversified investment opportunity in corporate bonds from emerging markets. The fund invests globally and enables investors to participate in the growth opportunities of these emerging markets, including securities from several Latin American countries such as Mexico, Brazil, Chile, Peru and Colombia. Currently, the bonds held in this fund have an average annual return of 6.7% (Source: Erste Asset Management, 8.3.2023).

However, one should be aware that emerging market bond prices can traditionally fluctuate more and there is a higher risk due to the medium to low credit rating of the companies. However, there are opportunities for attractive returns, especially if the region makes a comeback combined with falling yields and few defaults.

Advantages for the investor

- Chance of attractive returns from the most interesting emerging market corporate bonds

- Global diversification in emerging markets

- Foreign currencies are mostly hedged against the euro

- Risk diversification via a variety of bonds from a wide range of issuers

Risks to be considered

- Increased risk due to average and below average credit rating of participating companies.

- Emerging markets are traditionally subject to high volatility.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the fund prospectus or the Information for Investors pursuant to Art 21 AIFMG and the key information document are available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance. Past performance is not a reliable indicator of the future performance of a fund.

Please note: Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the Erste Bank and austrian Sparkassen banks.

Please also read the “Information about us and our securities services” published by your bank.